Question

1) Skoll Technologies is considering a 3-for-1 stock split on its common stock. Skoll's current stock price is $72.00 per share, and teh stock split

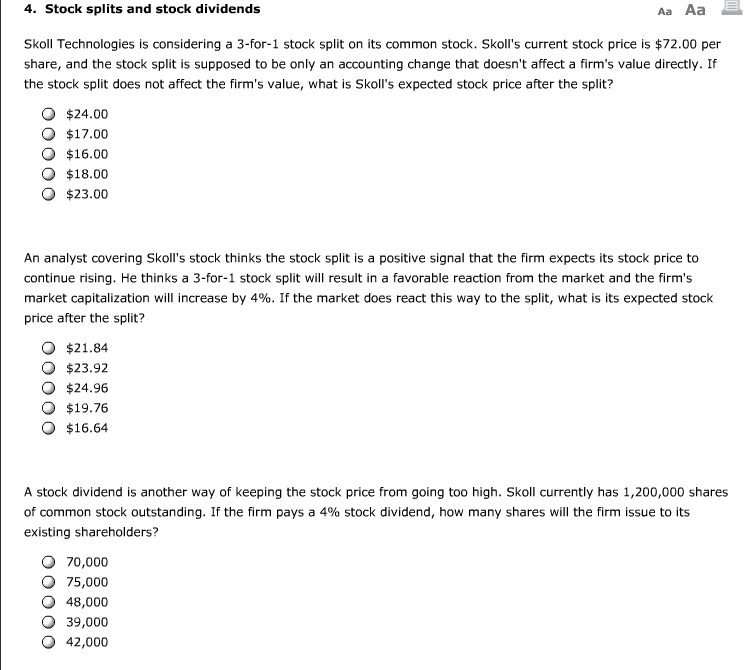

1) Skoll Technologies is considering a 3-for-1 stock split on its common stock. Skoll's current stock price is $72.00 per share, and teh stock split is supposed to be only an accounting change that doesn't affect a firm's value directly. If the stock sp lit does not affect the firm's value, what is Skoll's expected stock price after the split?

a) $24.00 b) $17.00 c) $16.00 d) $18.00 e) $23.00

2) An analyst covering Skill's stock thinks the stock split is a positive signal that the firm expects its stock price to continue rising. He thinks a 3-for-1 stock split will result in a favorable reaction from the market and the frim's market captialization will increase 4%. If the market does react this way to the split, what is its expected stock price after the split?

a) $21.84 b) $23.92 c) $24.96 d) $19.76 e) $16.64

3) A stock dividend is another way of keeping the stock price from going too high. Skoll currently has 1,200,000 shares of common stock outstanding. If the firm pays a 4% stock dividend, how many shares will the firm issue to its existing shareholders?

a) 70,000 b) 75,000 c) 48,000 d) 39,000 e) 42,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started