Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Semi-detached house in Puchong This property was sold for RM1,000,000 on 7 August 2019. The owner has to pay RM16,000 of commission to

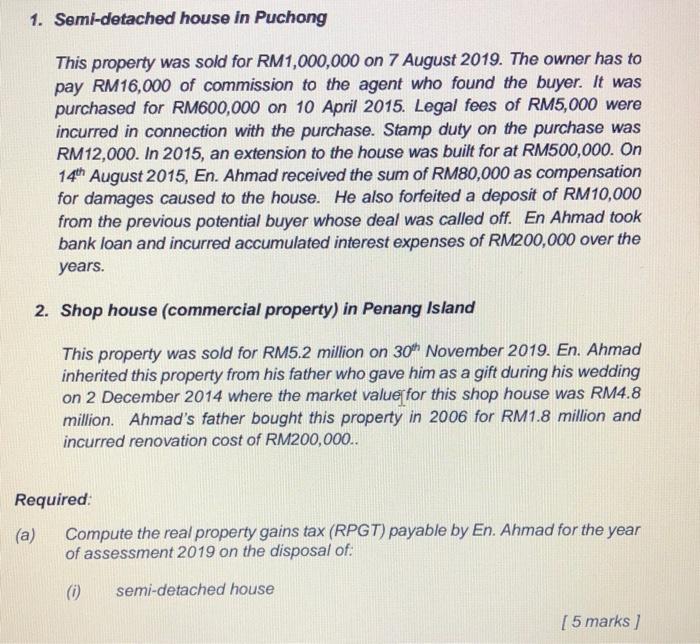

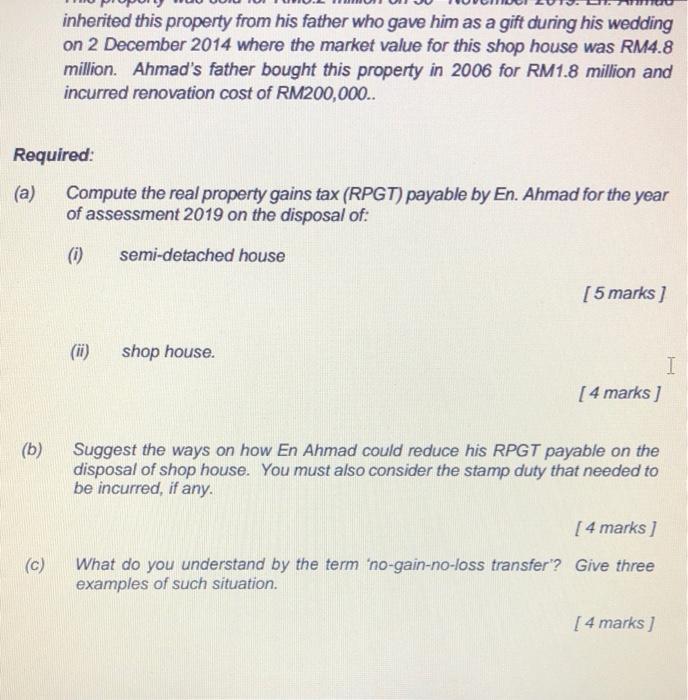

1. Semi-detached house in Puchong This property was sold for RM1,000,000 on 7 August 2019. The owner has to pay RM16,000 of commission to the agent who found the buyer. It was purchased for RM600,000 on 10 April 2015. Legal fees of RM5,000 were incurred in connection with the purchase. Stamp duty on the purchase was RM12,000. In 2015, an extension to the house was built for at RM500,000. On 14th August 2015, En. Ahmad received the sum of RM80,000 as compensation for damages caused to the house. He also forfeited a deposit of RM10,000 from the previous potential buyer whose deal was called off. En Ahmad took bank loan and incurred accumulated interest expenses of RM200,000 over the years. 2. Shop house (commercial property) in Penang Island This property was sold for RM5.2 million on 30th November 2019. En. Ahmad inherited this property from his father who gave him as a gift during his wedding on 2 December 2014 where the market value for this shop house was RM4.8 million. Ahmad's father bought this property in 2006 for RM1.8 million and incurred renovation cost of RM200,000.. Required: (a) Compute the real property gains tax (RPGT) payable by En. Ahmad for the year of assessment 2019 on the disposal of: (i) semi-detached house [ 5 marks] Required: (a) (b) inherited this property from his father who gave him as a gift during his wedding on 2 December 2014 where the market value for this shop house was RM4.8 million. Ahmad's father bought this property in 2006 for RM1.8 million and incurred renovation cost of RM200,000.. (c) Compute the real property gains tax (RPGT) payable by En. Ahmad for the year of assessment 2019 on the disposal of: (i) semi-detached house (ii) shop house. [5 marks] [4 marks] Suggest the ways on how En Ahmad could reduce his RPGT payable on the disposal of shop house. You must also consider the stamp duty that needed to be incurred, if any. [ 4 marks] What do you understand by the term 'no-gain-no-loss transfer? Give three examples of such situation. [ 4 marks] I 1. Semi-detached house in Puchong This property was sold for RM1,000,000 on 7 August 2019. The owner has to pay RM16,000 of commission to the agent who found the buyer. It was purchased for RM600,000 on 10 April 2015. Legal fees of RM5,000 were incurred in connection with the purchase. Stamp duty on the purchase was RM12,000. In 2015, an extension to the house was built for at RM500,000. On 14th August 2015, En. Ahmad received the sum of RM80,000 as compensation for damages caused to the house. He also forfeited a deposit of RM10,000 from the previous potential buyer whose deal was called off. En Ahmad took bank loan and incurred accumulated interest expenses of RM200,000 over the years. 2. Shop house (commercial property) in Penang Island This property was sold for RM5.2 million on 30th November 2019. En. Ahmad inherited this property from his father who gave him as a gift during his wedding on 2 December 2014 where the market value for this shop house was RM4.8 million. Ahmad's father bought this property in 2006 for RM1.8 million and incurred renovation cost of RM200,000.. Required: (a) Compute the real property gains tax (RPGT) payable by En. Ahmad for the year of assessment 2019 on the disposal of: (i) semi-detached house [ 5 marks] Required: (a) (b) inherited this property from his father who gave him as a gift during his wedding on 2 December 2014 where the market value for this shop house was RM4.8 million. Ahmad's father bought this property in 2006 for RM1.8 million and incurred renovation cost of RM200,000.. (c) Compute the real property gains tax (RPGT) payable by En. Ahmad for the year of assessment 2019 on the disposal of: (i) semi-detached house (ii) shop house. [5 marks] [4 marks] Suggest the ways on how En Ahmad could reduce his RPGT payable on the disposal of shop house. You must also consider the stamp duty that needed to be incurred, if any. [ 4 marks] What do you understand by the term 'no-gain-no-loss transfer? Give three examples of such situation. [ 4 marks] I 1. Semi-detached house in Puchong This property was sold for RM1,000,000 on 7 August 2019. The owner has to pay RM16,000 of commission to the agent who found the buyer. It was purchased for RM600,000 on 10 April 2015. Legal fees of RM5,000 were incurred in connection with the purchase. Stamp duty on the purchase was RM12,000. In 2015, an extension to the house was built for at RM500,000. On 14th August 2015, En. Ahmad received the sum of RM80,000 as compensation for damages caused to the house. He also forfeited a deposit of RM10,000 from the previous potential buyer whose deal was called off. En Ahmad took bank loan and incurred accumulated interest expenses of RM200,000 over the years. 2. Shop house (commercial property) in Penang Island This property was sold for RM5.2 million on 30th November 2019. En. Ahmad inherited this property from his father who gave him as a gift during his wedding on 2 December 2014 where the market value for this shop house was RM4.8 million. Ahmad's father bought this property in 2006 for RM1.8 million and incurred renovation cost of RM200,000.. Required: (a) Compute the real property gains tax (RPGT) payable by En. Ahmad for the year of assessment 2019 on the disposal of: (i) semi-detached house [ 5 marks] Required: (a) (b) inherited this property from his father who gave him as a gift during his wedding on 2 December 2014 where the market value for this shop house was RM4.8 million. Ahmad's father bought this property in 2006 for RM1.8 million and incurred renovation cost of RM200,000.. (c) Compute the real property gains tax (RPGT) payable by En. Ahmad for the year of assessment 2019 on the disposal of: (i) semi-detached house (ii) shop house. [5 marks] [4 marks] Suggest the ways on how En Ahmad could reduce his RPGT payable on the disposal of shop house. You must also consider the stamp duty that needed to be incurred, if any. [ 4 marks] What do you understand by the term 'no-gain-no-loss transfer? Give three examples of such situation. [ 4 marks] I

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 a The RPGT payable by En Ahmad for the year of assessment 2019 on the disposal of the semidetached ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started