Question

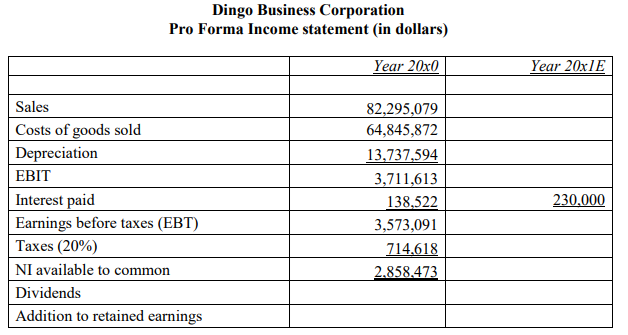

1). Suppose next year (Year 20x1E = S1) sales will increase by 25% over the current year sales. Assume the company is operating at full

1). Suppose next year (Year 20x1E = S1) sales will increase by 25% over the current year sales. Assume the company is operating at full capacity during the current year, and a company wants to pay out dividends at 75% of its net income. Determine the additional funds needed (use AFN formula)

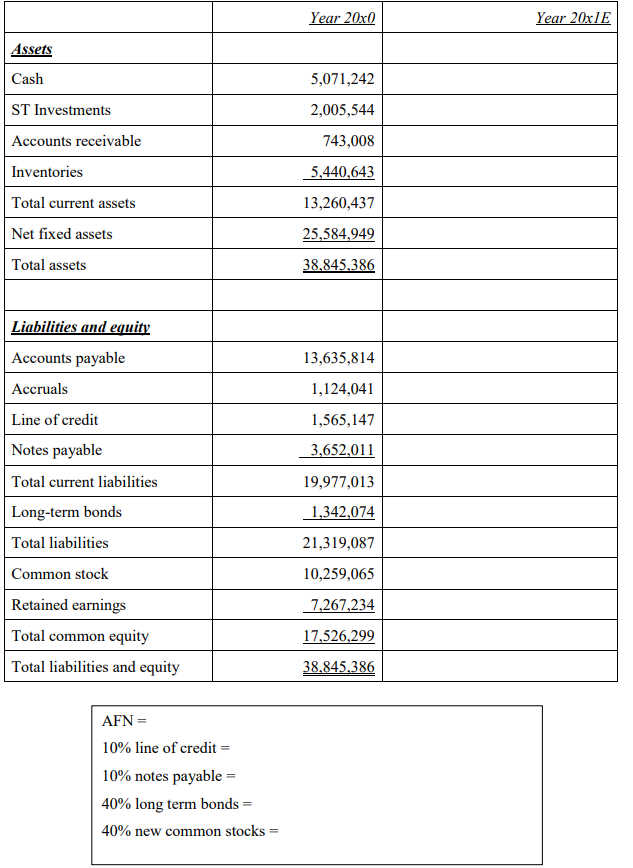

2). Pro Forma Statements (20x1E). Expected sales will increase by 30% over the current year sales. The company pays dividends at 80% of its net income. Depreciation for year 20x1E is calculated as 25% of net fixed assets. Assume the additional funds will be raised by 10% line of credit, 10% note payable, 40% long term bonds, and 40% issuing new common stocks.

Dingo Business Corporation Pro Forma Income statement (in dollars) \begin{tabular}{l} AFN= \\ 10% line of credit = \\ 10% notes payable = \\ 40% long term bonds = \\ 40% new common stocks = \\ \hline \end{tabular}

Dingo Business Corporation Pro Forma Income statement (in dollars) \begin{tabular}{l} AFN= \\ 10% line of credit = \\ 10% notes payable = \\ 40% long term bonds = \\ 40% new common stocks = \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started