Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- 1. Suppose a seller (i.e. the principal) wants to sell his good to a buyer (i.e. the agent) by pricing it optimally. Suppose

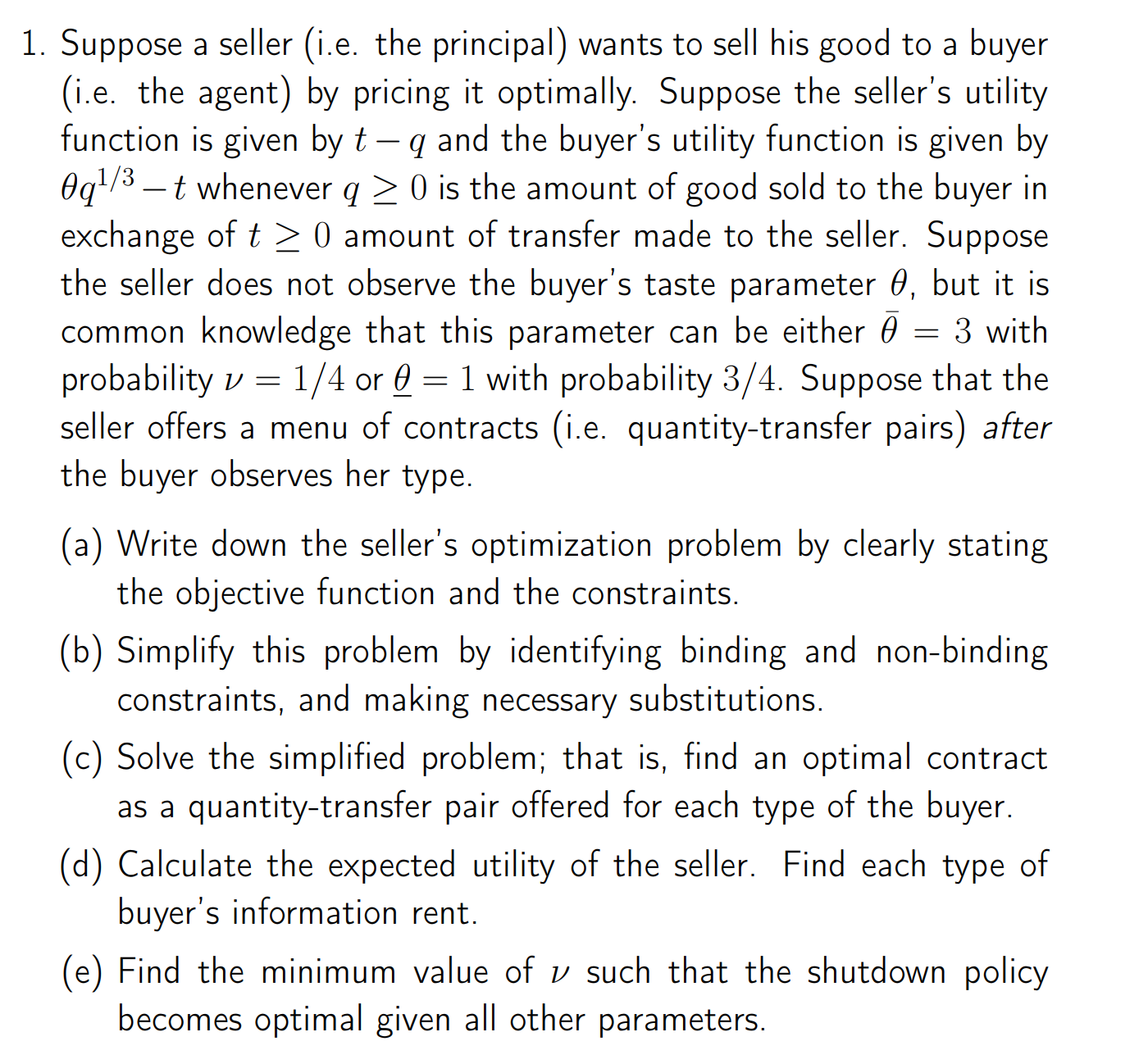

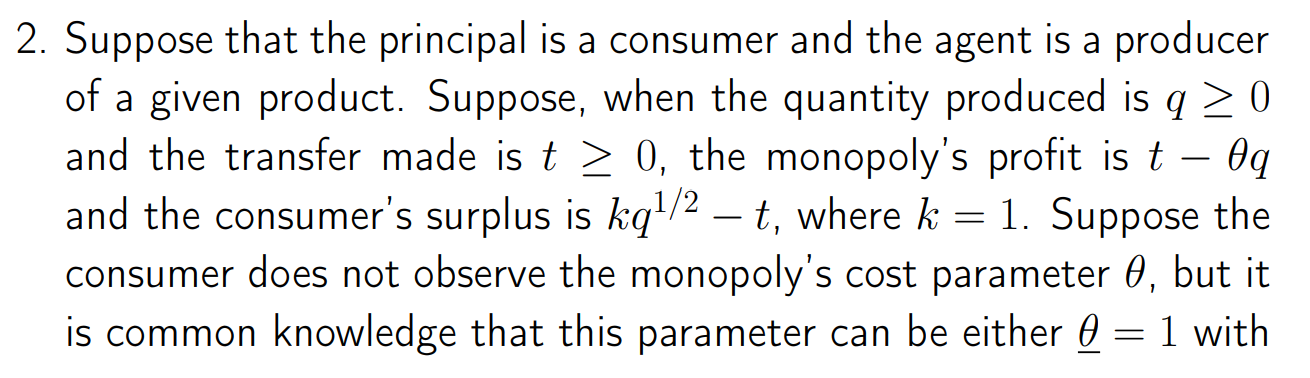

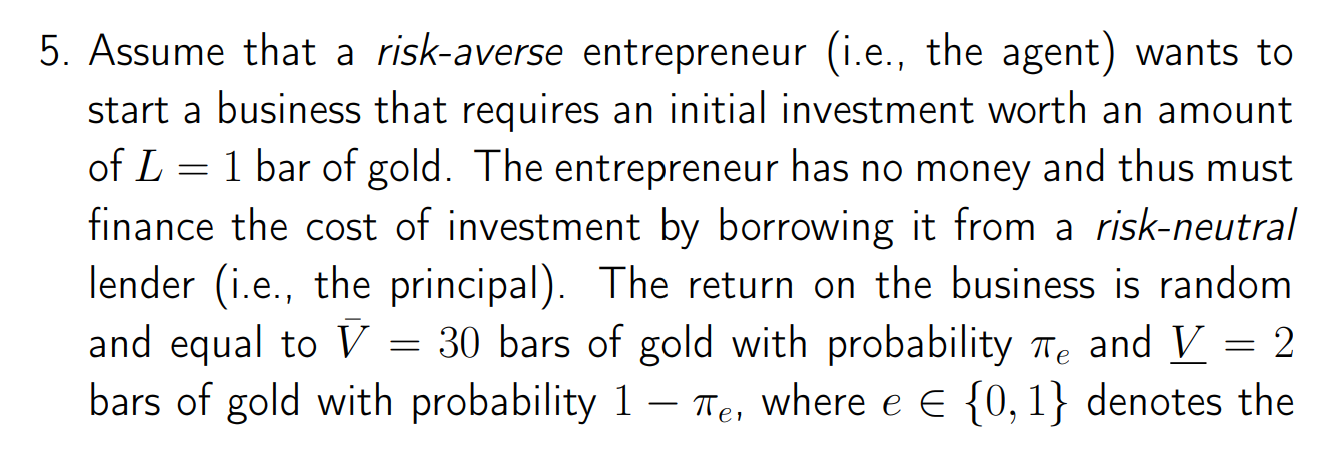

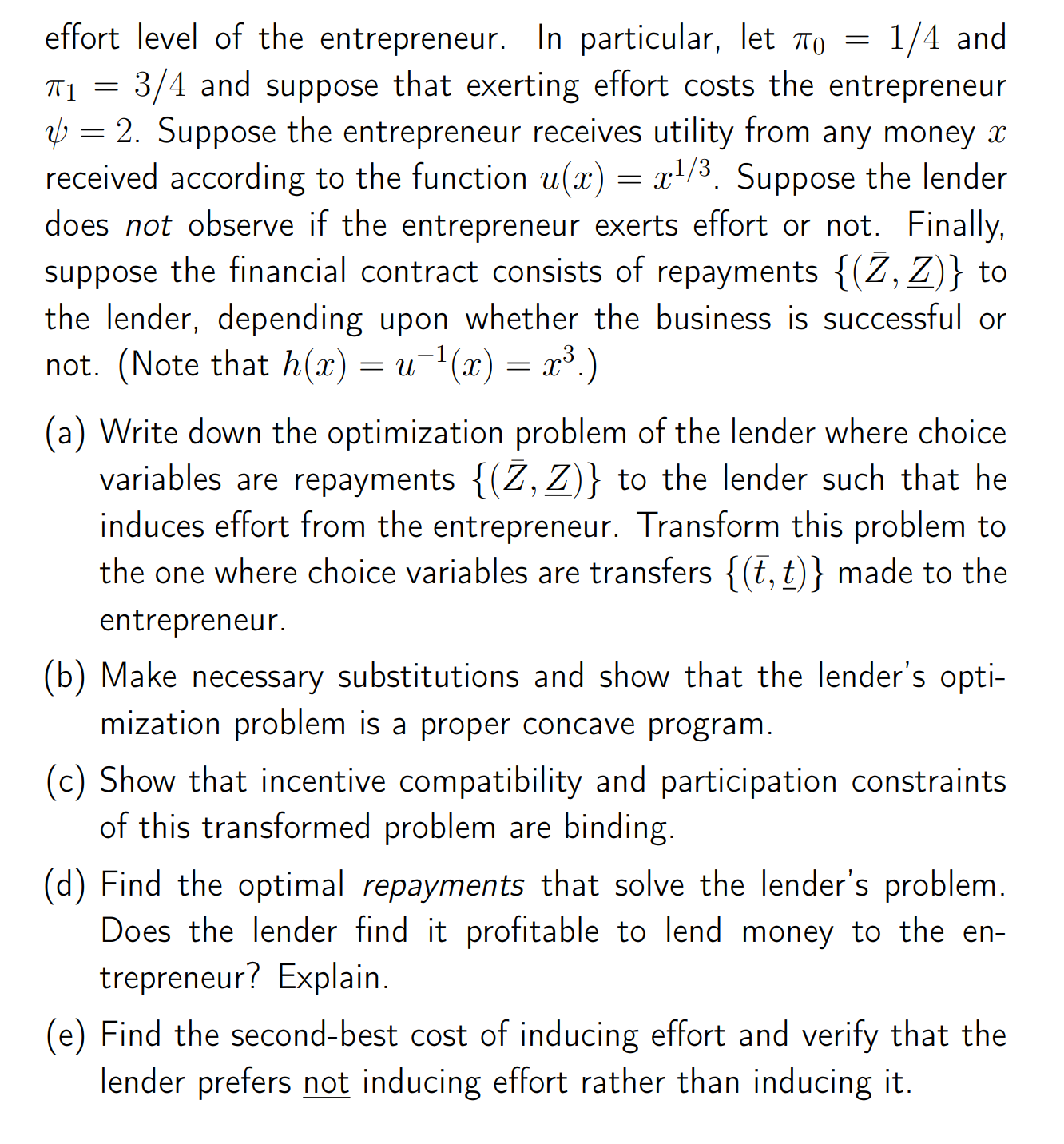

- 1. Suppose a seller (i.e. the principal) wants to sell his good to a buyer (i.e. the agent) by pricing it optimally. Suppose the seller's utility function is given by t- q and the buyer's utility function is given by 0q1/3 t whenever q 0 is the amount of good sold to the buyer in exchange of t 0 amount of transfer made to the seller. Suppose the seller does not observe the buyer's taste parameter 0, but it is common knowledge that this parameter can be either 0 = 3 with probability v = 1/4 or 0 = 1 with probability 3/4. Suppose that the seller offers a menu of contracts (i.e. quantity-transfer pairs) after the buyer observes her type. (a) Write down the seller's optimization problem by clearly stating. the objective function and the constraints. (b) Simplify this problem by identifying binding and non-binding constraints, and making necessary substitutions. (c) Solve the simplified problem; that is, find an optimal contract as a quantity-transfer pair offered for each type of the buyer. (d) Calculate the expected utility of the seller. Find each type of buyer's information rent. (e) Find the minimum value of v such that the shutdown policy becomes optimal given all other parameters. 2. Suppose that the principal is a consumer and the agent is a producer of a given product. Suppose, when the quantity produced is q 0 and the transfer made is t 0, the monopoly's profit is t Oq and the consumer's surplus is kq 1/2 - t, where k = 1. Suppose the consumer does not observe the monopoly's cost parameter 0, but it is common knowledge that this parameter can be either 1 with = probability v = 2/3 or 0 = 2 with probability 1/3. Suppose the consumer offers a menu of contracts before the monopoly observes. its type. (a) Write down the consumer's optimization problem by clearly stat- ing the objective function and the constraints. (b) Simplify this problem by noting binding and non-binding con- straints, and making necessary substitutions. (c) Solve the simplified problem; that is, find an optimal contract. as quantity-transfer pairs offered for each type of the monopoly. (d) Find the expected surplus of the consumer. Identify each type. of monopoly's information rent. (e) Suppose that the taste parameter of the consumers increases from k = 1 to k = 2. How does this change affect the informa- tion rent of each type of the producer? Do you think the effect you found is intuitive? Why or why not? Explain. 3. Suppose a medical company (i.e., the agent) supplies vaccine to a benevolent planner (i.e., the principal). The company makes a profit t0q when q 0 is the quantity produced and t 0 is the transfer made. Suppose with probability v = the company is efficient with cost parameter 0 = 1 and with probability / it is inefficient with cost parameter 0 = 2. Suppose that the planner offers a menu of contracts after the company observes its type. Suppose the company has to report its type 0 = {1,2} to be eligible. for the contract intended for the reported type. Suppose also that the planner can use an audit technology at a cost c(p) p to detect with probability p = [0, 1] the true cost parameter = {1,2} whenever the company misreports it, 0 0. The planner's surplus is given by 2ln(g) - tp when the probability of detection is = p [0, 1]. Suppose that, as part of its audit mechanism, the planner can charge the company up to 1 amount of payoff as a punishment P 0 whenever the company is caught misreporting its parameter. (a) Write down the planner's optimization problem by clearly stating the objective function and the constraints. (b) Simplify this problem by noting binding and non-binding con- straints, and making necessary substitutions. (c) Find the efficient type company's intended contract (t, q, p, P) as part of the optimal audit mechanism. (d) Find the inefficient type company's intended contract (t, , p, P) as part of the optimal audit mechanism. (e) Find the planner's expected payoff and each type of company's information rent. = To 4. Suppose a risk-neutral investor (i.e., the principal) wants to hire risk-neutral broker (i.e., the agent) to manage his portfolio. The outcome of his portfolio is stochastic and can be either q = 8 bitcoin or q 1 bitcoin. If the broker does not exert effort, then with probability 70 = 1/4 the outcome will be and with probability 3/4 it will be q. If the broker exerts effort, then with probability = 1/2 the outcome will be and with probability 1/2 it will be q. Exerting effort is costly to the broker and suppose this cost is equal to = 0.5. Suppose the investor receives a profit from the outcome of the portfolio according to the payoff function S(q) = q/2 while the broker receives a payoff of t from any payment t made to him. Finally, suppose the contract consists of payments {(t,t)} to the broker, depending upon whether the outcome is high or not. = (a) Suppose that the investor can observe whether the broker exerts effort or not. Set the optimization problem and find the opti- mal transfers when the investor induces effort. Show that the investor prefers inducing effort over not inducing effort. (b) Now suppose that the investor cannot observe whether the bro- ker exerts effort or not. Set the optimization problem and find the optimal transfers when the investor induces effort. What is the cost of inducing effort? l (c) Suppose again the investor cannot observe whether the broker exerts effort. Now suppose also that the investor cannot impose a transfer less than -1, where = 0.75. Set the optimization problem and find the optimal transfers when the investor induces effort. What is the expected limited liability rent of the broker? (d) Suppose once again the investor cannot observe whether the broker exerts effort. Now suppose also that the investor cannot impose a transfer less than -1, where = 0.25 this time. Set 1 the optimization problem and find the optimal transfers when the investor induces effort. What is the expected limited liability rent of the broker? (e) Suppose now that the investor decides to make the broker share- holder of the profits by using a simple linear sharing rule instead of paying her using transfers. Set the optimization problem and find the optimal linear sharing rule. 5. Assume that a risk-averse entrepreneur (i.e., the agent) wants to start a business that requires an initial investment worth an amount of L = 1 bar of gold. The entrepreneur has no money and thus must finance the cost of investment by borrowing it from a risk-neutral lender (i.e., the principal). The return on the business is random and equal to V = 30 bars of gold with probability Te and V = 2 bars of gold with probability 1 - e, where e = {0,1} denotes the = = = 1/4 and effort level of the entrepreneur. In particular, let To 3/4 and suppose that exerting effort costs the entrepreneur 2. Suppose the entrepreneur receives utility from any money x received according to the function u(x) = x/3. Suppose the lender does not observe if the entrepreneur exerts effort or not. Finally, suppose the financial contract consists of repayments {(Z, Z)} to the lender, depending upon whether the business is successful or not. (Note that h(x) = u(x) = x.) (a) Write down the optimization problem of the lender where choice variables are repayments {(Z, Z)} to the lender such that he induces effort from the entrepreneur. Transform this problem to the one where choice variables are transfers {(t,t)} made to the entrepreneur. (b) Make necessary substitutions and show that the lender's opti- mization problem is a proper concave program. (c) Show that incentive compatibility and participation constraints of this transformed problem are binding. (d) Find the optimal repayments that solve the lender's problem. Does the lender find it profitable to lend money to the en- trepreneur? Explain. (e) Find the second-best cost of inducing effort and verify that the lender prefers not inducing effort rather than inducing it.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started