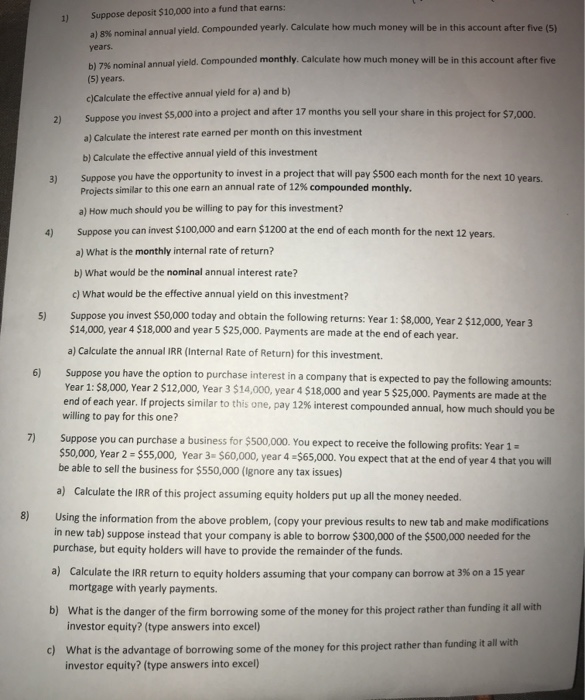

1) Suppose deposit $10,000 into a fund that earns: le nominalannual yield. Compounded yearly. Calculate how much money will be in this account after five (51 years. bi za nominalannual yield. Compounded monthly Calculate how much money will be in this account after five (5) years. c)Calculate the effective annual yield for a) and b) Suose au invest $5,000 into a project and after 17 months you sell your share in this project for $7.00 2) a) Calculate the interest rate earned per month on this investment b) Calculate the effective annual yield of this investment e vou have the opportunity to invest in a project that will pay $500 each month for the next 10 Projects similar to this one earn an annual rate of 12% compounded monthly. S 3) a) How much should you be willing to pay for this investment? Suppose you can invest $100,000 and earn $1200 at the end of each month for the next 12 years. a) What is the monthly internal rate of return? b) What would be the nominal annual interest rate? c) What would be the effective annual yield on this investment? 5) Suppose you invest $50,000 today and obtain the following returns: Year 1: $8,000, Year 2 $12,000, Year 3 $14,000 year 4 $18,000 and year 5 $25,000. Payments are made at the end of each year. a) Calculate the annual IRR (Internal Rate of Return) for this investment. Suppose you have the option to purchase interest in a company that is expected to pay the following amounts: Year 1: $8,000, Year 2 $12,000, Year 3 $14,000, year 4 $18,000 and year 5 $25,000. Payments are made at the end of each year. If projects similar to this one, pay 12% interest compounded annual, how much should you be willing to pay for this one? Suppose you can purchase a business for $500,000. You expect to receive the following profits: Year 1 = $50,000, Year 2 = $55,000, Year 3 $60,000, year 4 =$65,000. You expect that at the end of year 4 that you will be able to sell the business for $550,000 (ignore any tax issues) a) Calculate the IRR of this project assuming equity holders put up all the money needed. 8) Using the information from the above problem, (copy your previous results to new tab and make modifications in new tab) suppose instead that your company is able to borrow $300,000 of the $500,000 needed for the purchase, but equity holders will have to provide the remainder of the funds. a) Calculate the IRR return to equity holders assuming that your company can borrow at 3% on a 15 year mortgage with yearly payments. b) What is the danger of the firm borrowing some of the money for this project rather than funding it all with investor equity? (type answers into excel) C) What is the advantage of borrowing some of the money for this project rather than funding it all with investor equity? (type answers into excel)