Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Samantha Jones of Gorsuch Capital is considering investing in NewVenture. What share of the company will she require today if her required rate

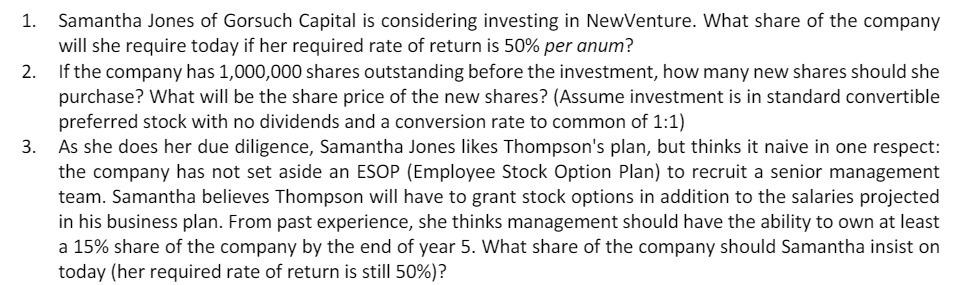

1. Samantha Jones of Gorsuch Capital is considering investing in NewVenture. What share of the company will she require today if her required rate of return is 50% per anum? 2. If the company has 1,000,000 shares outstanding before the investment, how many new shares should she purchase? What will be the share price of the new shares? (Assume investment is in standard convertible preferred stock with no dividends and a conversion rate to common of 1:1) 3. As she does her due diligence, Samantha Jones likes Thompson's plan, but thinks it naive in one respect: the company has not set aside an ESOP (Employee Stock Option Plan) to recruit a senior management team. Samantha believes Thompson will have to grant stock options in addition to the salaries projected in his business plan. From past experience, she thinks management should have the ability to own at least a 15% share of the company by the end of year 5. What share of the company should Samantha insist on today (her required rate of return is still 50%)?

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 We need more details regarding the financials and valuation of New Venture in order to establish how many shares Samantha Jones will need today The needed rate of return for Samantha Jones alone can...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started