Answered step by step

Verified Expert Solution

Question

1 Approved Answer

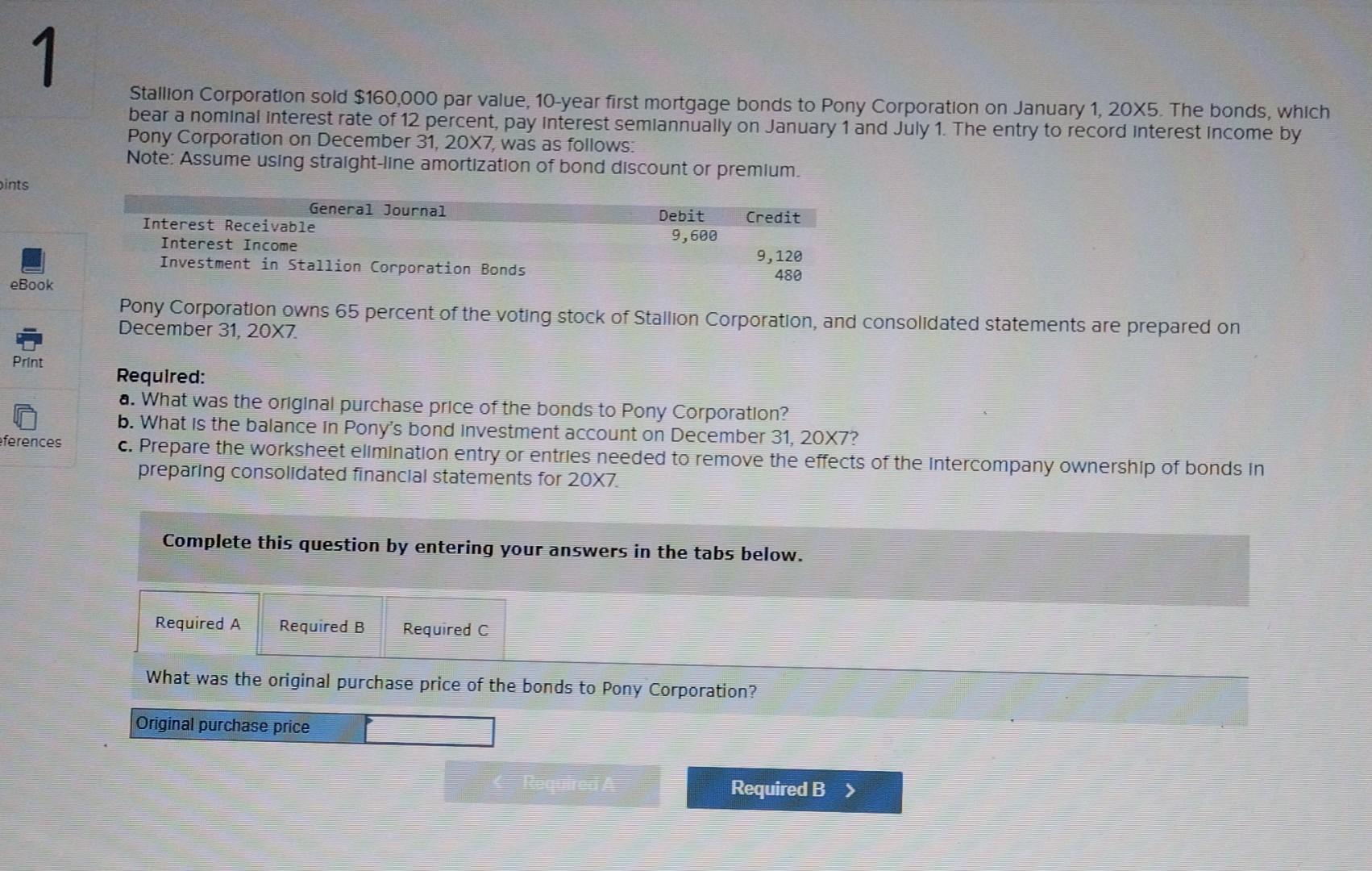

#1 Stallion Corporation sold $160,000 par value, 10 -year first mortgage bonds to Pony Corporation on January 1,205. The bonds, which bear a nominal interest

#1

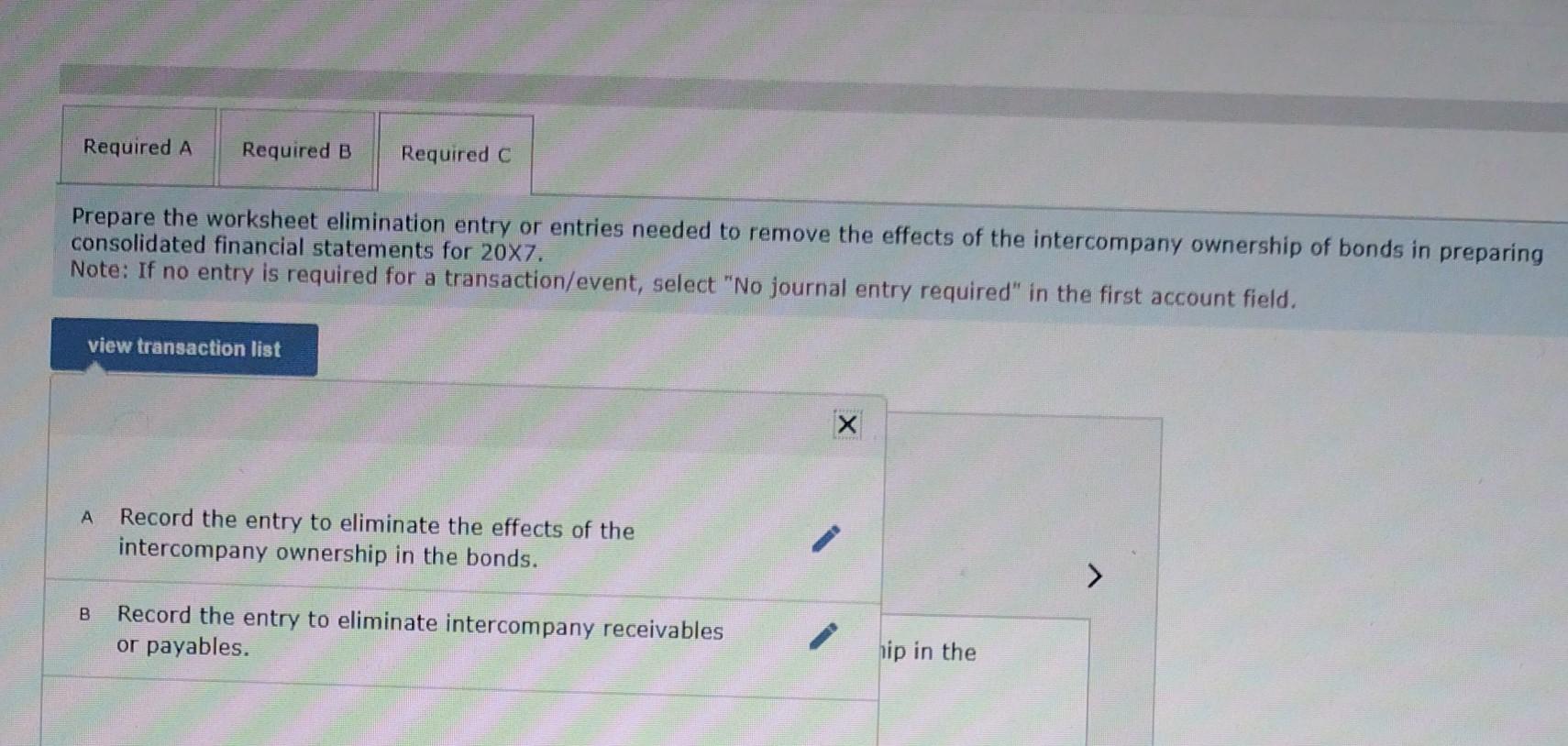

Stallion Corporation sold $160,000 par value, 10 -year first mortgage bonds to Pony Corporation on January 1,205. The bonds, which bear a nominal interest rate of 12 percent, pay Interest semiannually on January 1 and July 1 . The entry to record interest income by Pony Corporation on December 31,207, was as follows: Note: Assume using straight-line amortization of bond discount or premium. Pony Corporation owns 65 percent of the voting stock of Stallion Corporation, and consolidated statements are prepared on December 31,207 Required: a. What was the original purchase price of the bonds to Pony Corporation? b. What is the balance in Pony's bond Investment account on December 31, 20X7? c. Prepare the worksheet elimination entry or entries needed to remove the effects of the intercompany ownership of bonds in preparing consolidated financial statements for 207. Complete this question by entering your answers in the tabs below. What was the original purchase price of the bonds to Pony Corporation? Complete this question by entering your answers in the tabs below. What is the balance in Pony's bond investment account on December 31,207? Prepare the worksheet elimination entry or entries needed to remove the effects of the intercompany ownership of bonds in preparing consolidated financial statements for 207. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. A Record the entry to eliminate the effects of the intercompany ownership in the bonds. B Record the entry to eliminate intercompany receivables or payables. hip in theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started