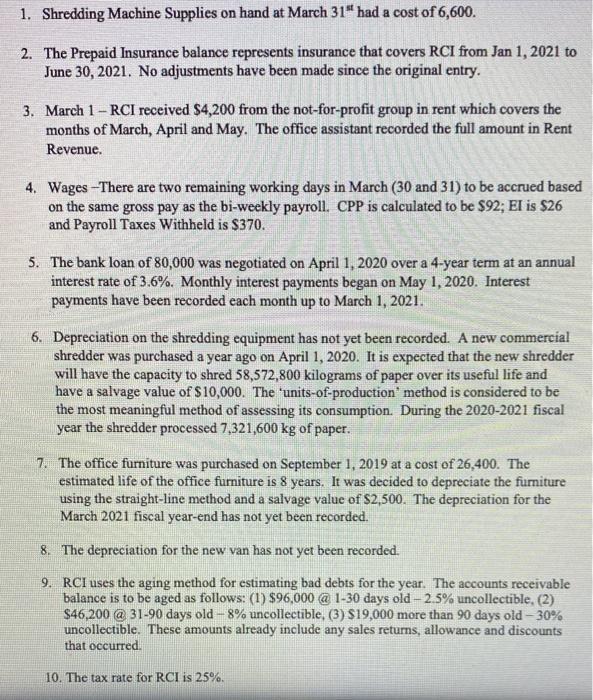

1. Shredding Machine Supplies on hand at March 31" had a cost of 6,600. 2. The Prepaid Insurance balance represents insurance that covers RCI from Jan 1, 2021 to June 30, 2021. No adjustments have been made since the original entry. 3. March 1 - RCI received $4,200 from the not-for-profit group in rent which covers the months of March, April and May. The office assistant recorded the full amount in Rent Revenue. 4. Wages - There are two remaining working days in March (30 and 31) to be accrued based on the same gross pay as the bi-weekly payroll. CPP is calculated to be $92; El is $26 and Payroll Taxes Withheld is $370. 5. The bank loan of 80,000 was negotiated on April 1, 2020 over a 4-year term at an annual interest rate of 3.6%. Monthly interest payments began on May 1, 2020. Interest payments have been recorded each month up to March 1, 2021. 6. Depreciation on the shredding equipment has not yet been recorded. A new commercial shredder was purchased a year ago on April 1, 2020. It is expected that the new shredder will have the capacity to shred 58,572,800 kilograms of paper over its useful life and have a salvage value of $10,000. The 'units-of-production' method is considered to be the most meaningful method of assessing its consumption. During the 2020-2021 fiscal year the shredder processed 7,321,600 kg of paper. 7. The office furniture was purchased on September 1, 2019 at a cost of 26,400. The estimated life of the office furniture is 8 years. It was decided to depreciate the furniture using the straight-line method and a salvage value of $2,500. The depreciation for the March 2021 fiscal year-end has not yet been recorded. 8. The depreciation for the new van has not yet been recorded. 9. RCI uses the aging method for estimating bad debts for the year. The accounts receivable balance is to be aged as follows: (1) $96,000 @ 1-30 days old - 2.5% uncollectible, (2) $46,200 @ 31-90 days old - 8% uncollectible, (3) $19,000 more than 90 days old -30% uncollectible. These amounts already include any sales returns, allowance and discounts that occurred. 10. The tax rate for RCI is 25%. 1. Shredding Machine Supplies on hand at March 31" had a cost of 6,600. 2. The Prepaid Insurance balance represents insurance that covers RCI from Jan 1, 2021 to June 30, 2021. No adjustments have been made since the original entry. 3. March 1 - RCI received $4,200 from the not-for-profit group in rent which covers the months of March, April and May. The office assistant recorded the full amount in Rent Revenue. 4. Wages - There are two remaining working days in March (30 and 31) to be accrued based on the same gross pay as the bi-weekly payroll. CPP is calculated to be $92; El is $26 and Payroll Taxes Withheld is $370. 5. The bank loan of 80,000 was negotiated on April 1, 2020 over a 4-year term at an annual interest rate of 3.6%. Monthly interest payments began on May 1, 2020. Interest payments have been recorded each month up to March 1, 2021. 6. Depreciation on the shredding equipment has not yet been recorded. A new commercial shredder was purchased a year ago on April 1, 2020. It is expected that the new shredder will have the capacity to shred 58,572,800 kilograms of paper over its useful life and have a salvage value of $10,000. The 'units-of-production' method is considered to be the most meaningful method of assessing its consumption. During the 2020-2021 fiscal year the shredder processed 7,321,600 kg of paper. 7. The office furniture was purchased on September 1, 2019 at a cost of 26,400. The estimated life of the office furniture is 8 years. It was decided to depreciate the furniture using the straight-line method and a salvage value of $2,500. The depreciation for the March 2021 fiscal year-end has not yet been recorded. 8. The depreciation for the new van has not yet been recorded. 9. RCI uses the aging method for estimating bad debts for the year. The accounts receivable balance is to be aged as follows: (1) $96,000 @ 1-30 days old - 2.5% uncollectible, (2) $46,200 @ 31-90 days old - 8% uncollectible, (3) $19,000 more than 90 days old -30% uncollectible. These amounts already include any sales returns, allowance and discounts that occurred. 10. The tax rate for RCI is 25%