Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Suppose that a Canadian Company, Maple Leaf Inc., is exporting its products to Australia in Nov. Upon this transaction, Maple Leaf will receive

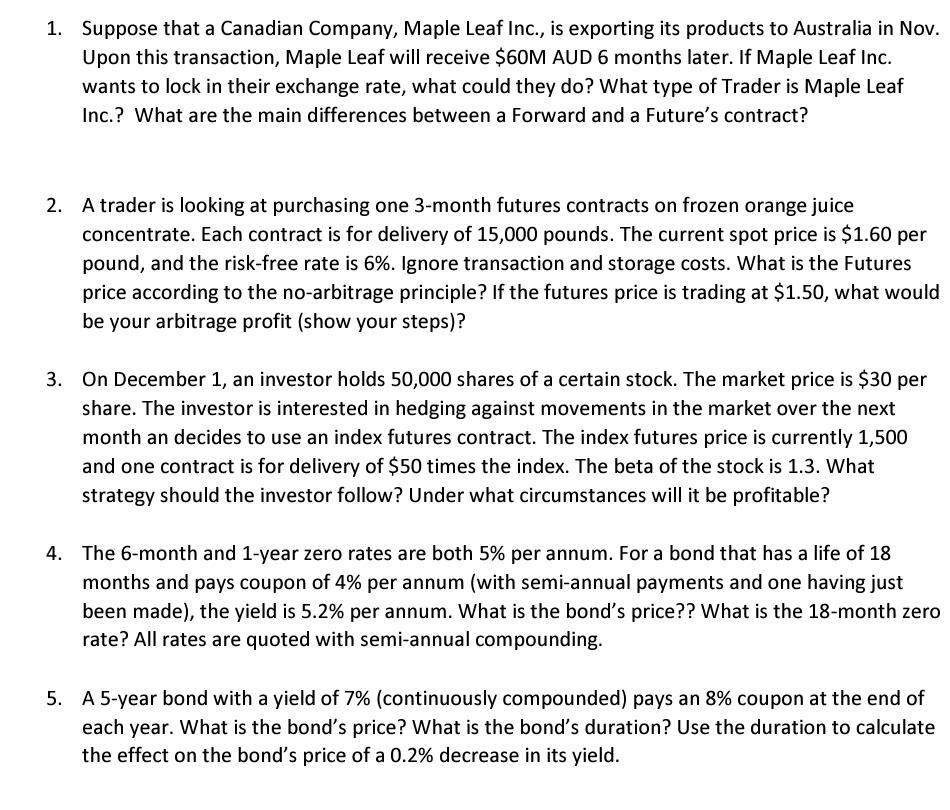

1. Suppose that a Canadian Company, Maple Leaf Inc., is exporting its products to Australia in Nov. Upon this transaction, Maple Leaf will receive $60M AUD 6 months later. If Maple Leaf Inc. wants to lock in their exchange rate, what could they do? What type of Trader is Maple Leaf Inc.? What are the main differences between a Forward and a Future's contract? 2. A trader is looking at purchasing one 3-month futures contracts on frozen orange juice concentrate. Each contract is for delivery of 15,000 pounds. The current spot price is $1.60 per pound, and the risk-free rate is 6%. Ignore transaction and storage costs. What is the Futures price according to the no-arbitrage principle? If the futures price is trading at $1.50, what would be your arbitrage profit (show your steps)? 3. On December 1, an investor holds 50,000 shares of a certain stock. The market price is $30 per share. The investor is interested in hedging against movements in the market over the next month an decides to use an index futures contract. The index futures price is currently 1,500 and one contract is for delivery of $50 times the index. The beta of the stock is 1.3. What strategy should the investor follow? Under what circumstances will it be profitable? 4. The 6-month and 1-year zero rates are both 5% per annum. For a bond that has a life of 18 months and pays coupon of 4% per annum (with semi-annual payments and one having just been made), the yield is 5.2% per annum. What is the bond's price?? What is the 18-month zero rate? All rates are quoted with semi-annual compounding. 5. A 5-year bond with a yield of 7% (continuously compounded) pays an 8% coupon at the end of each year. What is the bond's price? What is the bond's duration? Use the duration to calculate the effect on the bond's price of a 0.2% decrease in its yield.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started