Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a financial analyst at JPMorgan Chase investments, you are evaluating European call options and put options using Black Scholes model. Suppose BMI's stock

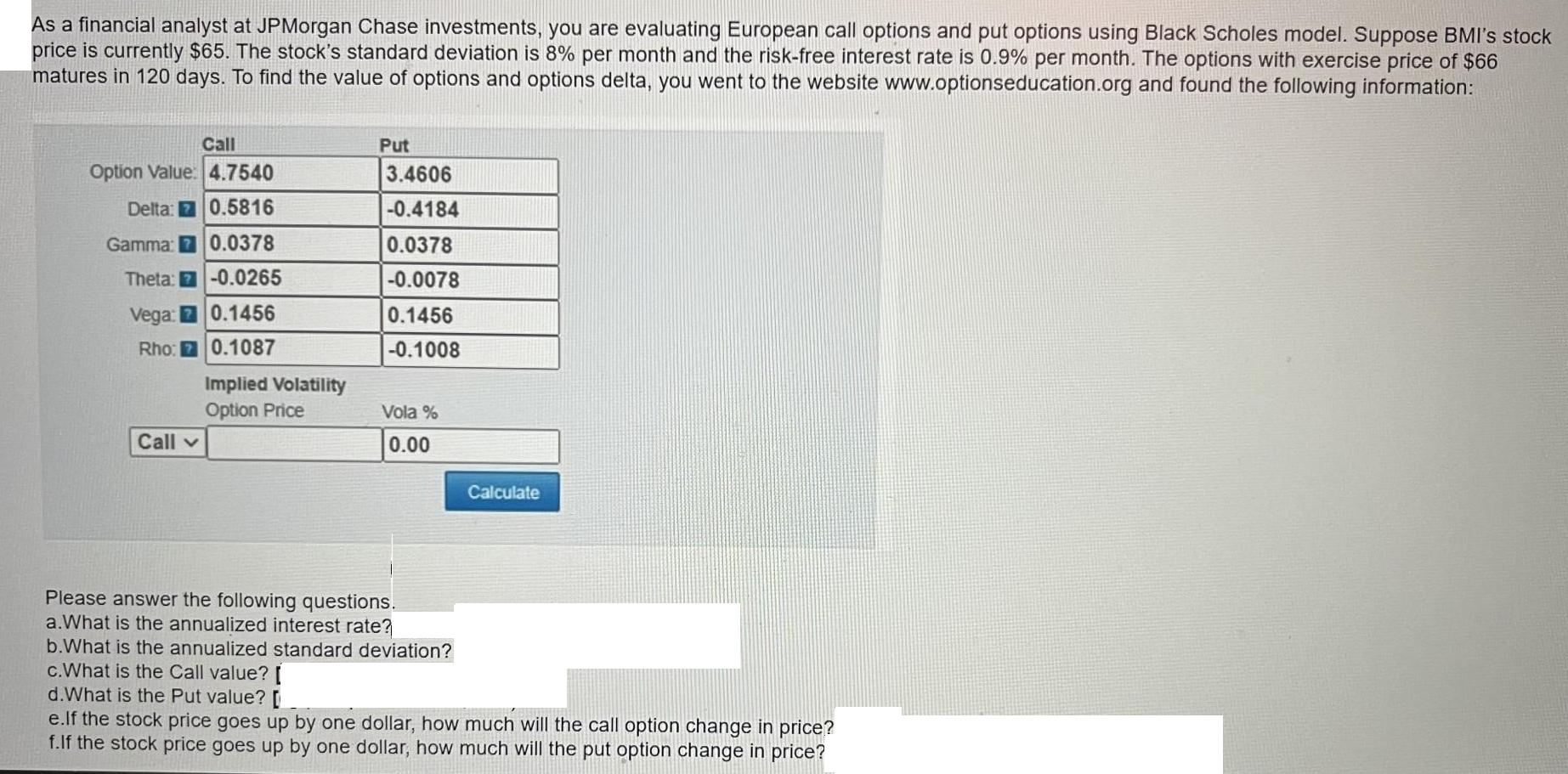

As a financial analyst at JPMorgan Chase investments, you are evaluating European call options and put options using Black Scholes model. Suppose BMI's stock price is currently $65. The stock's standard deviation is 8% per month and the risk-free interest rate is 0.9% per month. The options with exercise price of $66 matures in 120 days. To find the value of options and options delta, you went to the website www.optionseducation.org and found the following information: Call Option Value: 4.7540 Delta: 7 0.5816 Gamma:7 0.0378 Theta: -0.0265 Vega: 70.1456 Rho:7 0.1087 Call Implied Volatility Option Price Put 3.4606 -0.4184 0.0378 -0.0078 0.1456 -0.1008 Vola % 0.00 Calculate Please answer the following questions. a.What is the annualized interest rate? b.What is the annualized standard deviation? c.What is the Call value? [ d.What is the Put value? [ e.If the stock price goes up by one dollar, how much will the call option change in price? f.If the stock price goes up by one dollar, how much will the put option change in price?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the companys cash conversion cycle CCC we need to add the average collection period to the inventory turnover period and subtract the accounts payable payment period The formula for CCC ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started