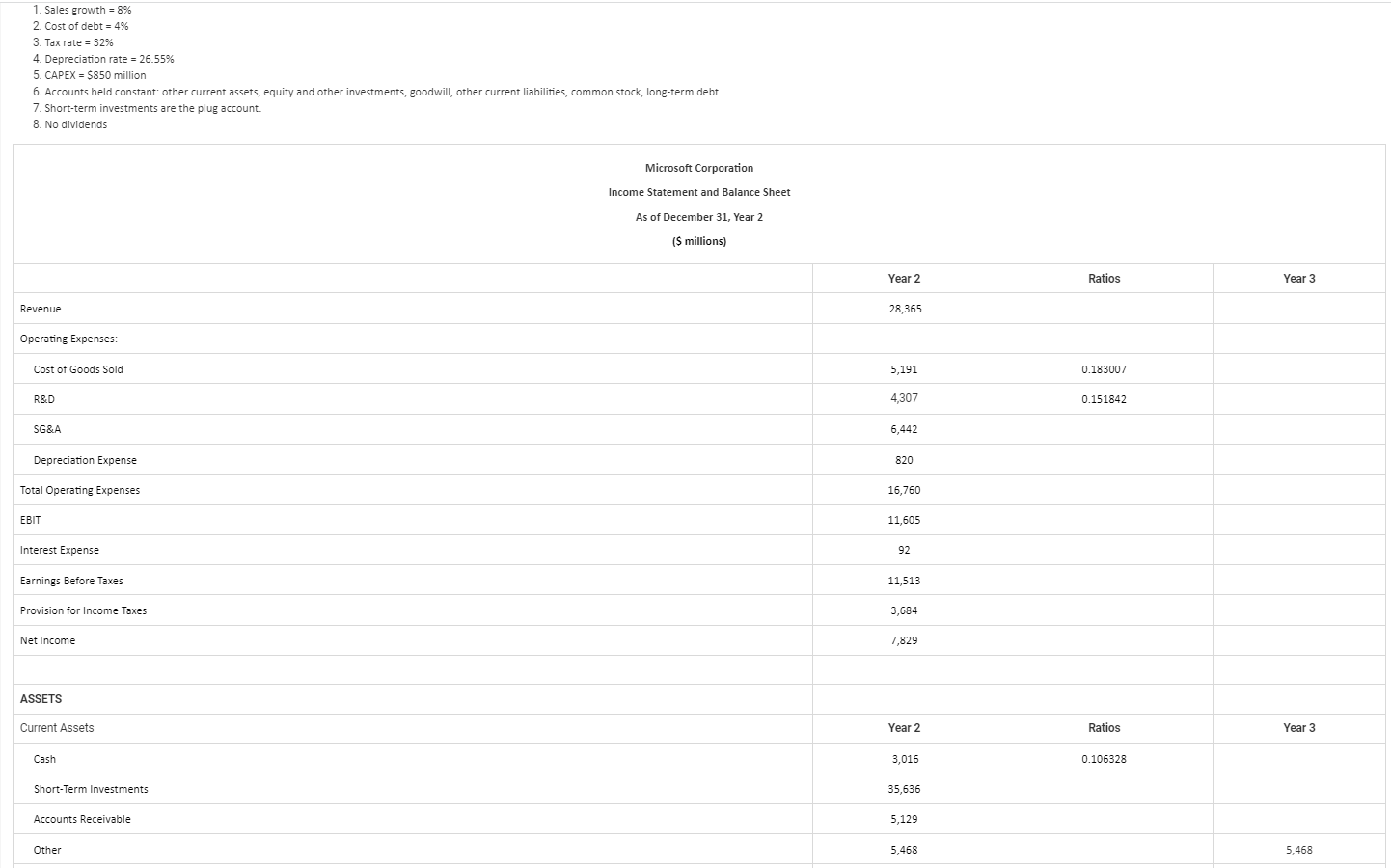

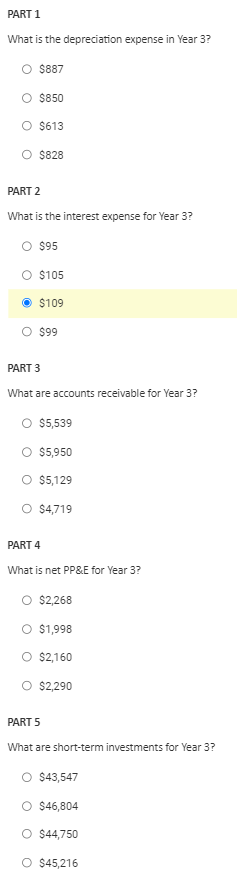

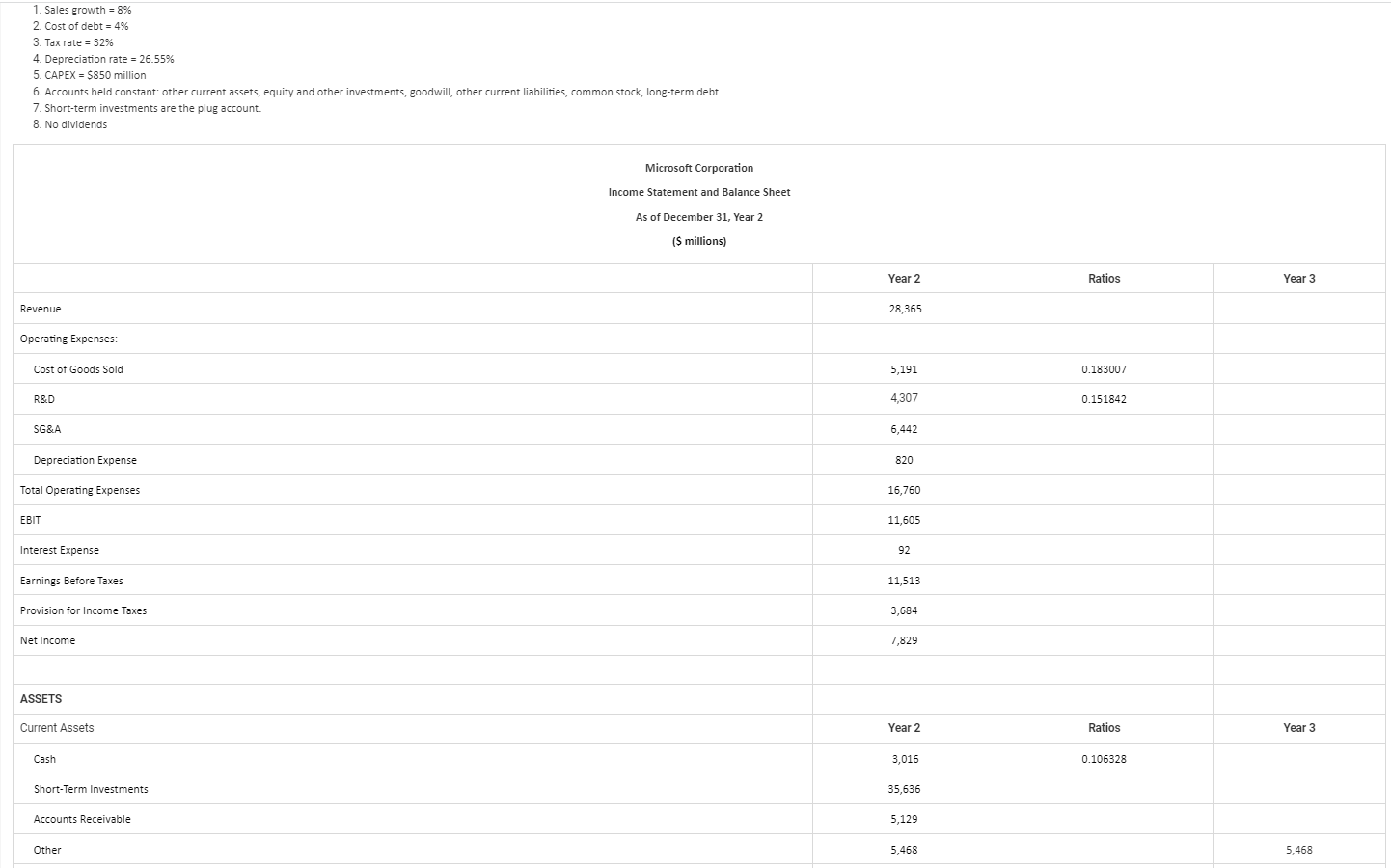

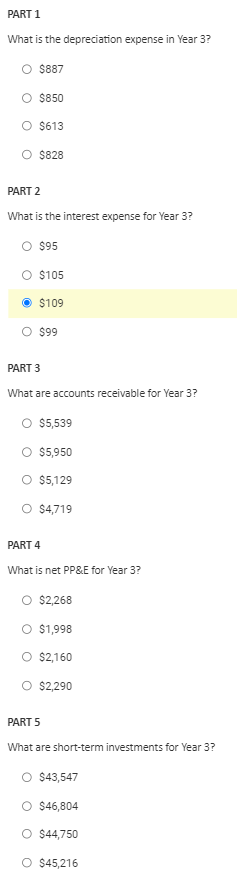

1. Sales growth = 8% 2. Cost of debt = 4% 3. Tax rate = 32% 4. Depreciation rate = 26.55% 5. CAPEX = $850 million 6. Accounts held constant: other current assets, equity and other investments, goodwill, other current liabilities, common stock, long-term debt 7. Short-term investments are the plug account. 8. No dividends Microsoft Corporation Income Statement and Balance Sheet As of December 31, Year 2 (5 millions) Year 2 Ratios Year 3 Revenue 28,365 Operating Expenses Cost of Goods Sold 5,191 0.183007 R&D 4,307 0.151842 SG&A 6,442 Depreciation Expense 820 Total Operating Expenses 16,760 EBIT 11,605 Interest Expense 92 Earnings Before Taxes 11,513 Provision for Income Taxes 3,684 Net Income 7,829 ASSETS Current Assets Year 2 Ratios Year 3 Cash 3,016 0.106328 Short-Term Investments 35,636 Accounts Receivable 5,129 Other 5,468 5,468 Total Current Assets 49,249 Property, Plant, & Equipment Net 2,268 Equity & Other Investments 15,133 15.133 Goodwill 1,669 Total Assets 68,319 LIABILITIES & STOCKHOLDERS' EQUITY Accounts Payable 1,208 Other 12.209 12.209 Total Current Liabilities 13,417 Long-Term Debt 2,722 2,722 Total Liabilities 16,139 Stockholders' Equity Common Stock 31,647 31,647 Retained Earnings 20,533 Total Stockholders' Equity 52,180 Total Liabilities and Stockholders' Equity 68,319 PART 1 What is the depreciation expense in Year 3? O $887 O $850 O $613 O $828 PART 2 What is the interest expense for Year 3? O $95 O $105 $109 O $99 PART 3 What are accounts receivable for Year 3? O $5,539 $5,950 O $5,129 O $4,719 PART 4 What is net PP&E for Year 3? O $2,268 O $1,998 O $2,160 O $2,290 PART 5 What are short-term investments for Year 3? O $43,547 O $46,804 O $44,750 O $45,216 1. Sales growth = 8% 2. Cost of debt = 4% 3. Tax rate = 32% 4. Depreciation rate = 26.55% 5. CAPEX = $850 million 6. Accounts held constant: other current assets, equity and other investments, goodwill, other current liabilities, common stock, long-term debt 7. Short-term investments are the plug account. 8. No dividends Microsoft Corporation Income Statement and Balance Sheet As of December 31, Year 2 (5 millions) Year 2 Ratios Year 3 Revenue 28,365 Operating Expenses Cost of Goods Sold 5,191 0.183007 R&D 4,307 0.151842 SG&A 6,442 Depreciation Expense 820 Total Operating Expenses 16,760 EBIT 11,605 Interest Expense 92 Earnings Before Taxes 11,513 Provision for Income Taxes 3,684 Net Income 7,829 ASSETS Current Assets Year 2 Ratios Year 3 Cash 3,016 0.106328 Short-Term Investments 35,636 Accounts Receivable 5,129 Other 5,468 5,468 Total Current Assets 49,249 Property, Plant, & Equipment Net 2,268 Equity & Other Investments 15,133 15.133 Goodwill 1,669 Total Assets 68,319 LIABILITIES & STOCKHOLDERS' EQUITY Accounts Payable 1,208 Other 12.209 12.209 Total Current Liabilities 13,417 Long-Term Debt 2,722 2,722 Total Liabilities 16,139 Stockholders' Equity Common Stock 31,647 31,647 Retained Earnings 20,533 Total Stockholders' Equity 52,180 Total Liabilities and Stockholders' Equity 68,319 PART 1 What is the depreciation expense in Year 3? O $887 O $850 O $613 O $828 PART 2 What is the interest expense for Year 3? O $95 O $105 $109 O $99 PART 3 What are accounts receivable for Year 3? O $5,539 $5,950 O $5,129 O $4,719 PART 4 What is net PP&E for Year 3? O $2,268 O $1,998 O $2,160 O $2,290 PART 5 What are short-term investments for Year 3? O $43,547 O $46,804 O $44,750 O $45,216