Answered step by step

Verified Expert Solution

Question

1 Approved Answer

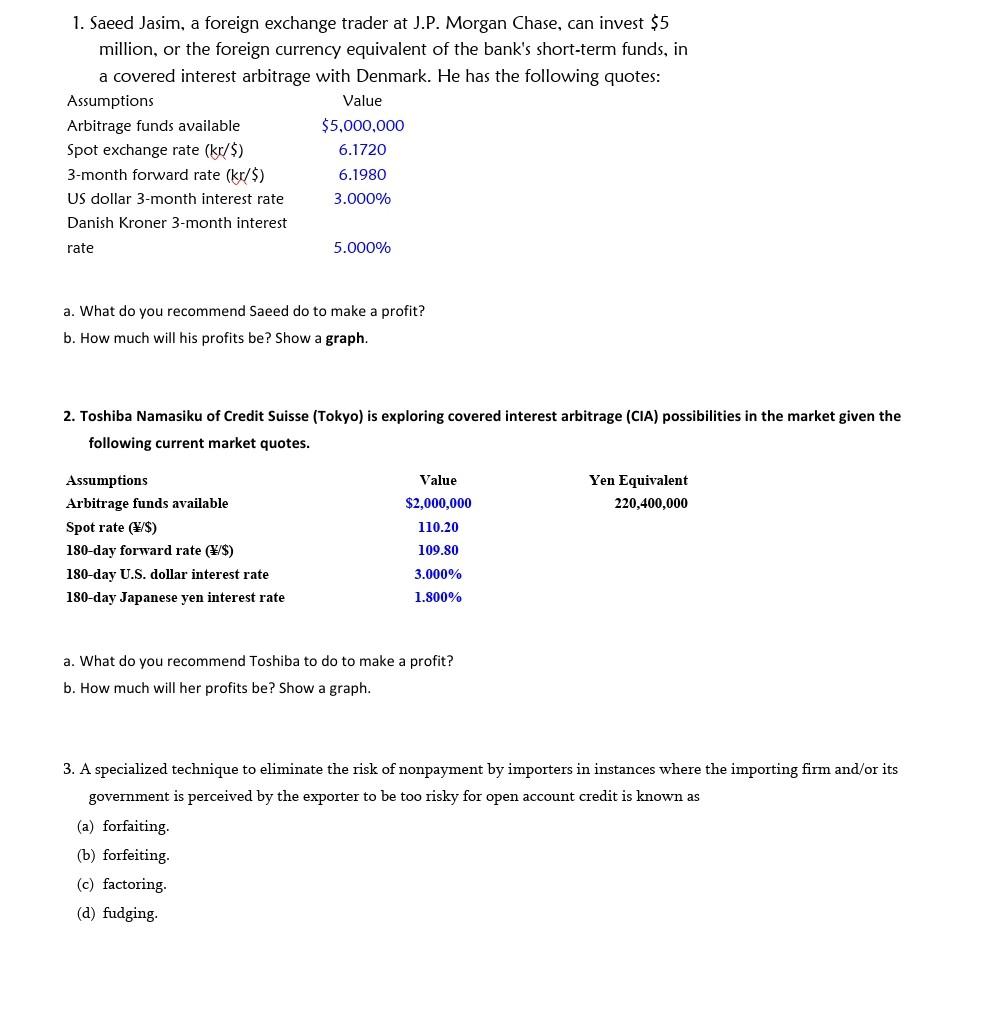

1. Saeed Jasim, a foreign exchange trader at J.P. Morgan Chase, can invest $5 million, or the foreign currency equivalent of the bank's short-term funds,

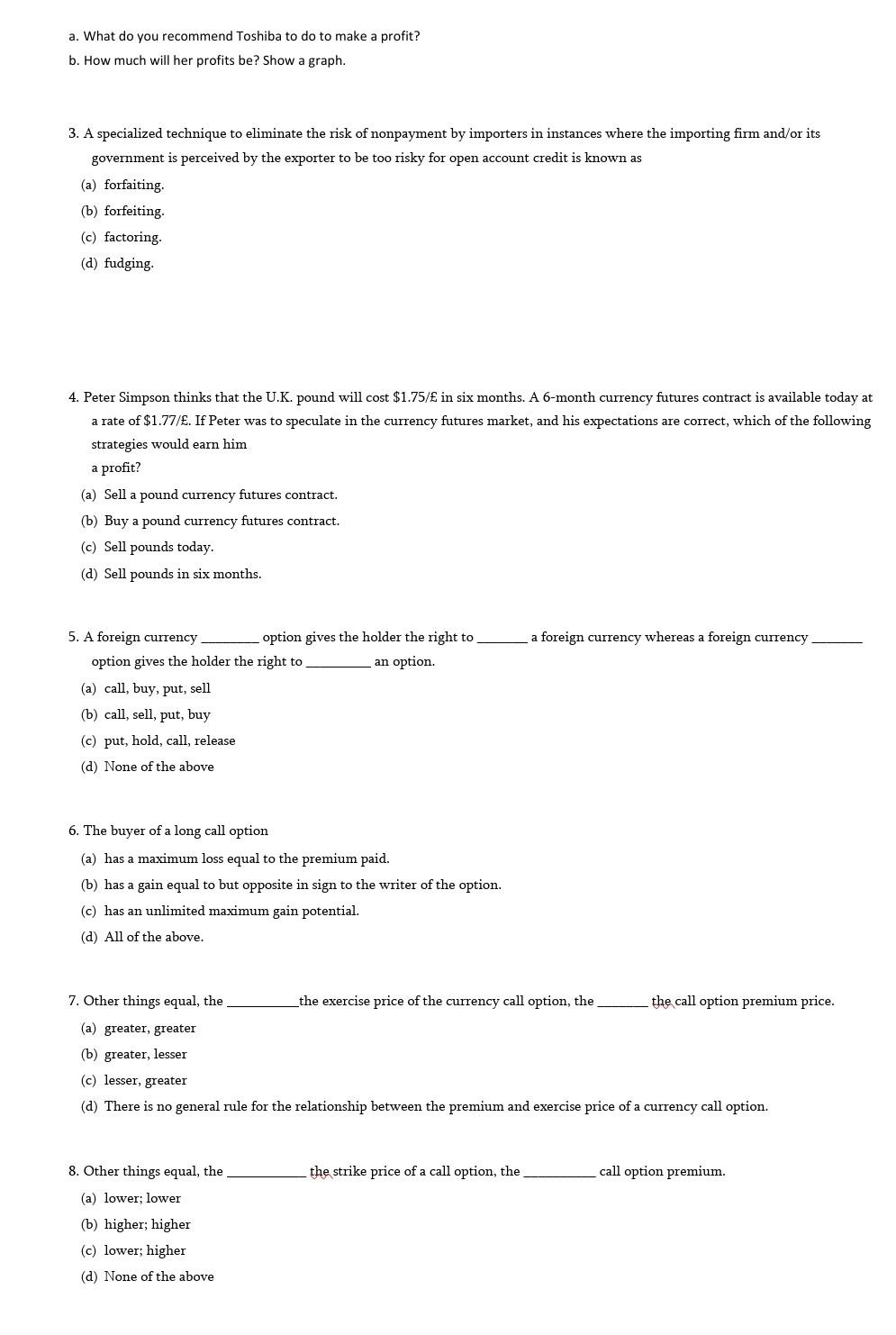

1. Saeed Jasim, a foreign exchange trader at J.P. Morgan Chase, can invest $5 million, or the foreign currency equivalent of the bank's short-term funds, in a covered interest arbitrage with Denmark. He has the following quotes: a. What do you recommend Saeed do to make a profit? b. How much will his profits be? Show a graph. 2. Toshiba Namasiku of Credit Suisse (Tokyo) is exploring covered interest arbitrage (CIA) possibilities in the market given the following current market quotes. a. What do you recommend Toshiba to do to make a profit? b. How much will her profits be? Show a graph. 3. A specialized technique to eliminate the risk of nonpayment by importers in instances where the importing firm and/or its government is perceived by the exporter to be too risky for open account credit is known as (a) forfaiting. (b) forfeiting. (c) factoring. (d) fudging. a. What do you recommend Toshiba to do to make a profit? b. How much will her profits be? Show a graph. 3. A specialized technique to eliminate the risk of nonpayment by importers in instances where the importing firm and/or its government is perceived by the exporter to be too risky for open account credit is known as (a) forfaiting. (b) forfeiting. (c) factoring. (d) fudging. 4. Peter Simpson thinks that the U.K. pound will cost $1.75/ in six months. A 6-month currency futures contract is available today at a rate of $1.77/E. If Peter was to speculate in the currency futures market, and his expectations are correct, which of the following strategies would earn him a profit? (a) Sell a pound currency futures contract. (b) Buy a pound currency futures contract. (c) Sell pounds today. (d) Sell pounds in six months. 5. A foreign currency option gives the holder the right to a foreign currency whereas a foreign currency option gives the holder the right to an option. (a) call, buy, put, sell (b) call, sell, put, buy (c) put, hold, call, release (d) None of the above 6. The buyer of a long call option (a) has a maximum loss equal to the premium paid. (b) has a gain equal to but opposite in sign to the writer of the option. (c) has an unlimited maximum gain potential. (d) All of the above. 7. Other things equal, the the exercise price of the currency call option, the the call option premium price. (a) greater, greater (b) greater, lesser (c) lesser, greater (d) There is no general rule for the relationship between the premium and exercise price of a currency call option. 8. Other things equal, the the strike price of a call option, the call option premium. (a) lower; lower (b) higher; higher (c) lower; higher (d) None of the above 1. Saeed Jasim, a foreign exchange trader at J.P. Morgan Chase, can invest $5 million, or the foreign currency equivalent of the bank's short-term funds, in a covered interest arbitrage with Denmark. He has the following quotes: a. What do you recommend Saeed do to make a profit? b. How much will his profits be? Show a graph. 2. Toshiba Namasiku of Credit Suisse (Tokyo) is exploring covered interest arbitrage (CIA) possibilities in the market given the following current market quotes. a. What do you recommend Toshiba to do to make a profit? b. How much will her profits be? Show a graph. 3. A specialized technique to eliminate the risk of nonpayment by importers in instances where the importing firm and/or its government is perceived by the exporter to be too risky for open account credit is known as (a) forfaiting. (b) forfeiting. (c) factoring. (d) fudging. a. What do you recommend Toshiba to do to make a profit? b. How much will her profits be? Show a graph. 3. A specialized technique to eliminate the risk of nonpayment by importers in instances where the importing firm and/or its government is perceived by the exporter to be too risky for open account credit is known as (a) forfaiting. (b) forfeiting. (c) factoring. (d) fudging. 4. Peter Simpson thinks that the U.K. pound will cost $1.75/ in six months. A 6-month currency futures contract is available today at a rate of $1.77/E. If Peter was to speculate in the currency futures market, and his expectations are correct, which of the following strategies would earn him a profit? (a) Sell a pound currency futures contract. (b) Buy a pound currency futures contract. (c) Sell pounds today. (d) Sell pounds in six months. 5. A foreign currency option gives the holder the right to a foreign currency whereas a foreign currency option gives the holder the right to an option. (a) call, buy, put, sell (b) call, sell, put, buy (c) put, hold, call, release (d) None of the above 6. The buyer of a long call option (a) has a maximum loss equal to the premium paid. (b) has a gain equal to but opposite in sign to the writer of the option. (c) has an unlimited maximum gain potential. (d) All of the above. 7. Other things equal, the the exercise price of the currency call option, the the call option premium price. (a) greater, greater (b) greater, lesser (c) lesser, greater (d) There is no general rule for the relationship between the premium and exercise price of a currency call option. 8. Other things equal, the the strike price of a call option, the call option premium. (a) lower; lower (b) higher; higher (c) lower; higher (d) None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started