Question

1) Suppose the dollars per pound spot rate is $1.31/ and the 12-month forward rate implies a forward discount of 4.00% on the pound. What

1) Suppose the dollars per pound spot rate is $1.31/ and the 12-month forward rate implies a forward discount of 4.00% on the pound. What must be the 12-month forward rate? [hint: The pound is traded at a discount in the forward market, compared to spot trades]

2) Suppose the three-month forward rate for the Indian rupees (INR) per Japanese yen (JPY) was INR 0.75/JPY, while the spot rate at the time was INR 0.73/JPY. A scientist located in New York speculates that the spot rate three months later will be INR 0.77/JPY. They decided to devote 500,000 yen in order to try to profit from this speculation, by making a trade in the forward market. Describe the cash flows and the profit if the prediction comes true (Specify the amounts and currencies). [hint: the trade was made in the forward market; it was not a buy-and-hold strategy of nor ]

3) An option trader purchased a call option on Russian ruble () with a strike price of $0.01350/, at a premium of 0.00040 dollars per ruble and with an expiration date three months from now. The option is for 2,500,000. (a) What would be the traders profit or loss if the spot rate at maturity is $0.01310/? (b) What would be the traders profit or loss if the spot rate at maturity is $0.01380/?

4) Consider the following option contract on the Euro: It is a call option for 125,000 euros, with settlement prices in terms of US dollars per one euro (i.e., if exercised, 125,000 will be delivered in exchange for the appropriate number of dollars) The strike price is 1.2000 dollars per euro, and the premium is 0.0150 dollars per euro.

(a) Suppose a trader writes ten of these call option contracts. What would be the traders profit or loss if the spot rate upon the option expiration is 1.1750 dollars per euro?

(b) A different options trader purchased one of these call option contracts. What would be the traders profit or loss if the spot rate upon the option expiration is 1.850 dollars per euro?

(c) Another trader purchased two of these call option contracts. What would be this traders profit or loss if the spot rate upon the option expiration is 1.225 dollars per euro?

(d) Suppose that soon after taking these positions (but before their expiration), the value of the dollar would depreciate substantially, well beyond expectations. Would it benefit the long position in this option or the short position?

5) Consider the following option contract on the Euro: It is a put option for 125,000 euros, with settlement prices in terms of US dollars per one euro (i.e., if exercised, euros will be exchanged for the appropriate number of dollars) The strike price is 1.2000 dollars per euro, and the premium is 0.0300 dollars per euro.

(a) Suppose a trader entered a long position by buying seven of these put option contracts. What would be the traders profit or loss if the spot rate upon the option expiration is 1.1950 dollars per euro?

(b) A different options trader took a short position in this put option (for seven contracts). What would be the traders profit or loss if the spot rate upon the option expiration is 1.2050 dollars per euro?

(c) Another trader writes seven of these put option contracts. What would be this traders profit or loss if the spot rate upon the option expiration is 1.1900 dollars per euro? (

d) Suppose that soon after taking these positions (but before their expiration), the value of the dollar would depreciate substantially, well beyond expectations. Would it benefit the long position in this option or the short position?

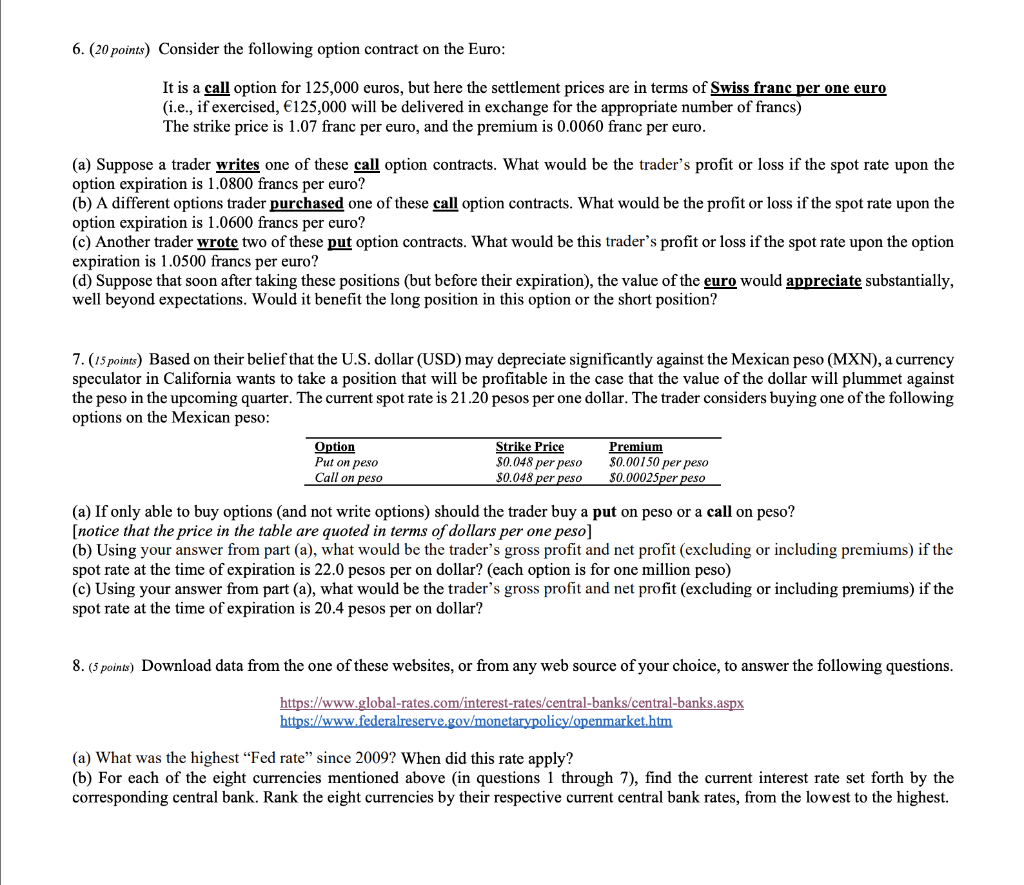

6. (20 points) Consider the following option contract on the Euro: It is a call option for 125,000 euros, but here the settlement prices are in terms of Swiss franc per one euro (i.e., if exercised, 125,000 will be delivered in exchange for the appropriate number of francs) The strike price is 1.07 franc per euro, and the premium is 0.0060 franc per euro. (a) Suppose a trader writes one of these call option contracts. What would be the trader's profit or loss if the spot rate upon the option expiration is 1.0800 francs per euro? (b) A different options trader purchased one of these call option contracts. What would be the profit or loss if the spot rate upon the option expiration is 1.0600 francs per euro? (c) Another trader wrote two of these put option contracts. What would be this trader's profit or loss if the spot rate upon the option expiration is 1.0500 francs per euro? (d) Suppose that soon after taking these positions (but before their expiration), the value of the euro would appreciate substantially, well beyond expectations. Would it benefit the long position in this option or the short position? 7. (15 points) Based on their belief that the U.S. dollar (USD) may depreciate significantly against the Mexican Peso (MXN), a currency speculator in California wants to take a position that will be profitable in the case that the value of the dollar will plummet against the peso in the upcoming quarter. The current spot rate is 21.20 pesos per one dollar. The trader considers buying one of the following options on the Mexican peso: Option Put on peso Call on peso Strike Price 048 per peso $0.048 per peso Premium $0.00150 per peso $0.00025per peso (a) If only able to buy options and not write options) should the trader buy a put on peso or a call on peso? [notice that the price in the table are quoted in terms of dollars per one peso] (b) Using your answer from part (a), what would be the trader's gross profit and net profit (excluding or including premiums) if the spot rate at the time of expiration is 22.0 pesos per on dollar? (each option is for one million peso) (c) Using your answer from part (a), what would be the trader's gross profit and net profit (excluding or including premiums) if the spot rate at the time of expiration is 20.4 pesos per on dollar? 8. (5 points) Download data from the one of these websites, or from any web source of your choice, to answer the following questions. https://www.global-rates.com/interest-rates/central-banks/central-banks.aspx https://www.federalreserve.gov/monetarypolicy/openmarket.htm (a) What was the highest "Fed rate since 2009? When did this rate apply? (b) For each of the eight currencies mentioned above (in questions 1 through 7), find the current interest rate set forth by the corresponding central bank. Rank the eight currencies by their respective current central bank rates, from the lowest to the highest. 6. (20 points) Consider the following option contract on the Euro: It is a call option for 125,000 euros, but here the settlement prices are in terms of Swiss franc per one euro (i.e., if exercised, 125,000 will be delivered in exchange for the appropriate number of francs) The strike price is 1.07 franc per euro, and the premium is 0.0060 franc per euro. (a) Suppose a trader writes one of these call option contracts. What would be the trader's profit or loss if the spot rate upon the option expiration is 1.0800 francs per euro? (b) A different options trader purchased one of these call option contracts. What would be the profit or loss if the spot rate upon the option expiration is 1.0600 francs per euro? (c) Another trader wrote two of these put option contracts. What would be this trader's profit or loss if the spot rate upon the option expiration is 1.0500 francs per euro? (d) Suppose that soon after taking these positions (but before their expiration), the value of the euro would appreciate substantially, well beyond expectations. Would it benefit the long position in this option or the short position? 7. (15 points) Based on their belief that the U.S. dollar (USD) may depreciate significantly against the Mexican Peso (MXN), a currency speculator in California wants to take a position that will be profitable in the case that the value of the dollar will plummet against the peso in the upcoming quarter. The current spot rate is 21.20 pesos per one dollar. The trader considers buying one of the following options on the Mexican peso: Option Put on peso Call on peso Strike Price 048 per peso $0.048 per peso Premium $0.00150 per peso $0.00025per peso (a) If only able to buy options and not write options) should the trader buy a put on peso or a call on peso? [notice that the price in the table are quoted in terms of dollars per one peso] (b) Using your answer from part (a), what would be the trader's gross profit and net profit (excluding or including premiums) if the spot rate at the time of expiration is 22.0 pesos per on dollar? (each option is for one million peso) (c) Using your answer from part (a), what would be the trader's gross profit and net profit (excluding or including premiums) if the spot rate at the time of expiration is 20.4 pesos per on dollar? 8. (5 points) Download data from the one of these websites, or from any web source of your choice, to answer the following questions. https://www.global-rates.com/interest-rates/central-banks/central-banks.aspx https://www.federalreserve.gov/monetarypolicy/openmarket.htm (a) What was the highest "Fed rate since 2009? When did this rate apply? (b) For each of the eight currencies mentioned above (in questions 1 through 7), find the current interest rate set forth by the corresponding central bank. Rank the eight currencies by their respective current central bank rates, from the lowest to the highestStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started