Question

1) Suppose that you are managing stock portfolio with total value of RM3 million. The beta of the stock portfolio is 1.5. Worried about potentially

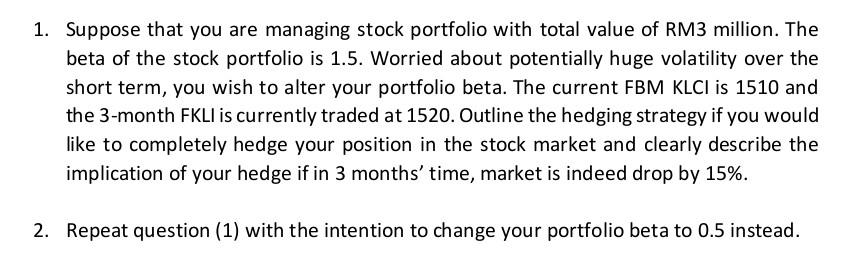

1) Suppose that you are managing stock portfolio with total value of RM3 million. The beta of the stock portfolio is 1.5. Worried about potentially huge volatility over the short term, you wish to alter your portfolio beta. The current FBM KLCI is 1510 and the 3-month FKLI is currently traded at 1520. Outline the hedging strategy if you would like to completely hedge your position in the stock market and clearly describe the implication of your hedge if in 3 months time, market is indeed drop by 15%.

a)Repeat question (1) with the intention to change your portfolio beta to 0.5 instead.

1. Suppose that you are managing stock portfolio with total value of RM3 million. The beta of the stock portfolio is 1.5. Worried about potentially huge volatility over the short term, you wish to alter your portfolio beta. The current FBM KLCI is 1510 and the 3-month FKLI is currently traded at 1520. Outline the hedging strategy if you would like to completely hedge your position in the stock market and clearly describe the implication of your hedge if in 3 months' time, market is indeed drop by 15%. 2. Repeat question (1) with the intention to change your portfolio beta to 0.5 instead. 1. Suppose that you are managing stock portfolio with total value of RM3 million. The beta of the stock portfolio is 1.5. Worried about potentially huge volatility over the short term, you wish to alter your portfolio beta. The current FBM KLCI is 1510 and the 3-month FKLI is currently traded at 1520. Outline the hedging strategy if you would like to completely hedge your position in the stock market and clearly describe the implication of your hedge if in 3 months' time, market is indeed drop by 15%. 2. Repeat question (1) with the intention to change your portfolio beta to 0.5 insteadStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started