Answered step by step

Verified Expert Solution

Question

1 Approved Answer

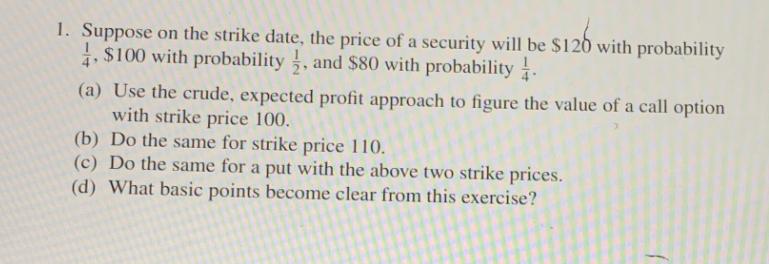

1. Suppose on the strike date, the price of a security will be $120 with probability 4, $100 with probability, and $80 with probability.

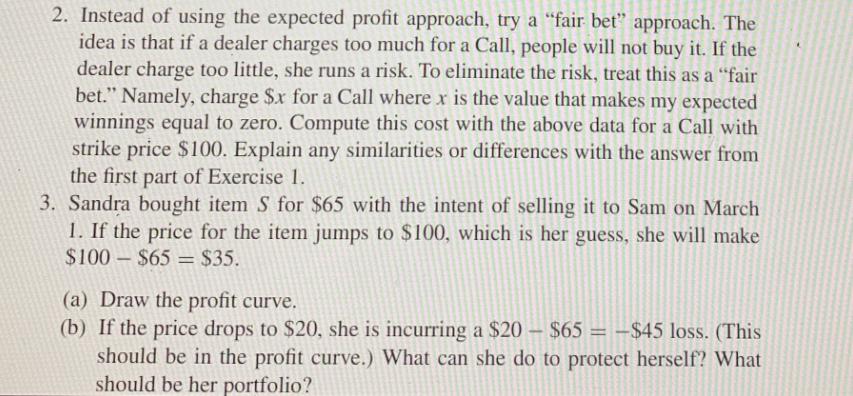

1. Suppose on the strike date, the price of a security will be $120 with probability 4, $100 with probability, and $80 with probability. (a) Use the crude, expected profit approach to figure the value of a call option with strike price 100. (b) Do the same for strike price 110. (c) Do the same for a put with the above two strike prices. (d) What basic points become clear from this exercise? 2. Instead of using the expected profit approach, try a "fair bet" approach. The idea is that if a dealer charges too much for a Call, people will not buy it. If the dealer charge too little, she runs a risk. To eliminate the risk, treat this as a "fair bet." Namely, charge $x for a Call where x is the value that makes my expected winnings equal to zero. Compute this cost with the above data for a Call with strike price $100. Explain any similarities or differences with the answer from the first part of Exercise 1. 3. Sandra bought item S for $65 with the intent of selling it to Sam on March 1. If the price for the item jumps to $100, which is her guess, she will make $100-$65 = $35. (a) Draw the profit curve. (b) If the price drops to $20, she is incurring a $20 - $65 = -$45 loss. (This should be in the profit curve.) What can she do to protect herself? What should be her portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started