Answered step by step

Verified Expert Solution

Question

1 Approved Answer

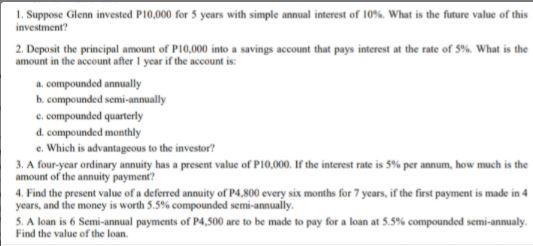

1. Suppose Glenn invested P10,000 for 5 years with simple annual interest of 10%. What is the future value of this investment? 2. Deposit

1. Suppose Glenn invested P10,000 for 5 years with simple annual interest of 10%. What is the future value of this investment? 2. Deposit the principal amount of PI0,000 into a savings account that pays interest at the rate of s%. What is the amount in the account after I year if the account is: a. compounded annually b. compounded semi-annually e. compounded quarteriy d. compounded monthly e. Which is advantageous to the investor? 3. A four-year ordinary annuity has a present value of PI0,000. If the interest rate is 5% per annum, how much is the amount of the annuity payment? 4. Find the present value of a deferred annuity of P4.800 every six months for 7 years, if the first payment is made in 4 years, and the money is worth 5.5% compounded semi-annually. S. A loan is 6 Semi-annual payments of P4,500 are to be made to pay for a loan at 5.5% compounded semi-annualy. Find the value of the loan.

Step by Step Solution

★★★★★

3.32 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

U Gla nvated ta00frSm I Pxrxt 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started