Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Seymour is a calendar year taxpayer and 20% partner in the RST partnership, which began business on 1/1/2023. Under applicable tax laws, assume

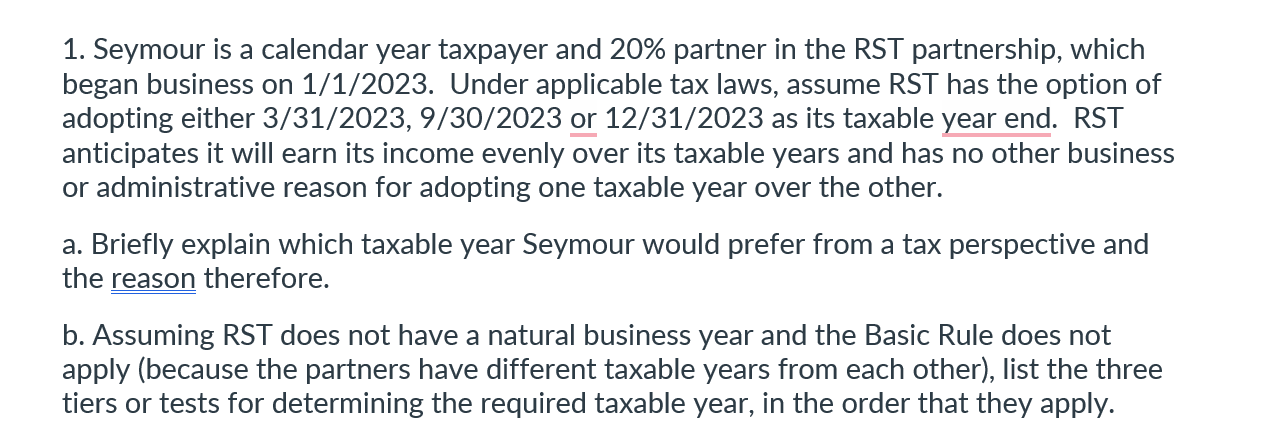

1. Seymour is a calendar year taxpayer and 20% partner in the RST partnership, which began business on 1/1/2023. Under applicable tax laws, assume RST has the option of adopting either 3/31/2023, 9/30/2023 or 12/31/2023 as its taxable year end. RST anticipates it will earn its income evenly over its taxable years and has no other business or administrative reason for adopting one taxable year over the other. a. Briefly explain which taxable year Seymour would prefer from a tax perspective and the reason therefore. b. Assuming RST does not have a natural business year and the Basic Rule does not apply (because the partners have different taxable years from each other), list the three tiers or tests for determining the required taxable year, in the order that they apply.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a From a tax perspective Seymour would prefer RST to adopt the 1231 taxable year end The reason for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started