Question

1. SM stand-alone unlevered enterprise and equity value Current business stand-alone outlook for Schwartzel Marine for the upcoming 10 years is as follows, in MEUR:

1. SM stand-alone unlevered enterprise and equity value

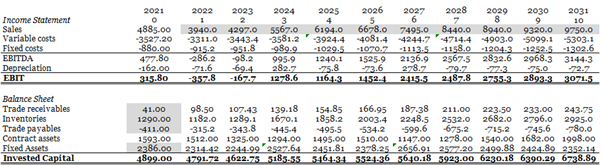

Current business stand-alone outlook for Schwartzel Marine for the upcoming 10 years is as follows, in MEUR:

Table 1.1. Schwartzel Marine Pro Forma Income Statements and Assets without merger synergies, 2022-2031

The Liability side (minus Trade payables) is omitted here as it contains only equity. Last years (2021) realized numbers are period 0. Trade receivables + Inventories Trade payables equal non-interest-bearing operative net working capital items. Contract assets are unfinished longer-term projects. Each year some long-term projects are completed and new ones arise. The change in contract assets represents net cash spent in ongoing projects if positive (cash received if negative).

Depreciation of fixed assets is 3% of previous years undepreciated book asset value. SM does not hold notable cash reserves or other interest-bearing current assets. Invested Capital (IC) is the balance sheet total minus Trade payables, representing investors total invested capital, i.e. the book value of total interest-bearing capital.

The expected SM after-tax Enterprise Value (EV) in year 10 (capturing the present value of free cash flows generated beyond year 10, the so called Horizon Value (HV) is estimated by the forecasted industry average EV/Invested Capital multiple of 3.25 (using year 10 IC).

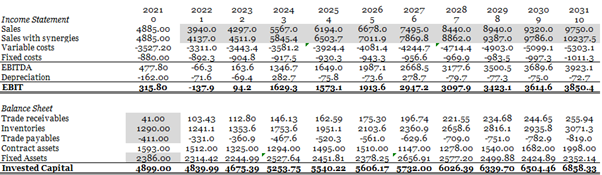

Operative synergies of the merger would include a +5% boost in annual sales due to marketing and sustainability brand synergies thanks to merger. Fixed operative costs can also be reduced by -2.5% per year from each years projected level. The synergy benefits from the merger have the following expected impact on the SM income statement (in MEUR):

Table 1.2. Schwartzel Marine Pro Forma Income Statements and Assets with merger synergies, 2022-2031

1. Value given all equity financing

Estimate SMs cost of unlevered equity, specifically

Task 1.1. Estimate the Shipping and marine industry asset beta using three data sources: 1. Damodaran benchmark data for Levered and Unlevered betas per US industry, 2. the corresponding data for Europe. See http://pages.stern.nyu.edu/~adamodar/. 3. Use the monthly Shipping and Marine equity portfolio returns to estimate the beta. Data is found in Ken French 49 monthly industry portfolio data set. https://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html Use monthly returns for Jan. 2016-Jan. 2022 (73 months of monthly data). You can find the monthly market index excess returns (Mkt-RF) from the Fama-French 3 Factors file which also has the monthly risk-free rate. See BDeM (5th ed.) example 12.7. for some methodological details.

You may use Damodarans industry average D/E-ratios. You may assume debt is risk-free for the purpose of beta estimation as Shipping and marine industry leverage is on average moderate although the business is cyclical (the effect is, if anything, a slight upward bias in the unlevered beta estimate). Adjust for the average percentage of cash of Shipping and Marine firm assets when estimating the asset beta (Damodaran). You may ignore taxes - which is correct also theoretically when D/V-ratios are assumed to be managed to a target. Do your own adjustments rather than taking Damodarans unlevered beta estimates directly because he applies his own averaging schemes for his purposes! Of course, you can compare your final unlevered Shipping and Marine industry beta estimates to his and see whether there is a material difference!

10 Income Statement Sales Variable costs Fixed costs EBITDA Depreciation EBIT 2021 o 4885.00 -3527.20 880.00 477.80 -162.00 315.80 2022 2023 2024 1 3 3940.0 4297.0 5567.0 -3311.0 3443.4 -3581.2 -915.2 -951.8 -989.9 286.2 -98.2 995-9 71.6 -69.4 282.7 -357.8 - 16707 1278.6 2025 4 6194.0 -3924.4 -1029.5 1240.1 -75.8 1164.3 2026 5 6678.0 -4081.4 -1070.7 1525.9 -73.6 1452.4 2027 2028 2029 2030 2031 6 8 9 7495.0 8440.0 8940.0 9320.0 9750.0 -4244.74714-4 -4903.05099.1 -5303.1 -1113.5 -1158.0 -1204.3 1252.5 -1302.6 2136.9 2567.5 2832.6 2968.3 3144-3 278.7 -77.3 275.0 22.2 2.415.5 2487.8 3755.3 2893.33071.5 Balance Sheet Trade receivables Inventories Trade payables Contract assets Fixed Assets Invested Capital 41.00 1290.00 -411.00 1593.00 2386.00 4899.00 98.50 107.43 139.18 154.85 166.95 187.38 211.00 223.50 233.00 243.75 1182.0 1289.1 1670.1 1858.2 2003-4 2248.5 2532.0 2682.0 2796.0 2925.0 -315.2 -343.8 -445-4 -495-5 -534.2 -599.6 -675.2 -715.2 -745.6 -780.0 1512.00 1325.00 1294.00 1495.00 1510.00 1147.00 1278.00 1540.00 1682.00 1998.00 2314-42 2244-99 2527.64 2451.812378.252656.91 2577-202499.88 2424.89 2352.14 4791.72 4622.755185-55 5464.34 5524-36 5640.18 5923.00 6230.18 6390.29 6788.89 2026 Income Statement Sales Sales with synergies Variable costs Fixed costs EBITDA Depreciation EBIT 2021 o 4885.00 4885.00 -3527.20 -880.00 477.80 -162.00 315.80 2022 2023 2024 1 2 3 3940.0 4297.0 5567.0 4137.0 4511.9 5845-4 -3311.0 -3443,4 3581.2 -904.8 -917.5 -66.3 1346.7 771.6 60.4 282.7 -137.9 94-2 1629.3 2025 4 6194.0 6503.7 -3924.4 -930.3 1649.0 75.8 1573.1 2027 2028 2029 2030 2031 5 6 7 8 9 10 6678.0 7495.0 8440.0 8940.0 9320.0 9750.0 7011.9 7869.8 8862.0 9387.0 9786.0 10237.5 -408144244.74714-4 -4903.0-5099.1 -5303.1 -943-3 -956.6 -269.9 -983-5 -997.3 -1011.3 1987.1 2668.5 3177.6 3500.5 3689.6 3923.1 22.6 278.7 .79.7 773 75.0 1913-6 2947.2 3097.9 3123-1 3614.63850.1 -892.3 163.6 Balance Sheet Trade receivables Inventories Trade payables Contract assets Fixed Assets Invested Capital 41.00 1290.00 -411.00 1593.00 2386.00 4899.00 103-43 112.80 146.13 162.59 175-30 196.74 221.55 234.68 244.65 255.94 1241.1 1353.6 1753.6 1951.1 2103.6 2360.9 2658.6 2816.1 2935.8 3071.3 -331.0 -360.9 467.6 -520.3 -561.0 -629.6 -709.0 -751.0 -782.9 -819.0 1512.00 1325.00 1294.00 1495.00 1510.00 1147.00 1278.00 1540.00 1682.00 1998.00 2314.42 2244.99'2527.64 2451.81 2378.25'2656.91 2577.20 2499.88 2424.89 2352.14 4839.99_4675.39 5253.775 5540.22 5606.175732.00 6026.39 6339.70 6504-46 6858.33 10 Income Statement Sales Variable costs Fixed costs EBITDA Depreciation EBIT 2021 o 4885.00 -3527.20 880.00 477.80 -162.00 315.80 2022 2023 2024 1 3 3940.0 4297.0 5567.0 -3311.0 3443.4 -3581.2 -915.2 -951.8 -989.9 286.2 -98.2 995-9 71.6 -69.4 282.7 -357.8 - 16707 1278.6 2025 4 6194.0 -3924.4 -1029.5 1240.1 -75.8 1164.3 2026 5 6678.0 -4081.4 -1070.7 1525.9 -73.6 1452.4 2027 2028 2029 2030 2031 6 8 9 7495.0 8440.0 8940.0 9320.0 9750.0 -4244.74714-4 -4903.05099.1 -5303.1 -1113.5 -1158.0 -1204.3 1252.5 -1302.6 2136.9 2567.5 2832.6 2968.3 3144-3 278.7 -77.3 275.0 22.2 2.415.5 2487.8 3755.3 2893.33071.5 Balance Sheet Trade receivables Inventories Trade payables Contract assets Fixed Assets Invested Capital 41.00 1290.00 -411.00 1593.00 2386.00 4899.00 98.50 107.43 139.18 154.85 166.95 187.38 211.00 223.50 233.00 243.75 1182.0 1289.1 1670.1 1858.2 2003-4 2248.5 2532.0 2682.0 2796.0 2925.0 -315.2 -343.8 -445-4 -495-5 -534.2 -599.6 -675.2 -715.2 -745.6 -780.0 1512.00 1325.00 1294.00 1495.00 1510.00 1147.00 1278.00 1540.00 1682.00 1998.00 2314-42 2244-99 2527.64 2451.812378.252656.91 2577-202499.88 2424.89 2352.14 4791.72 4622.755185-55 5464.34 5524-36 5640.18 5923.00 6230.18 6390.29 6788.89 2026 Income Statement Sales Sales with synergies Variable costs Fixed costs EBITDA Depreciation EBIT 2021 o 4885.00 4885.00 -3527.20 -880.00 477.80 -162.00 315.80 2022 2023 2024 1 2 3 3940.0 4297.0 5567.0 4137.0 4511.9 5845-4 -3311.0 -3443,4 3581.2 -904.8 -917.5 -66.3 1346.7 771.6 60.4 282.7 -137.9 94-2 1629.3 2025 4 6194.0 6503.7 -3924.4 -930.3 1649.0 75.8 1573.1 2027 2028 2029 2030 2031 5 6 7 8 9 10 6678.0 7495.0 8440.0 8940.0 9320.0 9750.0 7011.9 7869.8 8862.0 9387.0 9786.0 10237.5 -408144244.74714-4 -4903.0-5099.1 -5303.1 -943-3 -956.6 -269.9 -983-5 -997.3 -1011.3 1987.1 2668.5 3177.6 3500.5 3689.6 3923.1 22.6 278.7 .79.7 773 75.0 1913-6 2947.2 3097.9 3123-1 3614.63850.1 -892.3 163.6 Balance Sheet Trade receivables Inventories Trade payables Contract assets Fixed Assets Invested Capital 41.00 1290.00 -411.00 1593.00 2386.00 4899.00 103-43 112.80 146.13 162.59 175-30 196.74 221.55 234.68 244.65 255.94 1241.1 1353.6 1753.6 1951.1 2103.6 2360.9 2658.6 2816.1 2935.8 3071.3 -331.0 -360.9 467.6 -520.3 -561.0 -629.6 -709.0 -751.0 -782.9 -819.0 1512.00 1325.00 1294.00 1495.00 1510.00 1147.00 1278.00 1540.00 1682.00 1998.00 2314.42 2244.99'2527.64 2451.81 2378.25'2656.91 2577.20 2499.88 2424.89 2352.14 4839.99_4675.39 5253.775 5540.22 5606.175732.00 6026.39 6339.70 6504-46 6858.33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started