Answered step by step

Verified Expert Solution

Question

1 Approved Answer

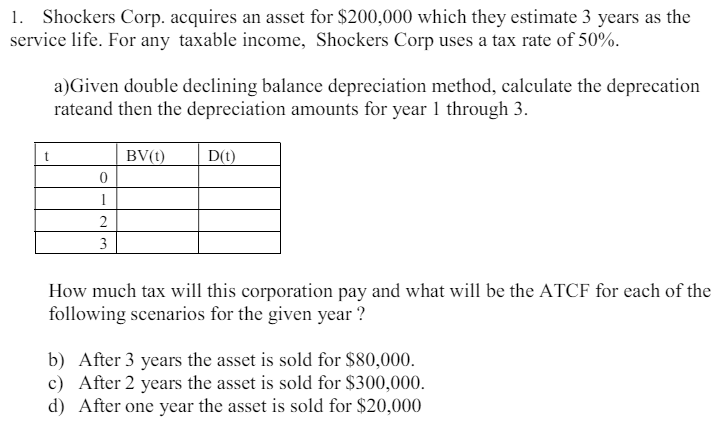

1. Shockers Corp. acquires an asset for $200,000 which they estimate 3 years as the service life. For any taxable income, Shockers Corp uses

1. Shockers Corp. acquires an asset for $200,000 which they estimate 3 years as the service life. For any taxable income, Shockers Corp uses a tax rate of 50%. a)Given double declining balance depreciation method, calculate the deprecation rateand then the depreciation amounts for year 1 through 3. 0 1 2 3 BV(t) D(t) How much tax will this corporation pay and what will be the ATCF for each of the following scenarios for the given year? b) After 3 years the asset is sold for $80,000. c) After 2 years the asset is sold for $300,000. d) After one year the asset is sold for $20,000

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer a First lets calculate the depreciation rate using the double declining balance method The fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664264dc0c744_981162.pdf

180 KBs PDF File

664264dc0c744_981162.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started