Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Suppose that utility takes the standard form U-U(C, L) and that the budget constraint is C = V+w(T-L). Let Q denote commuting time:

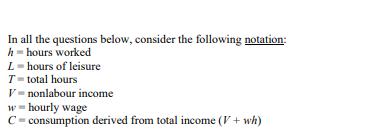

1. Suppose that utility takes the standard form U-U(C, L) and that the budget constraint is C = V+w(T-L). Let Q denote commuting time: what is the effect of an increase in Q upon L and h? 2. Depict the standard budget line CV+w(T-L) and the optimal choice of a labour market participant who works for 8 hours or less. Now suppose that firms offer 1.5w for every additional overtime hour worked in excess of h-8hrs. Depict the new budget line. What happens to the optimal number of hours the individual works? Is it possible that the introduction of overtime can reduce them? 3. Anne gains utility from consumption C and leisure L. The most leisure she can consume in any given week is 110 hours. Her utility function is U(C, L) CXL. This functional form implies that Anne's marginal rate of substitution is C/L. Anne receives $660 each week from her grandmother regardless of how much Anne works. What is Anne's reservation wage? 4. Ben earns $15 per hour for up to 40 hours of work each week and $30 per hour for every hour in excess of 40. Ben also faces a 20 percent tax rate, pays $4 per hour in childcare expenses for each hour he works, and receives $80 in child support payments each week. There are 110 (non-sleeping) hours in the week. Graph Ben's weekly budget line. 5. Consider a person who can work up to 80 hours each week at a pre-tax wage of $20 per hour but faces a constant 20% payroll tax. Under these conditions, the worker maximizes her utility by choosing to work 50 hours each week. The government proposes a negative income tax whereby everyone is given $300 each week and anyone can supplement her income further by working. To pay for the negative income tax, the payroll tax rate will be increased to 50%. (a) On a single graph, draw the worker's original budget line and her budget line under the negative income tax. (b) Show that the worker will choose to work fewer hours if the negative income tax is adopted. (c) Will the worker's utility be greater under the negative income tax? In all the questions below, consider the following notation: h-hours worked L = hours of leisure T-total hours V nonlabour income w-hourly wage C=consumption derived from total income (V+ wh)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started