Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each of the event mentioned below, determine which component(s) of China's GDP of the current year is affected and by how much, and

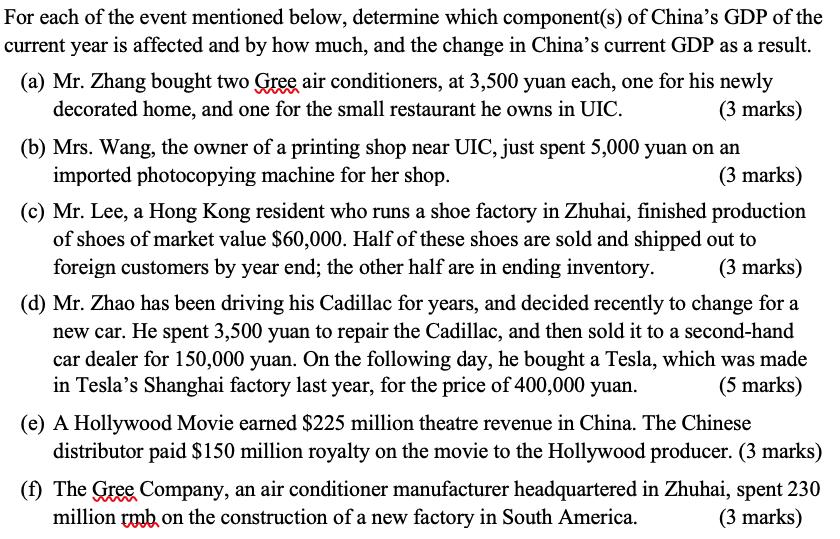

For each of the event mentioned below, determine which component(s) of China's GDP of the current year is affected and by how much, and the change in China's current GDP as a result. (a) Mr. Zhang bought two Gree air conditioners, at 3,500 yuan each, one for his newly decorated home, and one for the small restaurant he owns in UIC. (3 marks) (b) Mrs. Wang, the owner of a printing shop near UIC, just spent 5,000 yuan on an imported photocopying machine for her shop. (3 marks) (c) Mr. Lee, a Hong Kong resident who runs a shoe factory in Zhuhai, finished production of shoes of market value $60,000. Half of these shoes are sold and shipped out to foreign customers by year end; the other half are in ending inventory. (3 marks) (d) Mr. Zhao has been driving his Cadillac for years, and decided recently to change for a new car. He spent 3,500 yuan to repair the Cadillac, and then sold it to a second-hand car dealer for 150,000 yuan. On the following day, he bought a Tesla, which was made in Tesla's Shanghai factory last year, for the price of 400,000 yuan. (5 marks) (e) A Hollywood Movie earned $225 million theatre revenue in China. The Chinese distributor paid $150 million royalty on the movie to the Hollywood producer. (3 marks) (f) The Gree Company, an air conditioner manufacturer headquartered in Zhuhai, spent 230 million mb, on the construction of a new factory in South America. (3 marks)

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

For each of the event mentioned below determine which components of Chinas GDP of the current year is affected and by how much and the change in Chinas current GDP as a result a Mr Zhang bought two Gr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started