Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Suppose the historical annual volatility and mean of returns on the Japanese TOPIX index are 20% and 2%, respectively, while the annual historical

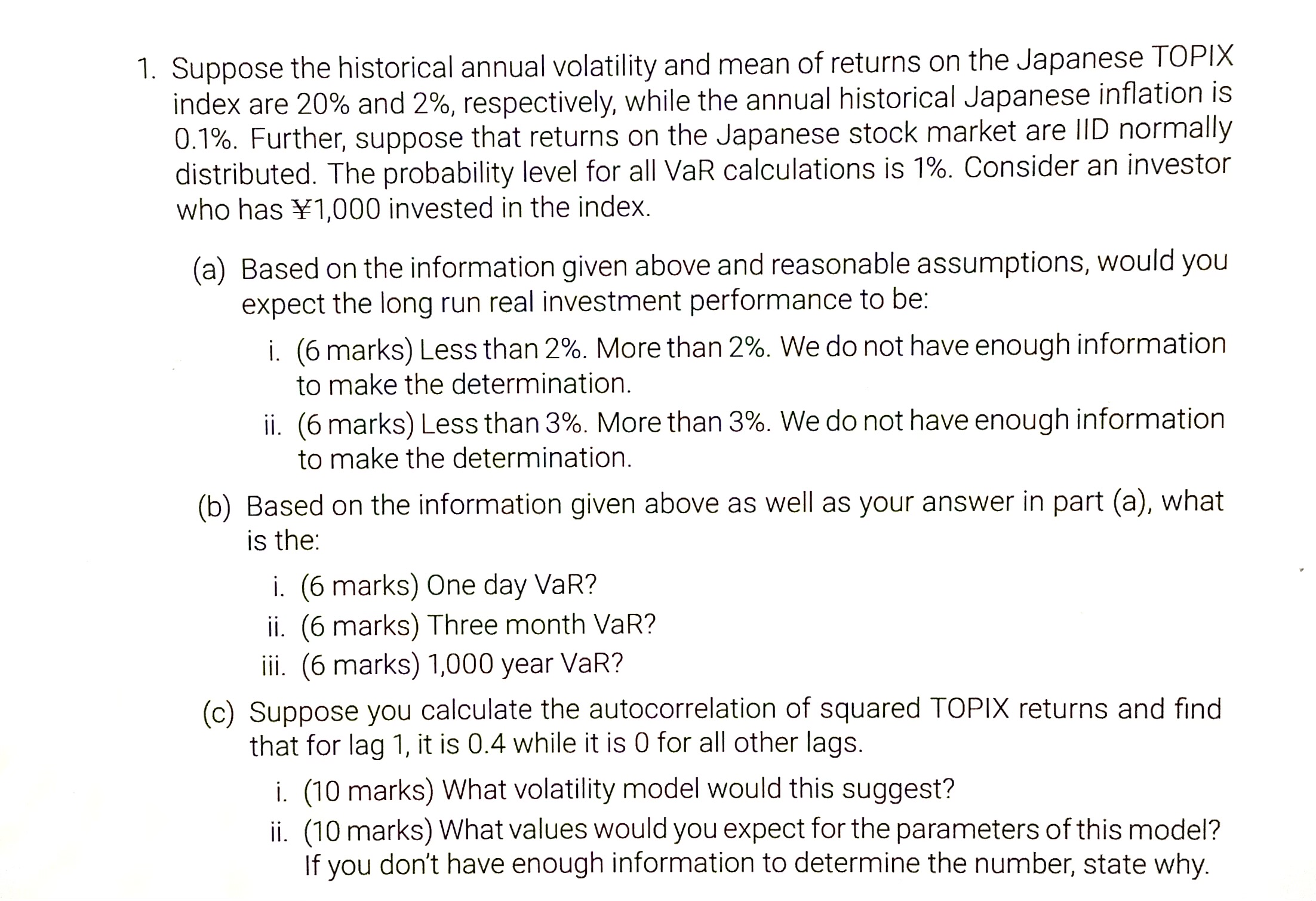

1. Suppose the historical annual volatility and mean of returns on the Japanese TOPIX index are 20% and 2%, respectively, while the annual historical Japanese inflation is 0.1%. Further, suppose that returns on the Japanese stock market are IID normally distributed. The probability level for all VaR calculations is 1%. Consider an investor who has 1,000 invested in the index. (a) Based on the information given above and reasonable assumptions, would you expect the long run real investment performance to be: i. (6 marks) Less than 2%. More than 2%. We do not have enough information to make the determination. ii. (6 marks) Less than 3%. More than 3%. We do not have enough information to make the determination. (b) Based on the information given above as well as your answer in part (a), what is the: i. (6 marks) One day VaR? ii. (6 marks) Three month VaR? iii. (6 marks) 1,000 year Var? (c) Suppose you calculate the autocorrelation of squared TOPIX returns and find that for lag 1, it is 0.4 while it is 0 for all other lags. i. (10 marks) What volatility model would this suggest? ii. (10 marks) What values would you expect for the parameters of this model? If you don't have enough information to determine the number, state why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Based on the information given we can assess the longrun real investment performance i The historical mean of returns on the Japanese TOPIX index is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started