Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Suppose a town's population is composed of 3 types of voters with the following distribution: 20% are in Group 1, 35% are in

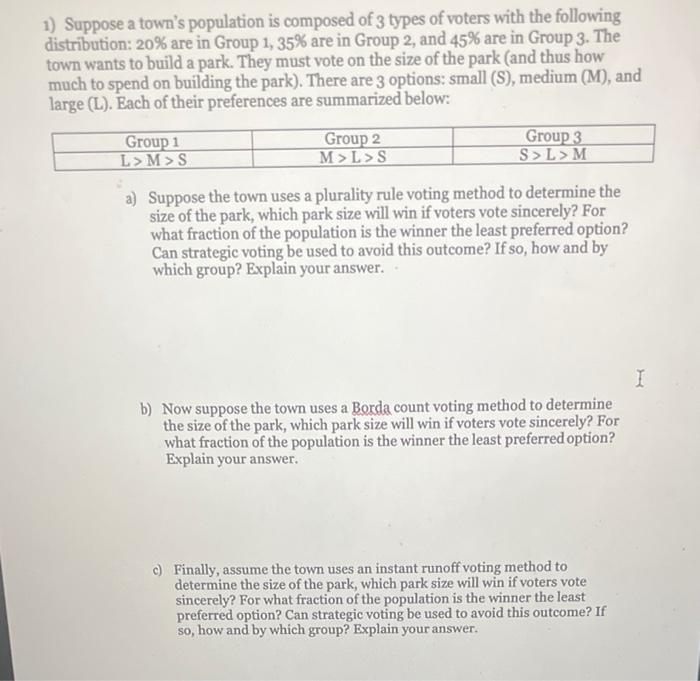

1) Suppose a town's population is composed of 3 types of voters with the following distribution: 20% are in Group 1, 35% are in Group 2, and 45% are in Group 3. The town wants to build a park. They must vote on the size of the park (and thus how much to spend on building the park). There are 3 options: small (S), medium (M), and large (L). Each of their preferences are summarized below: Group 1 L>M>S Group 2 M>L>S Group 3 S>L>M a) Suppose the town uses a plurality rule voting method to determine the size of the park, which park size will win if voters vote sincerely? For what fraction of the population is the winner the least preferred option? Can strategic voting be used to avoid this outcome? If so, how and by which group? Explain your answer. b) Now suppose the town uses a Borda count voting method to determine the size of the park, which park size will win if voters vote sincerely? For what fraction of the population is the winner the least preferred option? Explain your answer. c) Finally, assume the town uses an instant runoff voting method to determine the size of the park, which park size will win if voters vote sincerely? For what fraction of the population is the winner the least preferred option? Can strategic voting be used to avoid this outcome? If so, how and by which group? Explain your answer. I

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a In a plurality rule voting method the park size that wins is the one with the most votes regardless of the margin of victory Based on the preferences of each group Group 1 prefers L M S Group 2 prefers M L S and Group 3 prefers S L M If voters vote sincerely each group will vote for their preferred option Since Group 3 has the largest population 45 their preference ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started