Answered step by step

Verified Expert Solution

Question

1 Approved Answer

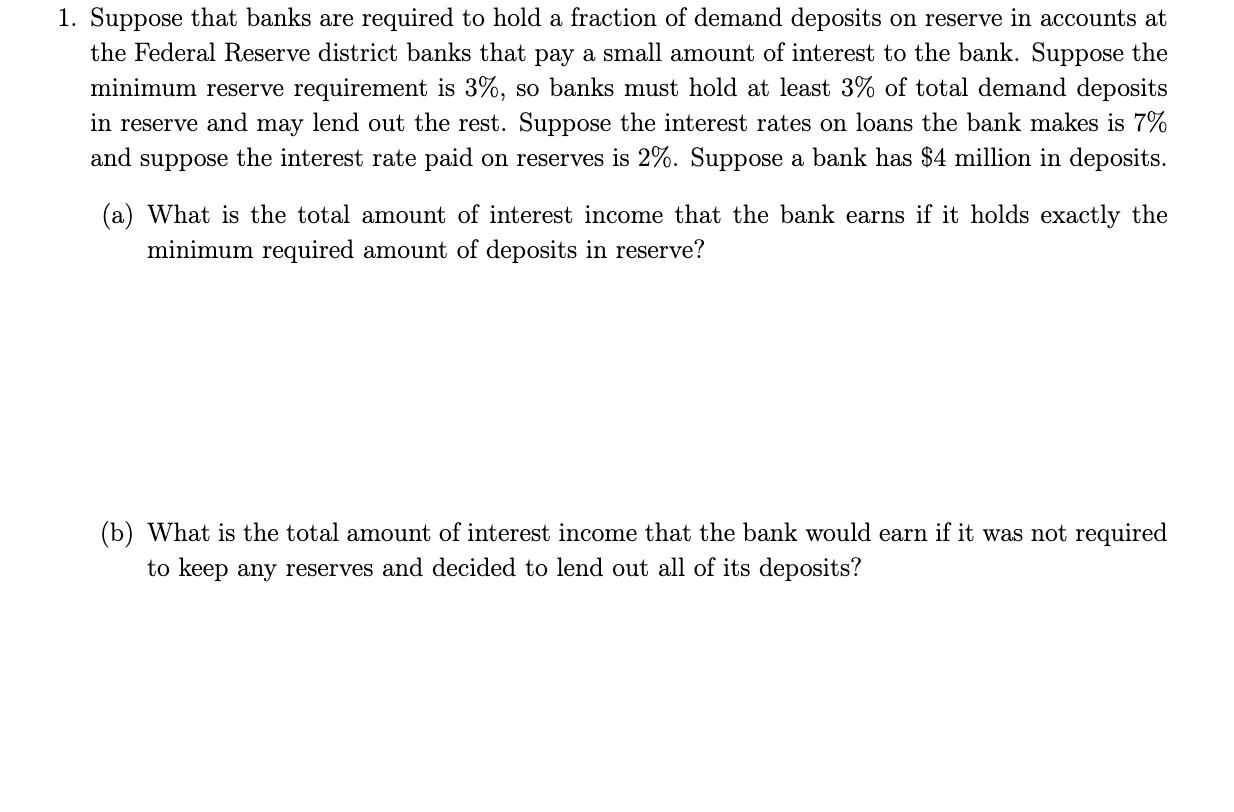

1. Suppose that banks are required to hold a fraction of demand deposits on reserve in accounts at the Federal Reserve district banks that

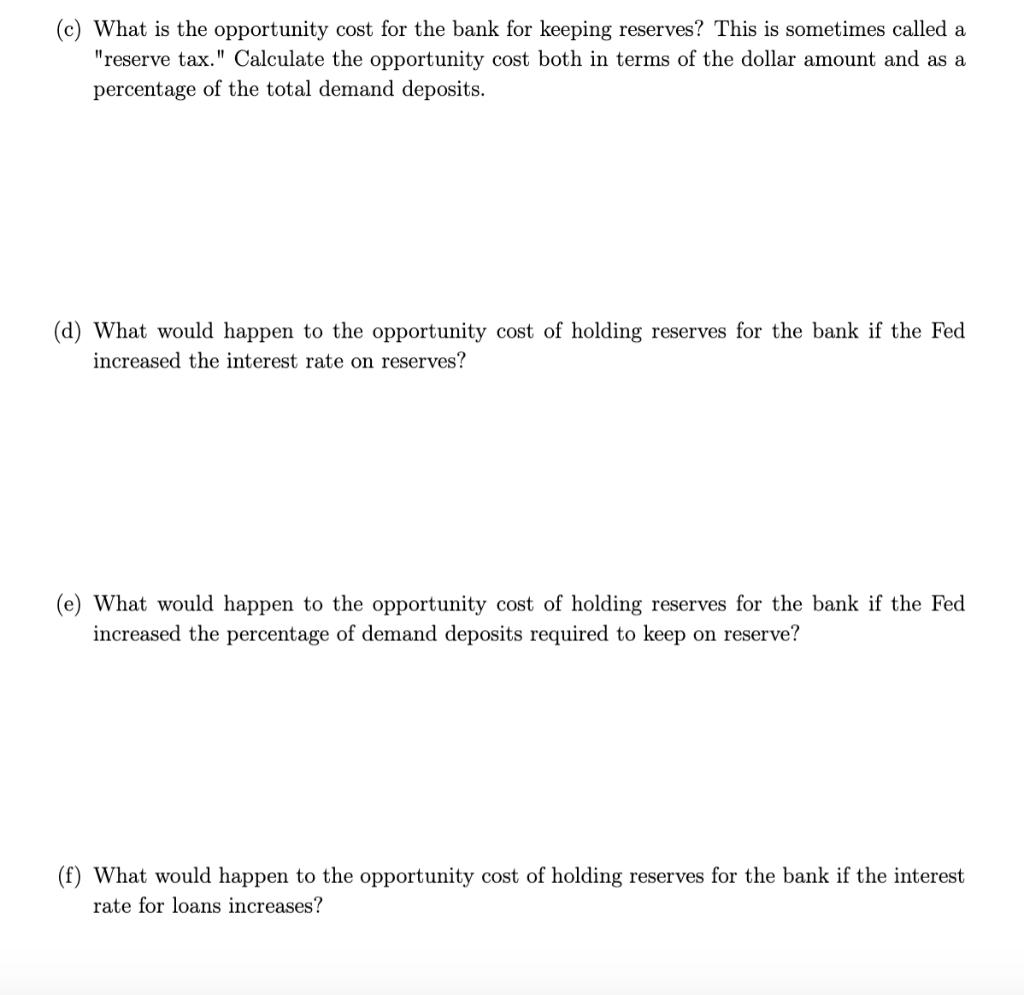

1. Suppose that banks are required to hold a fraction of demand deposits on reserve in accounts at the Federal Reserve district banks that pay a small amount of interest to the bank. Suppose the minimum reserve requirement is 3%, so banks must hold at least 3% of total demand deposits in reserve and may lend out the rest. Suppose the interest rates on loans the bank makes is 7% and suppose the interest rate paid on reserves is 2%. Suppose a bank has $4 million in deposits. (a) What is the total amount of interest income that the bank earns if it holds exactly the minimum required amount of deposits in reserve? (b) What is the total amount of interest income that the bank would earn if it was not required to keep any reserves and decided to lend out all of its deposits? (c) What is the opportunity cost for the bank for keeping reserves? This is sometimes called a "reserve tax." Calculate the opportunity cost both in terms of the dollar amount and as a percentage of the total demand deposits. (d) What would happen to the opportunity cost of holding reserves for the bank if the Fed increased the interest rate on reserves? (e) What would happen to the opportunity cost of holding reserves for the bank if the Fed increased the percentage of demand deposits required to keep on reserve? (f) What would happen to the opportunity cost of holding reserves for the bank if the interest rate for loans increases?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started