Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Suppose that the state space is given by s1, s2 and that an investor has preferences over risky portfolios z that can be

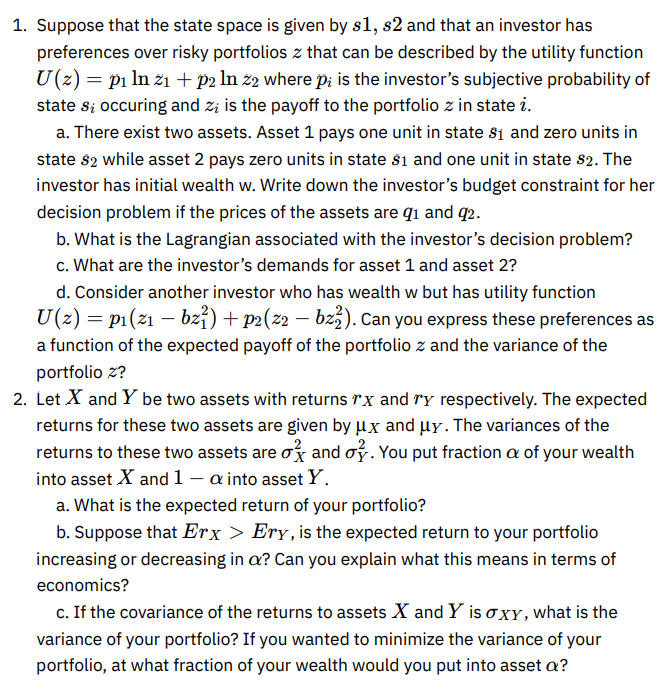

1. Suppose that the state space is given by s1, s2 and that an investor has preferences over risky portfolios z that can be described by the utility function U(z): = pi ln 21 + p2 In 22 where pi is the investor's subjective probability of state si occuring and zi is the payoff to the portfolio z in state i. a. There exist two assets. Asset 1 pays one unit in state $1 and zero units in state $2 while asset 2 pays zero units in state $1 and one unit in state $2. The investor has initial wealth w. Write down the investor's budget constraint for her decision problem if the prices of the assets are 91 and 92. b. What is the Lagrangian associated with the investor's decision problem? c. What are the investor's demands for asset 1 and asset 2? d. Consider another investor who has wealth w but has utility function U(z) = p(z bz) + p2(z2 - bz2). Can you express these preferences as a function of the expected payoff of the portfolio z and the variance of the portfolio z? 2. Let X and Y be two assets with returns rx and ry respectively. The expected returns for these two assets are given by x and y. The variances of the returns to these two assets are ) and . You put fraction a of your wealth into asset X and 1 - a into asset Y. a. What is the expected return of your portfolio? b. Suppose that Erx > Ery, is the expected return to your portfolio increasing or decreasing in a? Can you explain what this means in terms of economics? c. If the covariance of the returns to assets X and Y is XY, what is the variance of your portfolio? If you wanted to minimize the variance of your portfolio, at what fraction of your wealth would you put into asset a?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started