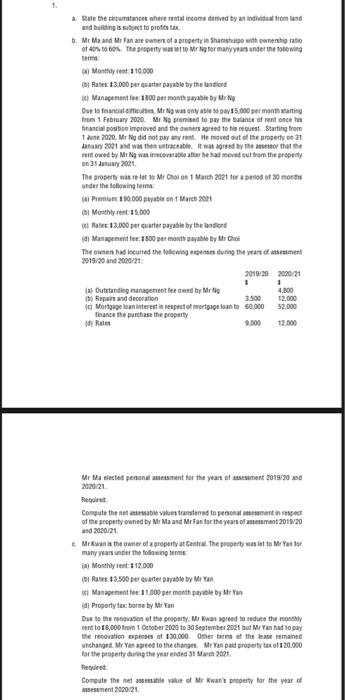

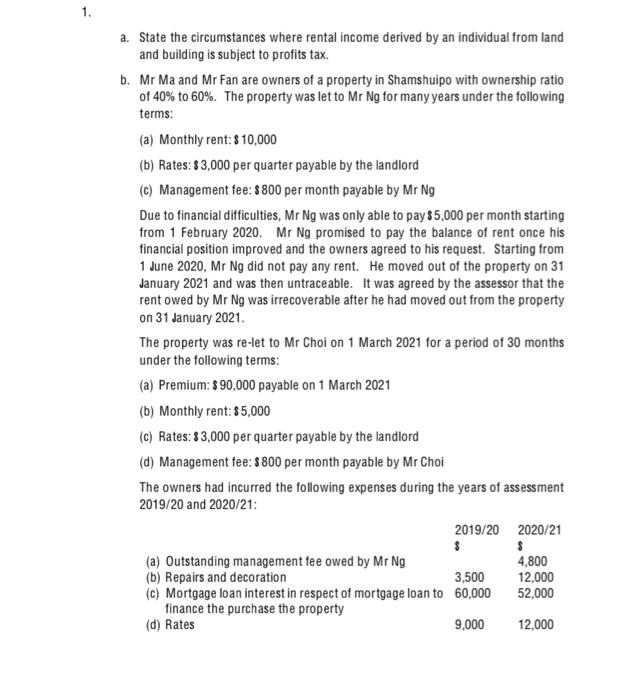

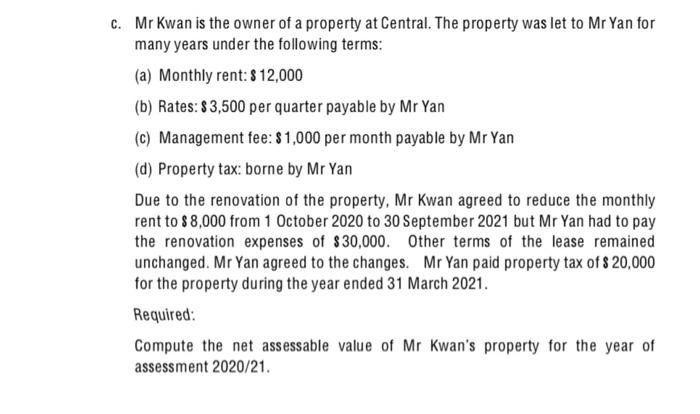

1. Sate e certumatances here mental income delived by an inte tromland and building is subject to prostu Mr Ma and Mr Fan are tens of a property in Shanghai with worshi ratio of 400Theroperty was to Mr Nig for many years under the following term Monthly 110.000 Rates: 13.000 per quarter payable by the landlord Management fee 1800 per month payable by Mr Ng Due to facilities. Me Ng was only able to pay 5.000 per month starting from 1 February 2020 Mr No Denised to pay the balance of rentonces financial position improved and the owners agreed to his request. Starting from 1 June 2020. Mr Ng did not pay any rent. He moved out of the property 0 31 January 2021 and was the cable. It was agreed by the that the muitowed by Mr Ngwair.coverabatter he had moved out from the property 312001 The property are het to Mr Chol on March 2021 for a period of 3 month under the following terms tai Premium 190.000 payable on March 2021 Monthlyet 15.000 13.000 per quarter payable by the landlord c) Management fee: 1800 per month payable by Mr Choi The ownen had incurred the following persis during the year of sement 2019/20 and 2000/21 2019/20 2020/21 1 #) Outstanding management feed by Mr 4.300 3.500 12.000 IdMortgage loan interest in respect of mortgage loan to 60.000 52.000 finance the purchase the property Mr Madlected peel anesment for the yean et asesitment 2019:20 and 2020/21 hele Compute the nestable values transferred to penonat penting of the property owned by Mr Ma and Mr Fan for the years of met 2011/20 and 2020/21 MrKwan is the owner of a property Centre. The property is it to Mr Pastor many years under the following Monthly real 112.000 DIR 13.500 per quarter payable by Mi Yan Management: 11.000 per month payable by Mr di Property tax borne by MrYan Due to the renovation of the property. Mr war agreed to reduce the only etto 18,00 1 October 2020 to 30 September 2021 but MrYan tad to pay the renovation expenses of 130.000. Other terms of the lease remained unchanged. My Yaared to the change. Me Yapaid property tax of 120.000 for the property during the year ended 31 March 2001 Required Comote the net sable value of Mr Kwan's property for the year of assement 2020/21 1. a. State the circumstances where rental income derived by an individual from land and building is subject to profits tax. b. Mr Ma and Mr Fan are owners of a property in Shamshuipo with ownership ratio of 40% to 60%. The property was let to Mr Ng for many years under the following terms: (a) Monthly rent: $10,000 (b) Rates: $3,000 per quarter payable by the landlord (c) Management fee: $ 800 per month payable by Mr Ng Due to financial difficulties, Mr Ng was only able to pay $5,000 per month starting from 1 February 2020. Mr Ng promised to pay the balance of rent once his financial position improved and the owners agreed to his request. Starting from 1 June 2020, Mr Ng did not pay any rent. He moved out of the property on 31 January 2021 and was then untraceable. It was agreed by the assessor that the rent owed by Mr Ng was irrecoverable after he had moved out from the property on 31 January 2021. The property was re-et to Mr Choi on 1 March 2021 for a period of 30 months under the following terms: (a) Premium: 890,000 payable on 1 March 2021 (b) Monthly rent: 85,000 (c) Rates: 83,000 per quarter payable by the landlord (d) Management fee: $800 per month payable by Mr Choi The owners had incurred the following expenses during the years of assessment 2019/20 and 2020/21: 2019/20 2020/21 $ $ (a) Outstanding management fee owed by Mr Ng 4,800 (b) Repairs and decoration 3,500 12,000 (c) Mortgage loan interest in respect of mortgage loan to 60,000 52,000 finance the purchase the property (d) Rates 9,000 12,000 C. Mr Kwan is the owner of a property at Central. The property was let to Mr Yan for many years under the following terms: (a) Monthly rent: $ 12,000 (b) Rates: $3,500 per quarter payable by Mr Yan (c) Management fee: $1,000 per month payable by Mr Yan (d) Property tax: borne by Mr Yan Due to the renovation of the property, Mr Kwan agreed to reduce the monthly rent to $8,000 from 1 October 2020 to 30 September 2021 but Mr Yan had to pay the renovation expenses of $30,000. Other terms of the lease remained unchanged. Mr Yan agreed to the changes. MrYan paid property tax of $ 20,000 for the property during the year ended 31 March 2021. Required: Compute the net assessable value of Mr Kwan's property for the year of assessment 2020/21 1. a. State the circumstances where rental income derived by an individual from land and building is subject to profits tax. b. Mr Ma and Mr Fan are owners of a property in Shamshuipo with ownership ratio of 40% to 60%. The property was let to Mr Ng for many years under the following terms: (a) Monthly rent: $10,000 (b) Rates: $3,000 per quarter payable by the landlord (c) Management fee: $800 per month payable by Mr Ng Due to financial difficulties, Mr Ng was only able to pay $5,000 per month starting from 1 February 2020. Mr Ng promised to pay the balance of rent once his financial position improved and the owners agreed to his request. Starting from 1 June 2020, Mr Ng did not pay any rent. He moved out of the property on 31 January 2021 and was then untraceable. It was agreed by the assessor that the rent owed by Mr Ng was irrecoverable after he had moved out from the property on 31 January 2021 The property was re-let to Mr Choi on 1 March 2021 for a period of 30 months under the following terms: (a) Premium: 890,000 payable on 1 March 2021 (b) Monthly rent: $5,000 (c) Rates: $3,000 per quarter payable by the landlord (d) Management fee: $ 800 per month payable by Mr Choi The owners had incurred the following expenses during the years of assessment 2019/20 and 2020/21: 2019/20 2020/21 $ $ (a) Outstanding management fee owed by Mr Ng 4,800 (b) Repairs and decoration 3,500 12,000 (c) Mortgage loan interest in respect of mortgage loan to 60,000 52,000 finance the purchase the property (d) Rates 9,000 12,000 Mr Ma elected personal assessment for the years of assessment 2019/20 and 2020/21. Required: Compute the net assessable values transferred to personal assessment in respect of the property owned by Mr Ma and Mr Fan for the years of assessment 2019/20 and 2020/21. C. Mr Kwan is the owner of a property at Central. The property was let to Mr Yan for many years under the following terms: (a) Monthly rent: $ 12,000 (b) Rates: $3,500 per quarter payable by Mr Yan (C) Management fee: $1,000 per month payable by Mr Yan (d) Property tax: borne by Mr Yan Due to the renovation of the property, Mr Kwan agreed to reduce the monthly rent to $8,000 from 1 October 2020 to 30 September 2021 but Mr Yan had to pay the renovation expenses of $30,000. Other terms of the lease remained unchanged. Mr Yan agreed to the changes. Mr Yan paid property tax of $ 20,000 for the property during the year ended 31 March 2021. Required: Compute the net assessable value of Mr Kwan's property for the year of assessment 2020/21. 1. a. State the circumstances where rental income derived by an individual from land and building is subject to profits tax. b. Mr Ma and Mr Fan are owners of a property in Shamshuipo with ownership ratio of 40% to 60%. The property was let to Mr Ng for many years under the following terms: (a) Monthly rent: $ 10,000 (b) Rates: 83,000 per quarter payable by the landlord (c) Management fee: $ 800 per month payable by Mr Ng Due to financial difficulties, Mr Ng was only able to pay $5,000 per month starting from 1 February 2020. Mr Ng promised to pay the balance of rent once his financial position improved and the owners agreed to his request. Starting from 1 June 2020, Mr Ng did not pay any rent. He moved out of the property on 31 January 2021 and was then untraceable. It was agreed by the assessor that the rent owed by Mr Ng was irrecoverable after he had moved out from the property on 31 January 2021. The property was re-let to Mr Choi on 1 March 2021 for a period of 30 months under the following terms: (a) Premium: 890,000 payable on 1 March 2021 (b) Monthly rent: $5,000 (C) Rates: $3,000 per quarter payable by the landlord (d) Management fee: $ 800 per month payable by Mr Choi The owners had incurred the following expenses during the years of assessment 2019/20 and 2020/21: 2019/20 $ (a) Outstanding management fee owed by Mr Ng (b) Repairs and decoration 3,500 (c) Mortgage loan interest in respect of mortgage loan to 60,000 finance the purchase the property (d) Rates 9,000 2020/21 $ 4,800 12,000 52,000 12,000 Mr Ma elected personal assessment for the years of assessment 2019/20 and 2020/21. Required: Compute the net assessable values transferred to personal assessment in respect of the property owned by Mr Ma and Mr Fan for the years of assessment 2019/20 and 2020/21. C. Mr Kwan is the owner of a property at Central. The property was let to Mr Yan for many years under the following terms: (a) Monthly rent: $ 12,000 (b) Rates: $3,500 per quarter payable by Mr Yan (C) Management fee: $1,000 per month payable by Mr Yan (d) Property tax: borne by Mr Yan Due to the renovation of the property, Mr Kwan agreed to reduce the monthly rent to $8,000 from 1 October 2020 to 30 September 2021 but Mr Yan had to pay the renovation expenses of $30,000. Other terms of the lease remained unchanged. Mr Yan agreed to the changes. Mr Yan paid property tax of $ 20,000 for the property during the year ended 31 March 2021. Required: Compute the net assessable value of Mr Kwan's property for the year of assessment 2020/21. 1. Sate e certumatances here mental income delived by an inte tromland and building is subject to prostu Mr Ma and Mr Fan are tens of a property in Shanghai with worshi ratio of 400Theroperty was to Mr Nig for many years under the following term Monthly 110.000 Rates: 13.000 per quarter payable by the landlord Management fee 1800 per month payable by Mr Ng Due to facilities. Me Ng was only able to pay 5.000 per month starting from 1 February 2020 Mr No Denised to pay the balance of rentonces financial position improved and the owners agreed to his request. Starting from 1 June 2020. Mr Ng did not pay any rent. He moved out of the property 0 31 January 2021 and was the cable. It was agreed by the that the muitowed by Mr Ngwair.coverabatter he had moved out from the property 312001 The property are het to Mr Chol on March 2021 for a period of 3 month under the following terms tai Premium 190.000 payable on March 2021 Monthlyet 15.000 13.000 per quarter payable by the landlord c) Management fee: 1800 per month payable by Mr Choi The ownen had incurred the following persis during the year of sement 2019/20 and 2000/21 2019/20 2020/21 1 #) Outstanding management feed by Mr 4.300 3.500 12.000 IdMortgage loan interest in respect of mortgage loan to 60.000 52.000 finance the purchase the property Mr Madlected peel anesment for the yean et asesitment 2019:20 and 2020/21 hele Compute the nestable values transferred to penonat penting of the property owned by Mr Ma and Mr Fan for the years of met 2011/20 and 2020/21 MrKwan is the owner of a property Centre. The property is it to Mr Pastor many years under the following Monthly real 112.000 DIR 13.500 per quarter payable by Mi Yan Management: 11.000 per month payable by Mr di Property tax borne by MrYan Due to the renovation of the property. Mr war agreed to reduce the only etto 18,00 1 October 2020 to 30 September 2021 but MrYan tad to pay the renovation expenses of 130.000. Other terms of the lease remained unchanged. My Yaared to the change. Me Yapaid property tax of 120.000 for the property during the year ended 31 March 2001 Required Comote the net sable value of Mr Kwan's property for the year of assement 2020/21 1. a. State the circumstances where rental income derived by an individual from land and building is subject to profits tax. b. Mr Ma and Mr Fan are owners of a property in Shamshuipo with ownership ratio of 40% to 60%. The property was let to Mr Ng for many years under the following terms: (a) Monthly rent: $10,000 (b) Rates: $3,000 per quarter payable by the landlord (c) Management fee: $ 800 per month payable by Mr Ng Due to financial difficulties, Mr Ng was only able to pay $5,000 per month starting from 1 February 2020. Mr Ng promised to pay the balance of rent once his financial position improved and the owners agreed to his request. Starting from 1 June 2020, Mr Ng did not pay any rent. He moved out of the property on 31 January 2021 and was then untraceable. It was agreed by the assessor that the rent owed by Mr Ng was irrecoverable after he had moved out from the property on 31 January 2021. The property was re-et to Mr Choi on 1 March 2021 for a period of 30 months under the following terms: (a) Premium: 890,000 payable on 1 March 2021 (b) Monthly rent: 85,000 (c) Rates: 83,000 per quarter payable by the landlord (d) Management fee: $800 per month payable by Mr Choi The owners had incurred the following expenses during the years of assessment 2019/20 and 2020/21: 2019/20 2020/21 $ $ (a) Outstanding management fee owed by Mr Ng 4,800 (b) Repairs and decoration 3,500 12,000 (c) Mortgage loan interest in respect of mortgage loan to 60,000 52,000 finance the purchase the property (d) Rates 9,000 12,000 C. Mr Kwan is the owner of a property at Central. The property was let to Mr Yan for many years under the following terms: (a) Monthly rent: $ 12,000 (b) Rates: $3,500 per quarter payable by Mr Yan (c) Management fee: $1,000 per month payable by Mr Yan (d) Property tax: borne by Mr Yan Due to the renovation of the property, Mr Kwan agreed to reduce the monthly rent to $8,000 from 1 October 2020 to 30 September 2021 but Mr Yan had to pay the renovation expenses of $30,000. Other terms of the lease remained unchanged. Mr Yan agreed to the changes. MrYan paid property tax of $ 20,000 for the property during the year ended 31 March 2021. Required: Compute the net assessable value of Mr Kwan's property for the year of assessment 2020/21 1. a. State the circumstances where rental income derived by an individual from land and building is subject to profits tax. b. Mr Ma and Mr Fan are owners of a property in Shamshuipo with ownership ratio of 40% to 60%. The property was let to Mr Ng for many years under the following terms: (a) Monthly rent: $10,000 (b) Rates: $3,000 per quarter payable by the landlord (c) Management fee: $800 per month payable by Mr Ng Due to financial difficulties, Mr Ng was only able to pay $5,000 per month starting from 1 February 2020. Mr Ng promised to pay the balance of rent once his financial position improved and the owners agreed to his request. Starting from 1 June 2020, Mr Ng did not pay any rent. He moved out of the property on 31 January 2021 and was then untraceable. It was agreed by the assessor that the rent owed by Mr Ng was irrecoverable after he had moved out from the property on 31 January 2021 The property was re-let to Mr Choi on 1 March 2021 for a period of 30 months under the following terms: (a) Premium: 890,000 payable on 1 March 2021 (b) Monthly rent: $5,000 (c) Rates: $3,000 per quarter payable by the landlord (d) Management fee: $ 800 per month payable by Mr Choi The owners had incurred the following expenses during the years of assessment 2019/20 and 2020/21: 2019/20 2020/21 $ $ (a) Outstanding management fee owed by Mr Ng 4,800 (b) Repairs and decoration 3,500 12,000 (c) Mortgage loan interest in respect of mortgage loan to 60,000 52,000 finance the purchase the property (d) Rates 9,000 12,000 Mr Ma elected personal assessment for the years of assessment 2019/20 and 2020/21. Required: Compute the net assessable values transferred to personal assessment in respect of the property owned by Mr Ma and Mr Fan for the years of assessment 2019/20 and 2020/21. C. Mr Kwan is the owner of a property at Central. The property was let to Mr Yan for many years under the following terms: (a) Monthly rent: $ 12,000 (b) Rates: $3,500 per quarter payable by Mr Yan (C) Management fee: $1,000 per month payable by Mr Yan (d) Property tax: borne by Mr Yan Due to the renovation of the property, Mr Kwan agreed to reduce the monthly rent to $8,000 from 1 October 2020 to 30 September 2021 but Mr Yan had to pay the renovation expenses of $30,000. Other terms of the lease remained unchanged. Mr Yan agreed to the changes. Mr Yan paid property tax of $ 20,000 for the property during the year ended 31 March 2021. Required: Compute the net assessable value of Mr Kwan's property for the year of assessment 2020/21. 1. a. State the circumstances where rental income derived by an individual from land and building is subject to profits tax. b. Mr Ma and Mr Fan are owners of a property in Shamshuipo with ownership ratio of 40% to 60%. The property was let to Mr Ng for many years under the following terms: (a) Monthly rent: $ 10,000 (b) Rates: 83,000 per quarter payable by the landlord (c) Management fee: $ 800 per month payable by Mr Ng Due to financial difficulties, Mr Ng was only able to pay $5,000 per month starting from 1 February 2020. Mr Ng promised to pay the balance of rent once his financial position improved and the owners agreed to his request. Starting from 1 June 2020, Mr Ng did not pay any rent. He moved out of the property on 31 January 2021 and was then untraceable. It was agreed by the assessor that the rent owed by Mr Ng was irrecoverable after he had moved out from the property on 31 January 2021. The property was re-let to Mr Choi on 1 March 2021 for a period of 30 months under the following terms: (a) Premium: 890,000 payable on 1 March 2021 (b) Monthly rent: $5,000 (C) Rates: $3,000 per quarter payable by the landlord (d) Management fee: $ 800 per month payable by Mr Choi The owners had incurred the following expenses during the years of assessment 2019/20 and 2020/21: 2019/20 $ (a) Outstanding management fee owed by Mr Ng (b) Repairs and decoration 3,500 (c) Mortgage loan interest in respect of mortgage loan to 60,000 finance the purchase the property (d) Rates 9,000 2020/21 $ 4,800 12,000 52,000 12,000 Mr Ma elected personal assessment for the years of assessment 2019/20 and 2020/21. Required: Compute the net assessable values transferred to personal assessment in respect of the property owned by Mr Ma and Mr Fan for the years of assessment 2019/20 and 2020/21. C. Mr Kwan is the owner of a property at Central. The property was let to Mr Yan for many years under the following terms: (a) Monthly rent: $ 12,000 (b) Rates: $3,500 per quarter payable by Mr Yan (C) Management fee: $1,000 per month payable by Mr Yan (d) Property tax: borne by Mr Yan Due to the renovation of the property, Mr Kwan agreed to reduce the monthly rent to $8,000 from 1 October 2020 to 30 September 2021 but Mr Yan had to pay the renovation expenses of $30,000. Other terms of the lease remained unchanged. Mr Yan agreed to the changes. Mr Yan paid property tax of $ 20,000 for the property during the year ended 31 March 2021. Required: Compute the net assessable value of Mr Kwan's property for the year of assessment 2020/21