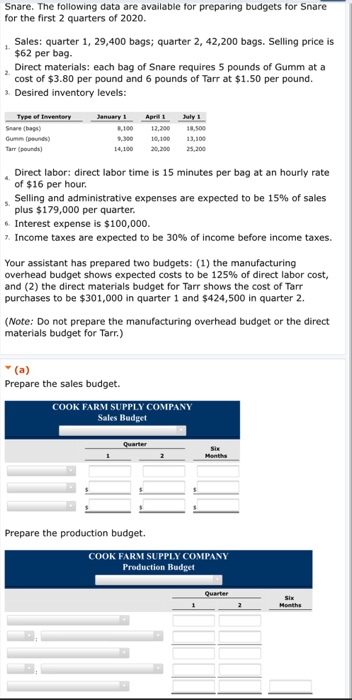

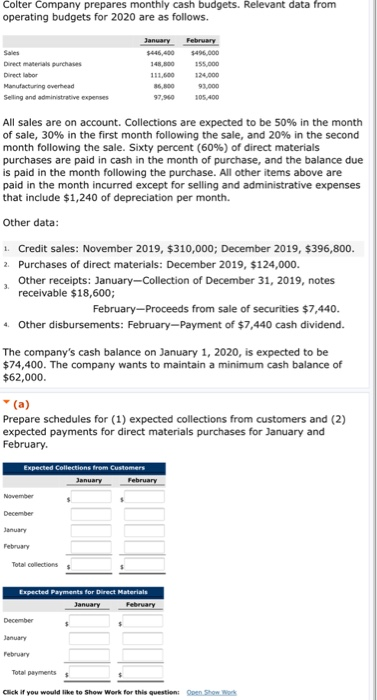

1 Snare. The following data are available for preparing budgets for Snare for the first 2 quarters of 2020. Sales: quarter 1, 29,400 bags, quarter 2, 42,200 bags. Selling price is $62 per bag Direct materials: each bag of Snare requires 5 pounds of Gumm at a 2 cost of $3.80 per pound and 6 pounds of Tarr at $1.50 per pound. 3. Desired inventory levels: Type of Inventory Snare (bags Gummus) The pounds January 1 April 1 July 1 8.100 12,200 18.500 9,300 10,100 13,100 14.100 20,2005,200 5 Direct labor: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour. Selling and administrative expenses are expected to be 15% of sales plus $179,000 per quarter. 6. Interest expense is $100,000. 7. Income taxes are expected to be 30% of income before income taxes. Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost, and (2) the direct materials budget for Tarr shows the cost of Tarr purchases to be $301,000 in quarter 1 and $424,500 in quarter 2. (Note: Do not prepare the manufacturing overhead budget or the direct materials budget for Tarr.) Prepare the sales budget. COOK FARM SUPPLY COMPANY Sales Budget Quarter Month Prepare the production budget. COOK FARM SUPPLY COMPANY Production Budget Quarter 2 Six Months Colter Company prepares monthly cash budgets. Relevant data from operating budgets for 2020 are as follows. Direct materials purchases Direct labor Manufacturing overhead Selling and administrative expenses January February $446,4005496,000 148,800 155.000 111.600 120.000 36,800 93.000 97,960 105.400 All sales are on account. Collections are expected to be 50% in the month of sale, 30% in the first month following the sale, and 20% in the second month following the sale. Sixty percent (60%) of direct materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items above are paid in the month incurred except for selling and administrative expenses that include $1,240 of depreciation per month. Other data: 1. Credit sales: November 2019, $310,000; December 2019, $396,800. 2. Purchases of direct materials: December 2019, $124,000. Other receipts: January-Collection of December 31, 2019, notes receivable $18,600; February-Proceeds from sale of securities $7,440. 4. Other disbursements: February-Payment of $7,440 cash dividend. The company's cash balance on January 1, 2020, is expected to be $74,400. The company wants to maintain a minimum cash balance of $62,000. (a) Prepare schedules for (1) expected collections from customers and (2) expected payments for direct materials purchases for January and February Expected Collections from Customers January February December January February Total collections Expected Payments for Direct Materials January February December January February Total payments Click if you would like to Show Work for this question Open Show