Answered step by step

Verified Expert Solution

Question

1 Approved Answer

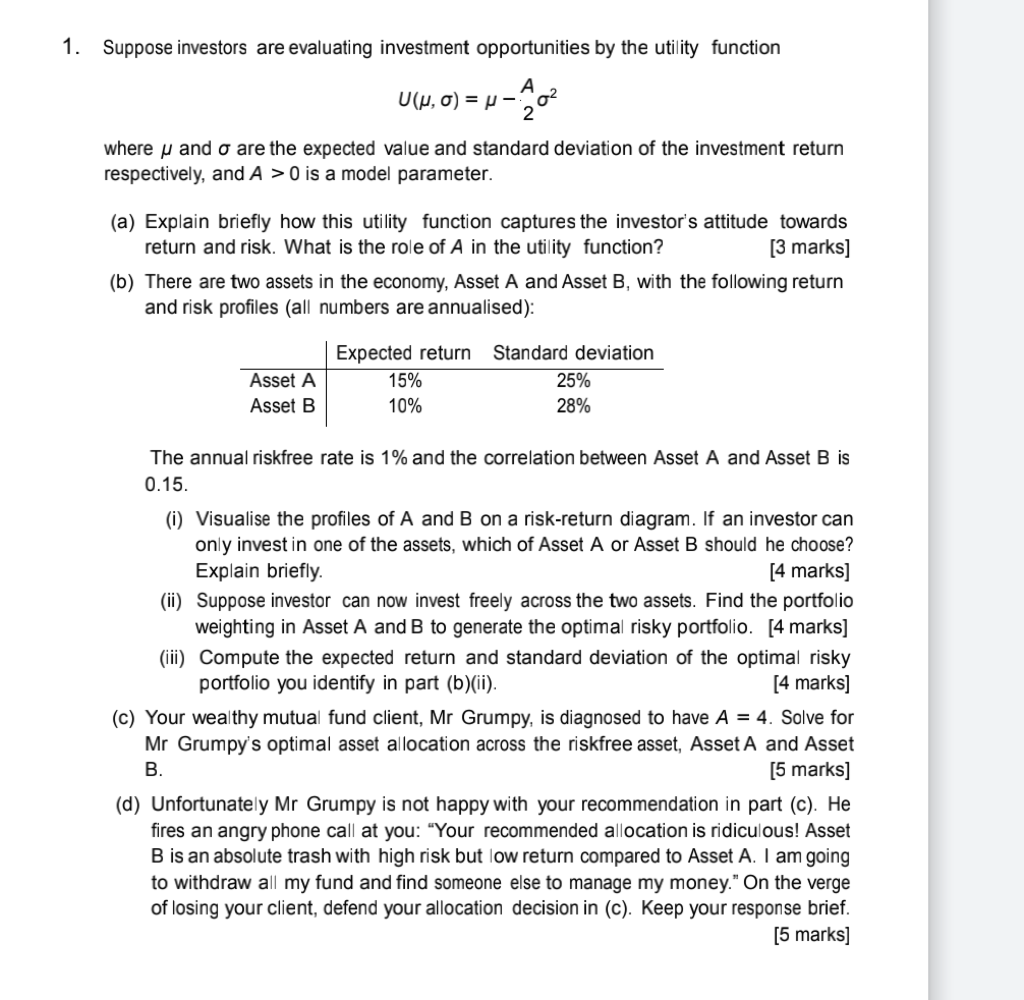

1. Suppose investors are evaluating investment opportunities by the utility function A U(, ) = - 0) 0 2 where and o are the

1. Suppose investors are evaluating investment opportunities by the utility function A U(, ) = - 0) 0 2 where and o are the expected value and standard deviation of the investment return respectively, and A > 0 is a model parameter. Asset A Asset B (a) Explain briefly how this utility function captures the investor's attitude towards return and risk. What is the role of A in the utility function? [3 marks] (b) There are two assets in the economy, Asset A and Asset B, with the following return and risk profiles (all numbers are annualised): Expected return Standard deviation 15% 10% 25% 28% The annual riskfree rate is 1% and the correlation between Asset A and Asset B is 0.15. (i) Visualise the profiles of A and B on a risk-return diagram. If an investor can only invest in one of the assets, which of Asset A or Asset B should he choose? Explain briefly. [4 marks] (ii) Suppose investor can now invest freely across the two assets. Find the portfolio weighting in Asset A and B to generate the optimal risky portfolio. [4 marks] (iii) Compute the expected return and standard deviation of the optimal risky portfolio you identify in part (b)(ii). [4 marks] (c) Your wealthy mutual fund client, Mr Grumpy, is diagnosed to have A = 4. Solve for Mr Grumpy's optimal asset allocation across the riskfree asset, Asset A and Asset B. [5 marks] (d) Unfortunately Mr Grumpy is not happy with your recommendation in part (c). He fires an angry phone call at you: "Your recommended allocation is ridiculous! Asset B is an absolute trash with high risk but low return compared to Asset A. I am going to withdraw all my fund and find someone else to manage my money." On the verge of losing your client, defend your allocation decision in (c). Keep your response brief. [5 marks]

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Please ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started