Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Shamrock Inc. was supposed to have received a payment of $20,000, 4 years ago, and $7,000, 2 years ago, from a customer who

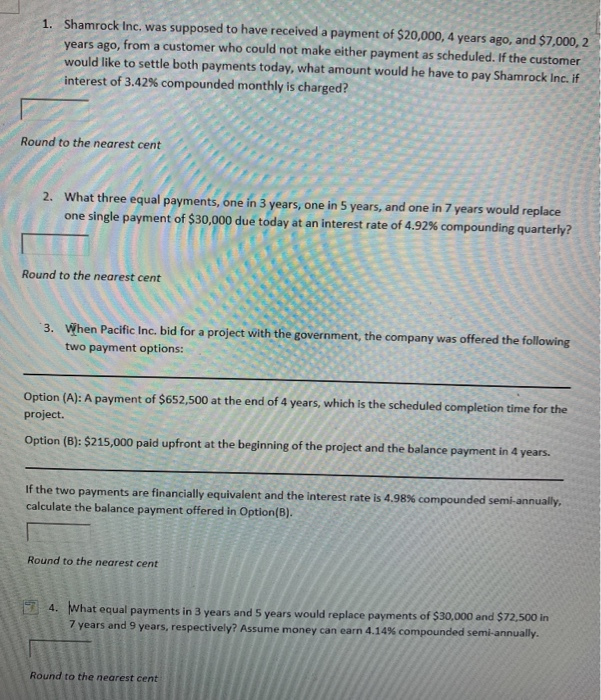

1. Shamrock Inc. was supposed to have received a payment of $20,000, 4 years ago, and $7,000, 2 years ago, from a customer who could not make either payment as scheduled. If the customer would like to settle both payments today, what amount would he have to pay Shamrock Inc. if interest of 3.42% compounded monthly is charged? Round to the nearest cent 2. What three equal payments, one in 3 years, one in 5 years, and one in 7 years would replace one single payment of $30,000 due today at an interest rate of 4.92% compounding quarterly? Round to the nearest cent 3. When Pacific Inc. bid for a project with the government, the company was offered the following two payment options: Option (A): A payment of $652,500 at the end of 4 years, which is the scheduled completion time for the project. Option (B): $215,000 paid upfront at the beginning of the project and the balance payment in 4 years. If the two payments are financially equivalent and the interest rate is 4.98% compounded semi-annually, calculate the balance payment offered in Option(B). Round to the nearest cent 4. What equal payments in 3 years and 5 years would replace payments of $30,000 and $72,500 in 7 years and 9 years, respectively? Assume money can earn 4.14% compounded semi-annually. Round to the nearest cent

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answers 1 3042233 2 1272919 3 39074777 4 4276327 12 34...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started