Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Suppose that Nathan and Mia work for the same employer, but they choose different medical plans based on their needs. Use the following

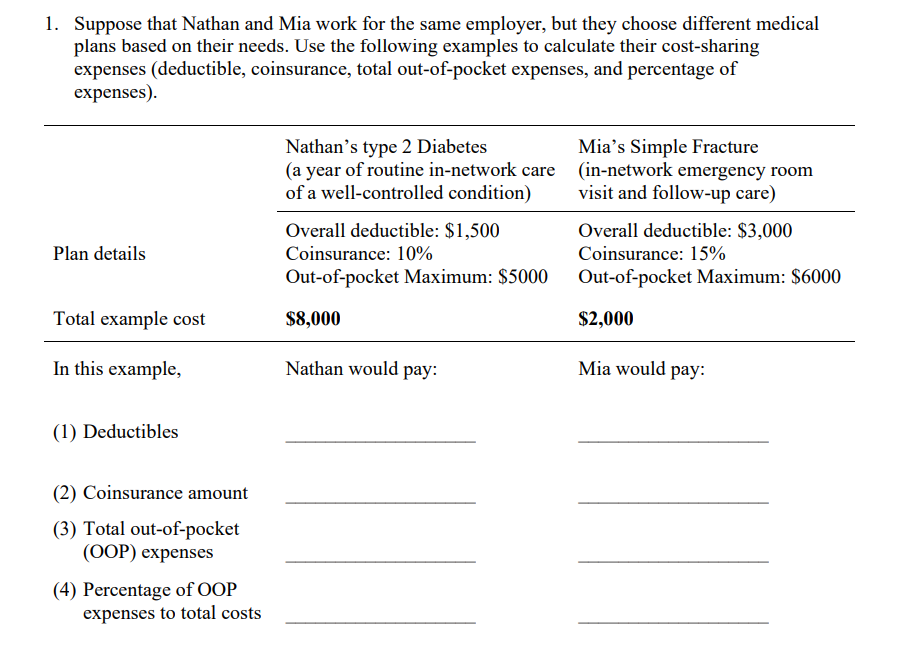

1. Suppose that Nathan and Mia work for the same employer, but they choose different medical plans based on their needs. Use the following examples to calculate their cost-sharing expenses (deductible, coinsurance, total out-of-pocket expenses, and percentage of expenses). Plan details Total example cost In this example, (1) Deductibles (2) Coinsurance amount (3) Total out-of-pocket (OOP) expenses (4) Percentage of OOP expenses to total costs Nathan's type 2 Diabetes (a year of routine in-network care of a well-controlled condition) Overall deductible: $1,500 Coinsurance: 10% Out-of-pocket Maximum: $5000 $8,000 Nathan would pay: Mia's Simple Fracture (in-network emergency room visit and follow-up care) Overall deductible: $3,000 Coinsurance: 15% Out-of-pocket Maximum: $6000 $2,000 Mia would pay:

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

For Nathan 1 Deductible Nathans deductible is 1500 Since his example cost is 8000 he would have to pay the full amount of his deductible before his in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started