Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Suppose a French investor (Jaques) wants to form a portfolio using two CAC40 stocks (AIR FRANCE and DANONE) for which he knows the

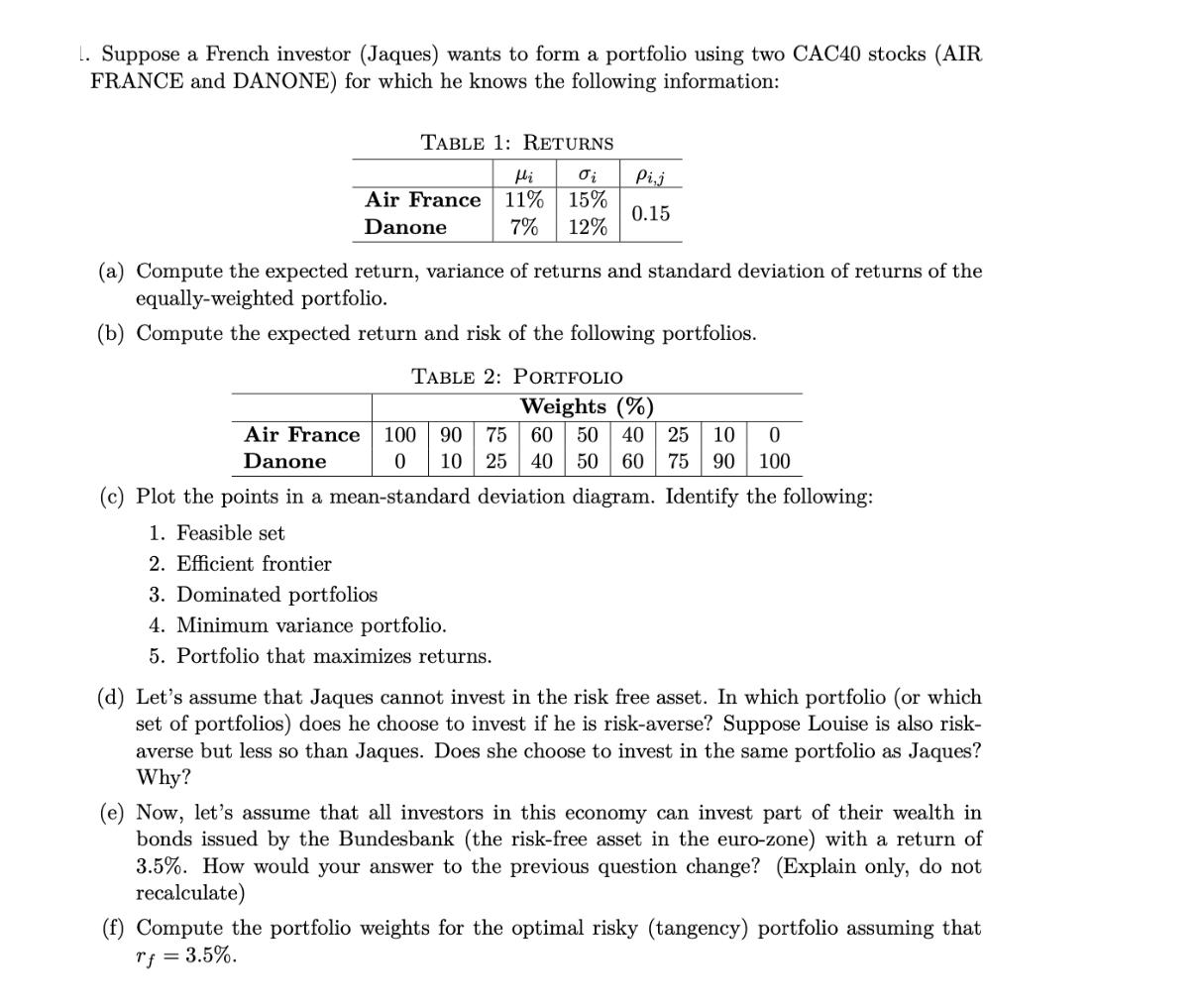

1. Suppose a French investor (Jaques) wants to form a portfolio using two CAC40 stocks (AIR FRANCE and DANONE) for which he knows the following information: TABLE 1: RETURNS Oi 15% 7% 12% fli Air France 11% Danone Pi,j 0.15 (a) Compute the expected return, variance of returns and standard deviation of returns of the equally-weighted portfolio. (b) Compute the expected return and risk of the following portfolios. TABLE 2: PORTFOLIO Weights (%) 60 0 50 40 25 10 0 10 25 40 50 60 75 90 100 Air France 100 90 75 Danone (c) Plot the points in a mean-standard deviation diagram. Identify the following: 1. Feasible set 2. Efficient frontier 3. Dominated portfolios 4. Minimum variance portfolio. 5. Portfolio that maximizes returns. (d) Let's assume that Jaques cannot invest in the risk free asset. In which portfolio (or which set of portfolios) does he choose to invest if he is risk-averse? Suppose Louise is also risk- averse but less so than Jaques. Does she choose to invest in the same portfolio as Jaques? Why? (e) Now, let's assume that all investors in this economy can invest part of their wealth in bonds issued by the Bundesbank (the risk-free asset in the euro-zone) with a return of 3.5%. How would your answer to the previous question ange (Explain only, do no recalculate) (f) Compute the portfolio weights for the optimal risky (tangency) portfolio assuming that rf = 3.5%.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started