Question

When Douglas Rogers (Doug) was in high school he was already interested in the stock market. Doug graduated from the University of Arizona (U of

When Douglas Rogers (Doug) was in high school he was already interested in the stock market. Doug graduated from the University of Arizona (U of A) with a degree in accounting in 1975 and a Masters in Business Administration (MBA) in 1977. He then moved to Los Angeles because he was in a serious relationship with a young woman. He also wanted to be in a large metropolitan area because of increased work opportunities. He worked in accounting in Los Angeles for about ten years, both as a CPA with a large accounting firm and in industry.

This gave him a lot of experience auditing large firms, including some publicly traded corporations.

He was offered a job as a comptroller with a venture capital financed startup firm called Callan Data Systems. This gave him an opportunity to work with a company from the ground up and it gave him some appreciation for the world of high tech and how companies functioned. Doug also learned the importance of writing and sticking with a business plan. Although they had some excellent software, based on UNIX systems, they really didn’t have a viable business plan. As a result Callan was one of those many startups in the 1990s that failed.

By this time, Doug wanted to move back to Arizona as he was tired of the hustle and bustle of Los Angeles and wanted a more peaceful and leisurely life style.

Nick Kronwall was an entrepreneur who owned an independent investment management firm in Tucson and decided to retire in 1985. Rather than sell his firm, he just decided to shut it down. One of his employees was Brad Toland who Doug met through a mutual friend. After many conversations, the two of them determined that they both wanted to begin an independent investment management firm. Brad also graduated from the U of A with a degree in oriental languages and was proficient in Japanese. His working relationship with Nick provided him with a business model on how to structure the business in an ethical way. Doug and Nick both understood that this type of business was built on trust and the initial startup didn’t require a large amount of capital. However, they would have to be patient in building that trust relationship so that they could develop a client base. The real incentive for both Brad and Doug was that they truly enjoyed analyzing corporations and determining how to select those companies that had outstanding management, excellent products, and positive cash flows.

♦ The traditional method of beginning an independent financial advisory firm is to develop a financial trust relationship with a bank or other financial institution. However, bankers were reluctant to recommend clients to a new start-up as they have a tendency to look for a track record. Brad and Doug knew they had a good business model and a stable plan based on Brad’s many years of experience with Nick but they only had one client. They developed a detailed business plan and realized that it would take them at least two years to receive any cash flow or income from the business. They realized that establishing a client base would take time.

Opening the Business. In the fall of 1986, Brad and Doug established Sonora Investment Management. While working in California, Doug managed to save about $100,000. Brad’s wife worked and had an income and Brad had also accumulated some savings. They began business with an initial investment of $4,000 each. They rented a small office and the $8,000 was enough to last for several months as neither of them drew a salary. Doug’s experience as a CPA insured that the business would comply with all financial reporting requirements. Both of these individuals were very ethical.

Business Strategy. The initial strategy for building a client base was to ask family and friends to allow them to manage a portion of their portfolio. This allowed these clients to compare Sonora Investment Management to their other portfolio managers. During their start-up phase many financial schemes had been in the headlines such as the housing market crisis, the massive Savings and Loan failures, and the failure of many financial institutions; they believed that trust could only be built by a firm that didn’t actually maintain the client’s account or hold client assets. Originally they used three brokerage firms to custody client assets—Quick & Reilly, Charles Schwab, and Waterhouse. Over the years, they found that the systems were excellent and that convertible bond transactions and pricing were better at Schwab. So, in the early 2000s they moved all client accounts to Schwab.

With their strategy of asking friends and relatives to manage a small amount of their portfolio, these clients discovered that their accounts grew faster and provided a better return than other managers. As a result, the partners did very well and people began to trust them with more of their assets. It took four years before they had a sufficient client base to begin drawing a salary. However, the thing that kept them going was that every year they saw a significant growth in the client base and the amount of money they were investing.

Investment Selection. Sonora Investment Management has been very successful because they have not strayed from their initial model of portfolio selection. They have a disciplined approach to selecting financial instruments for inclusion in client portfolios. The following outlines the basic approach and comes directly from a Sonora Investment PowerPoint presentation:

Company Growth. By 2003 the firm had grown to the extent that they required more expertise in the management of client assets. Tim Wilcox, who had managed the Schwab office in Tucson, was brought in with the understanding that he would become a partner if he made a significant contribution to the client base. By 2006, Tim became a full partner of the firm. In 2010 they hired Graham Gaines as a marketing manager. He had an extensive background in institutional marketing and strongly advised Sonora to expand into the Phoenix market.

Schwab surveyed their clients who left their firm and found that in the 1990s many clients left because they were people who had initially managed their own finances. As they aged and approached retirement, they felt they wanted professional management and would often transfer their accounts to a professional financial management firm. Rather than losing these clients, Schwab established a program where they turned high-value clients who wanted professional management over to a professional investment management firm. One of the small group of firms selected by Schwab was Sonora Investment Management. As a result, Sonora managers often had to travel from Tucson to Phoenix to interview potential clients. They began the process of cultivating clients in Phoenix and soon realized that they needed to establish an office in the Phoenix area.

Mike Arko graduated from the U of A summa cum laude with a degree in finance in 2001. He initially met Doug when he spoke at the U of A in one of Mike’s finance classes. Mike was so impressed by the Sonora business model that he and his parents became clients. After graduation, Mike worked in equity research for Sanford Bernstein and management consulting for Alvarez & Marsal. Mike also completed a Master’s in Business Administration at Arizona State University in 2009. His job as a management consultant for Alvarez & Marsal required him to travel extensively and he was on the road from Monday through Thursday. By 2011, Mike had married, had a child, and wanted to stop traveling. He called Sonora and asked about employment with the firm. Doug and Mike already had a long-term relationship and Sonora was looking to establish a Phoenix office so he hired Mike as the Vice President of Investment research in July 2011. Mike established the Phoenix office.

The firm continues its steady growth and now manages a portfolio with assets in excess of $250 million. The Phoenix office has been very successful and is also considering an expansion.

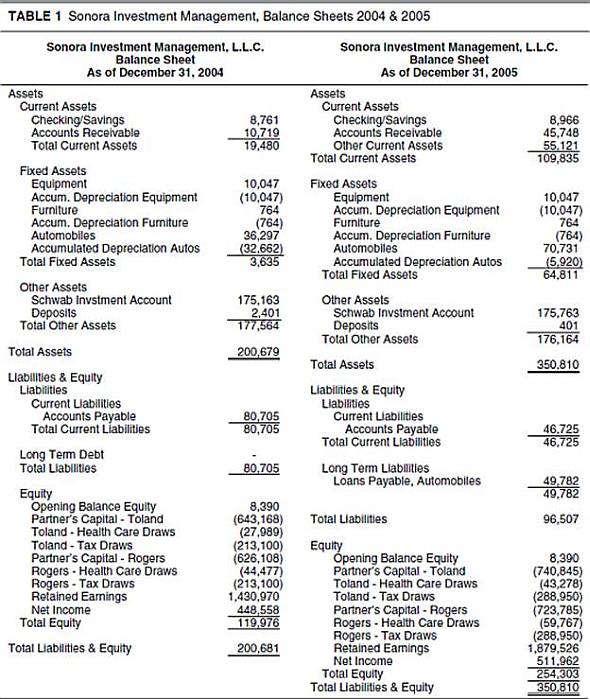

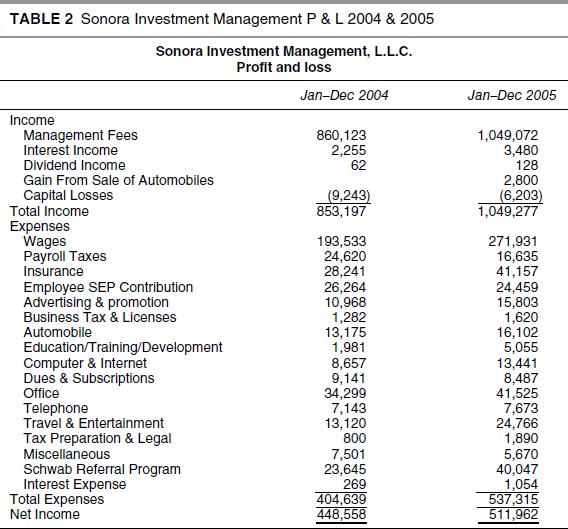

Sonora Investment Management charges an annual fee of one percent for the management of assets. What was the dollar value of assets under management by Sonora Investments in 2004 and 2005? What was their growth rate?

SONORA INVESTMENT MANAGEMENT I. General Methodology & Approach Sonora employs fundamental analysis in selecting individual securities. We search for companies that have a "wide moat" around their business. We look for firms that have a dominant business position with competitive advantages in an industry that has barriers to entry. Frequently this competi- tive advantage comes in the form of intellectual property and/or barriers to entry. From a financial perspective, we favor companies with strong balance sheets that are generating and growing free cash flow. We define free cash flow as cash from operations less capital expenditures. II. Equity Valuation We value equities using both DCF (discounted cash flows) and an analysis of comparable firms. In conducting the DCF, we use free cash flow to the firm(operating cash flow less capital expenditures) discounted at the WACC (weighted average cost of capital). When looking at comparable firms, we evaluate both public and transaction comps. A multiple of cash flow (typically EBITDA) or revenue is used based on the industry. This multiple may be adjusted for certain factors including size and control premium. Gross, operating and EBITDA margins are evalu- ated and compared to peers. Historical and projected growth rates are also an important part of the analysis. III. Fixed Income Valuation If we are looking at a potential investment in a corporate bond then the sole focus is on the ability of the firm to service the debt (make the interest and principal payments). We start with liquidity by identifying the amount of cash on the balance sheet as well as availability on their revolving credit facility. We then deter- mine how much free cash flow we can expect the company to generate on an annual basis. Once we have established liquidity, we examine the capital structure and focus on the size of the bond coupled with any debt maturities ahead of this issue. If we are looking at a convertible bond, we also value the equity of the firm and the potential for growth.

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 of 3 A Horizontal analysis It is the process of determining any decrease or increase in an ac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started