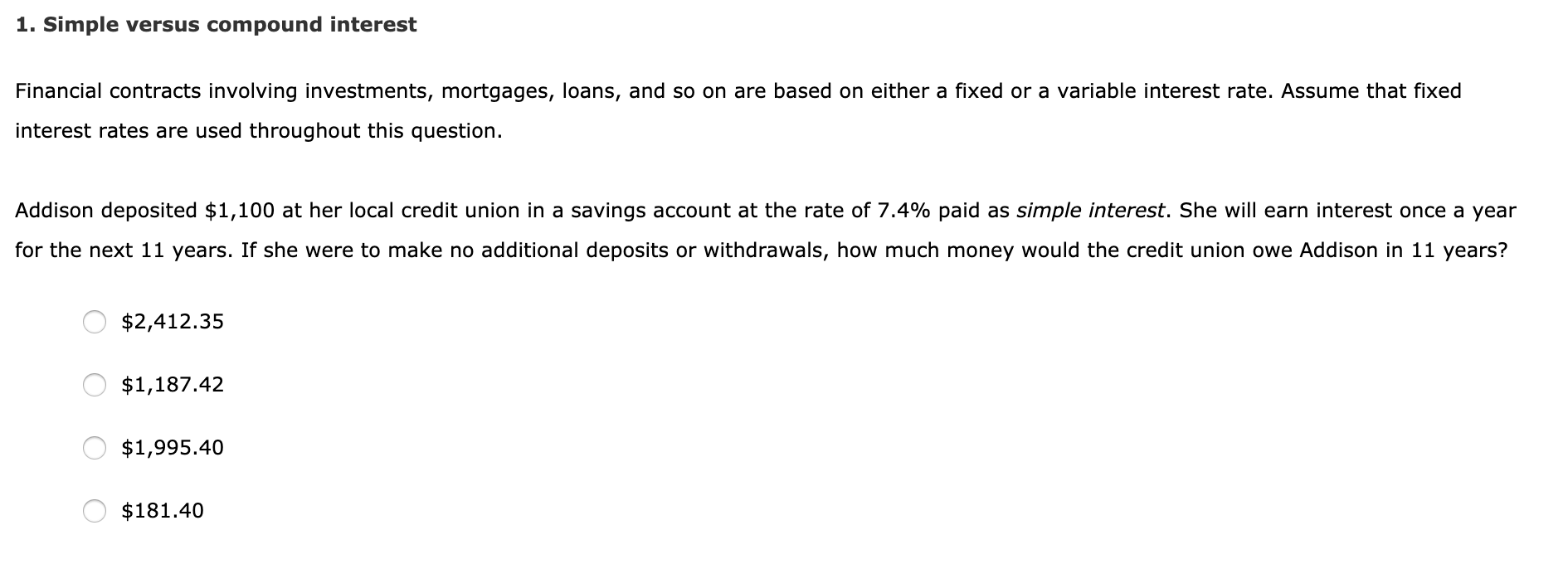

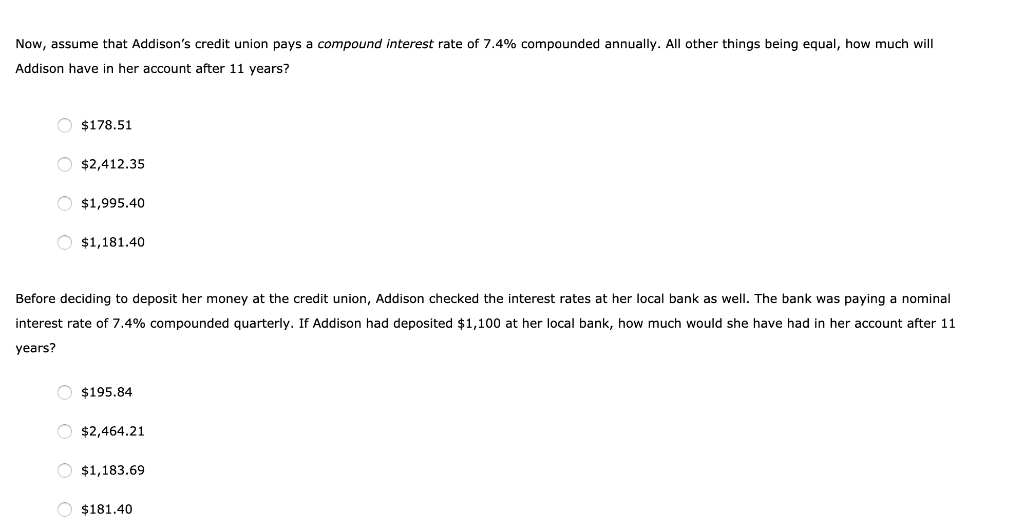

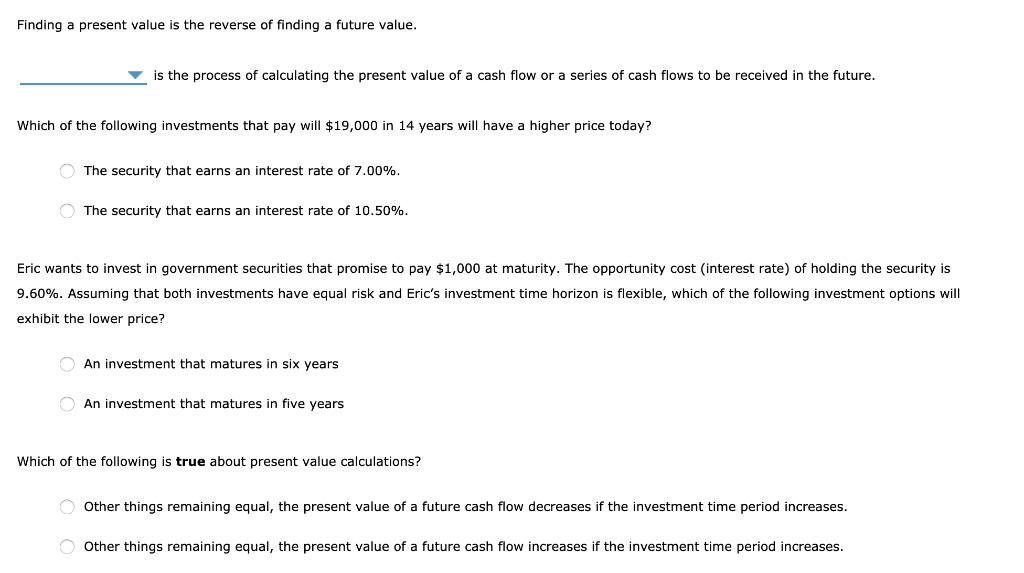

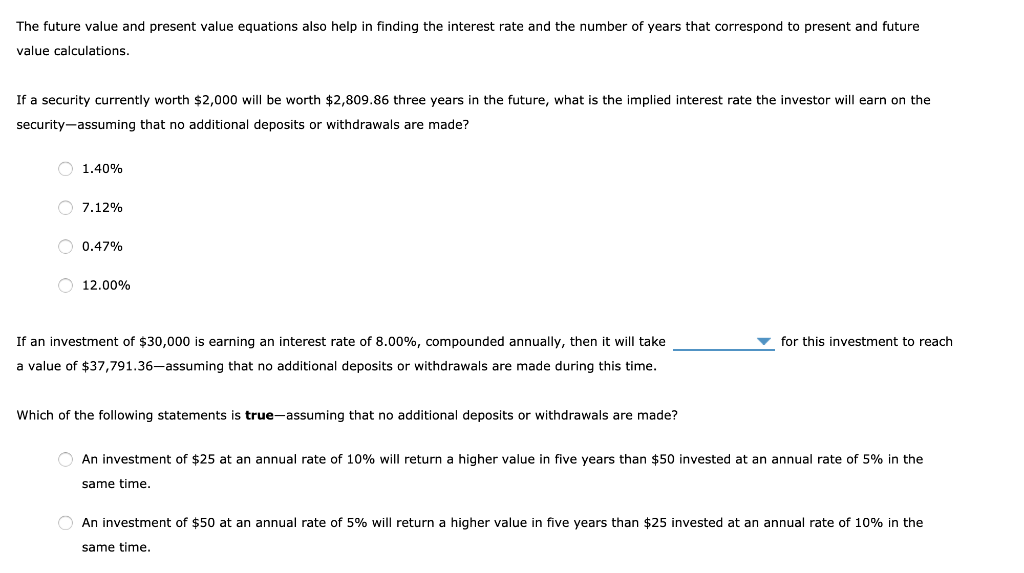

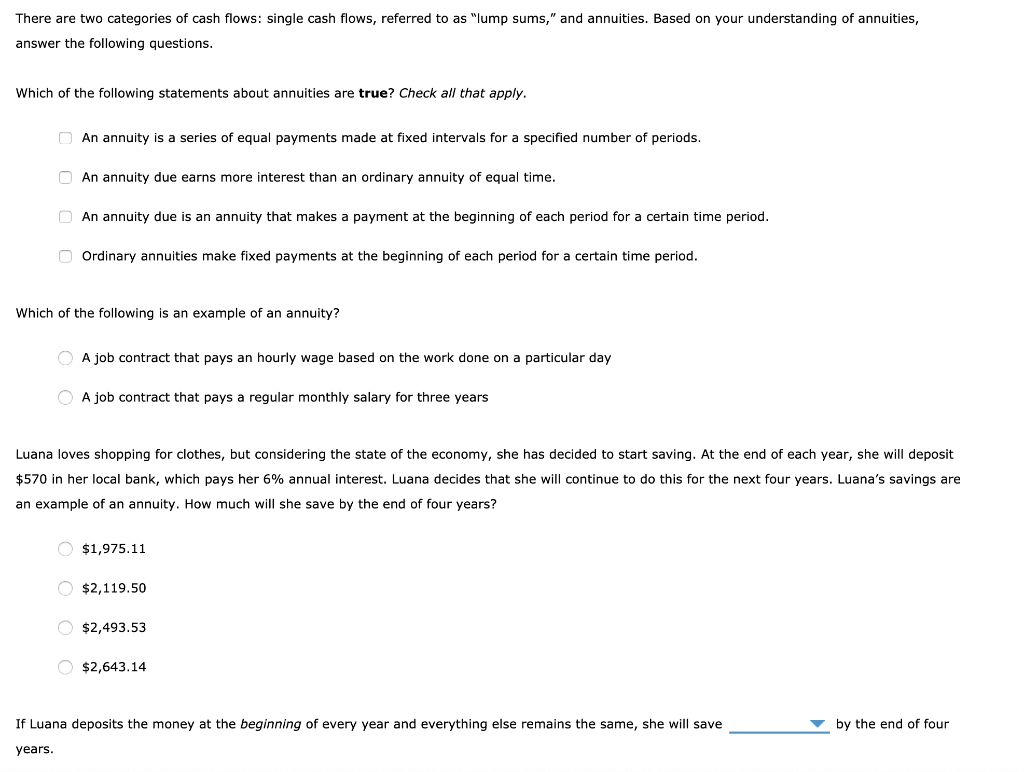

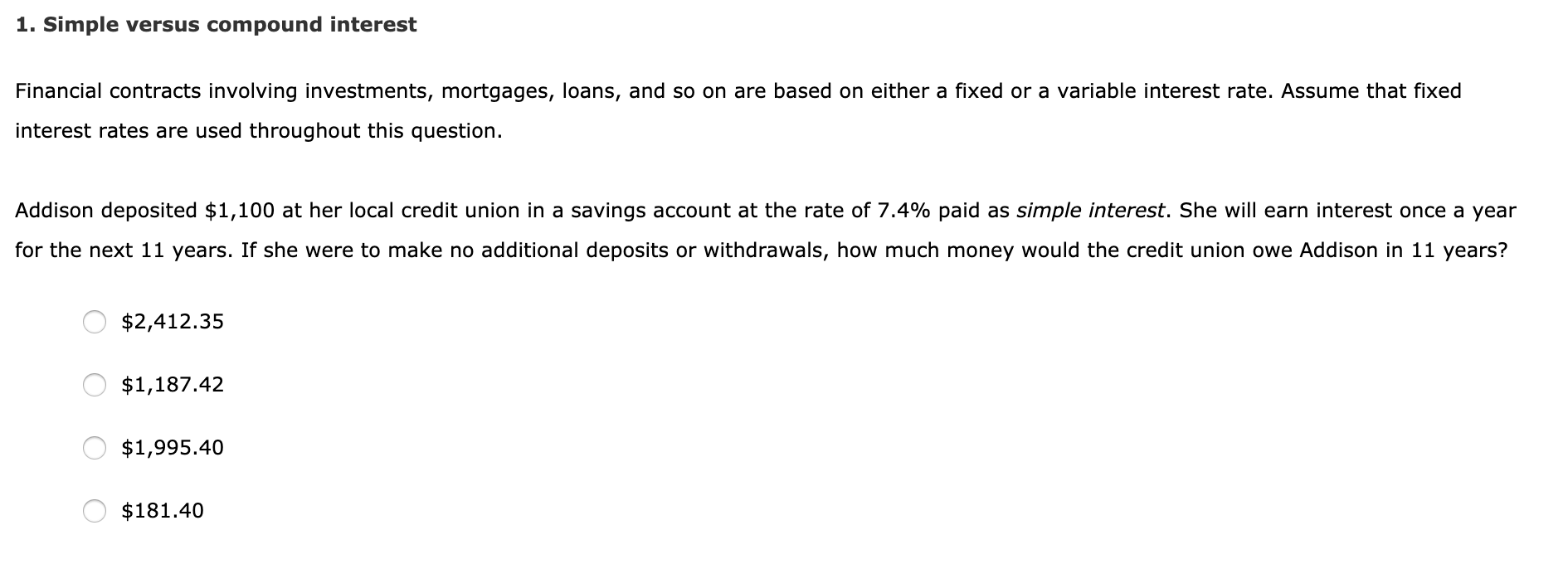

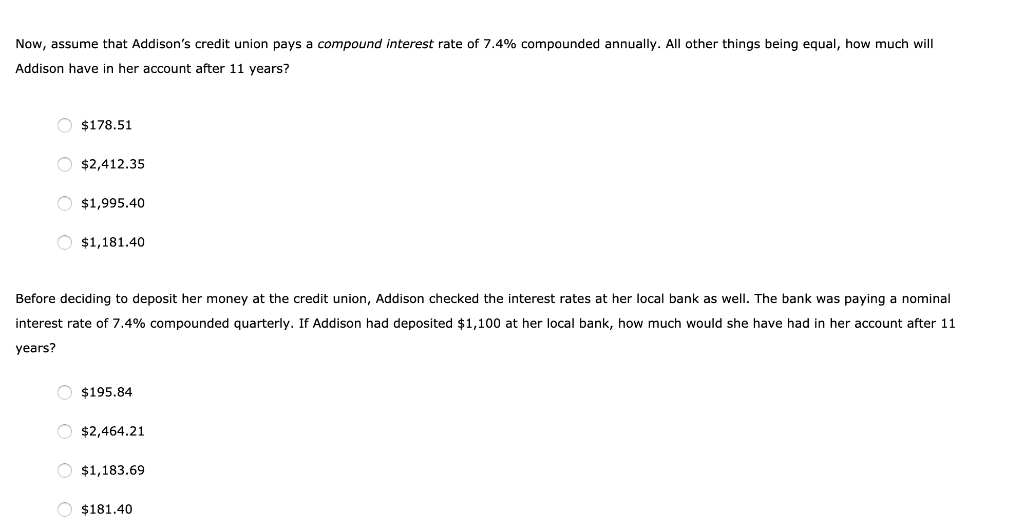

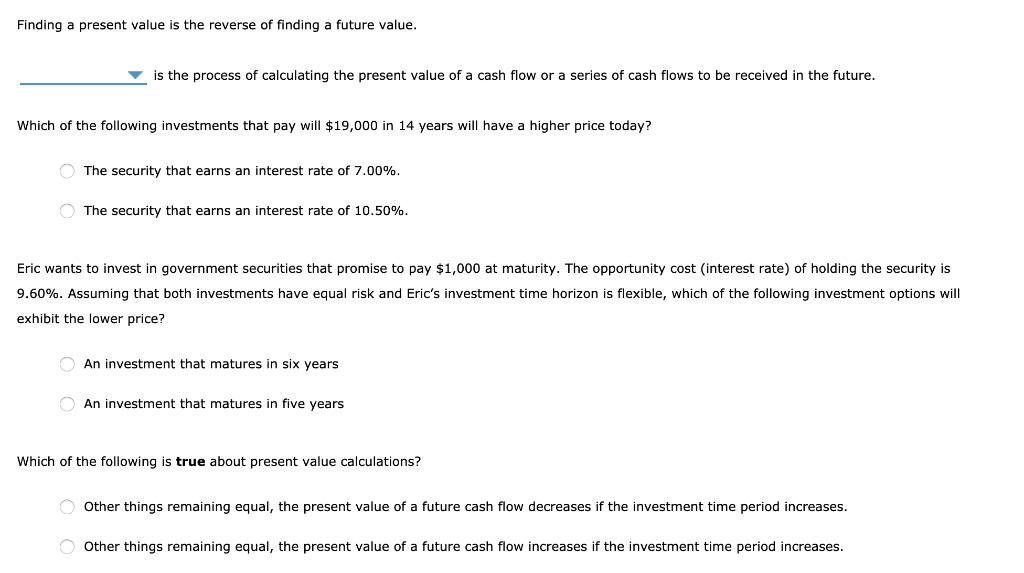

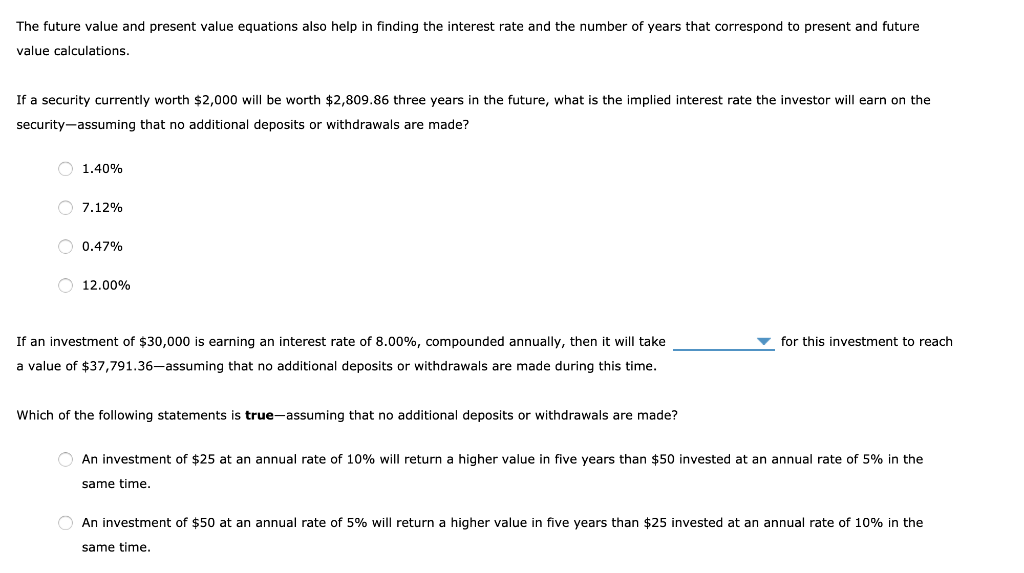

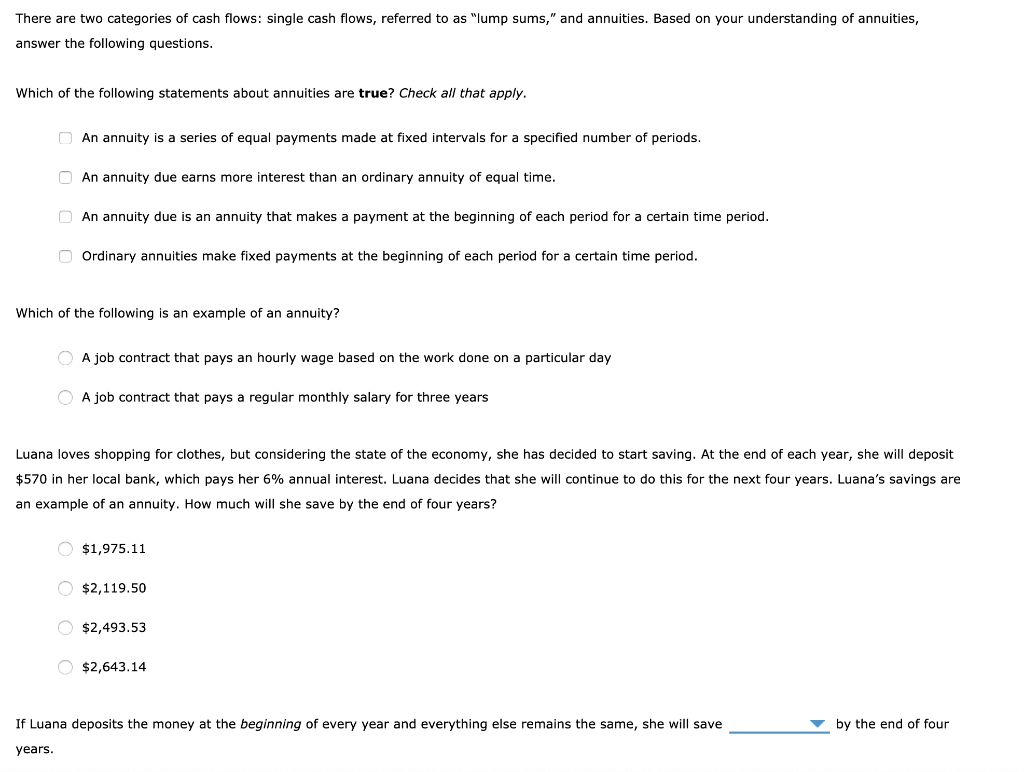

1. Simple versus compound interest Financial contracts involving investments, mortgages, loans, and so on are based on either a fixed or a variable interest rate. Assume that fixed interest rates are used throughout this question Addison deposited $1,100 at her local credit union in a savings account at the rate of 7.4% paid as simple interest. She will earn interest once a year for the next 11 years. If she were to make no additional deposits or withdrawals, how much money would the credit union owe Addison in 11 years? $2,412.35 $1,187.42 $1,995.40 $181.40 Finding a present value is the reverse of finding a future value. is the process of calculating the present value of a cash flow or a series of cash flows to be received in the future Which of the following investments that pay will $19,000 in 14 years will have a higher price today? The security that earns an interest rate of 7.00%. The security that earns an interest rate of 10.50% Eric wants to invest in government securities that promise to pay $1,000 at maturity. The opportunity cost (interest rate) of holding the security is 9.60%. Assuming that both investments have equal risk and Eric's investment time horizon is flexible, which of the following investment options will exhibit the lower price? An investment that matures in six years An investment that matures in five years Which of the following is true about present value calculations? Other things remaining equal, the present value of a future cash flow decreases if the investment time period increases. Other things remaining equal, the present value of a future cash flow increases if the investment time period increases. The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations If a security currently worth $2,000 will be worth $2,809.86 three years in the future, what is the implied interest rate the investor will earn on the security-assuming that no additional deposits or withdrawals are made? 1.40% 7.12% 0.47% O 12.00% If an investment of $30,000 is earning an interest rate of 8.00%, compounded annually, then it will take for this investment to reach a value of $37,791.36-assuming that no additional deposits or withdrawals are made during this time. Which of the following statements is true-assuming that no additional deposits or withdrawals are made? An investment of $25 at an annual rate of 10% will return a higher value in five years than $50 invested at an annual rate of 5% in the same time. An investment of $50 at an annual rate of 5% will return a higher value in five years than $25 invested at an annual rate of 10% in the same time