Answered step by step

Verified Expert Solution

Question

1 Approved Answer

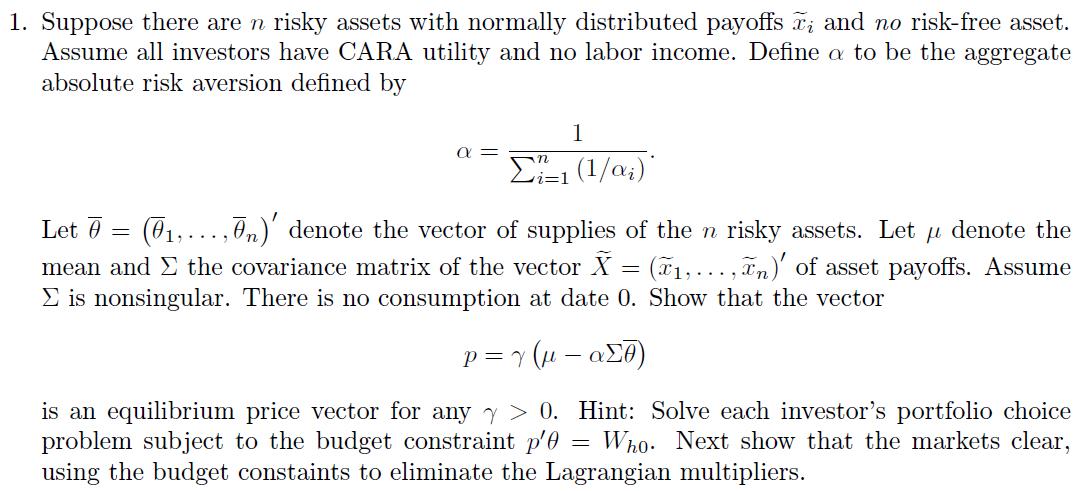

1. Suppose there are n risky assets with normally distributed payoffs , and no risk-free asset. Assume all investors have CARA utility and no

1. Suppose there are n risky assets with normally distributed payoffs , and no risk-free asset. Assume all investors have CARA utility and no labor income. Define a to be the aggregate absolute risk aversion defined by 1 = i_ (1/a)* Let 7 = (,...,n) denote the vector of supplies of the n risky assets. Let denote the mean and the covariance matrix of the vector X = (,...,n)' of asset payoffs. Assume is nonsingular. There is no consumption at date 0. Show that the vector p = ( - 7) is an equilibrium price vector for any > 0. Hint: Solve each investor's portfolio choice problem subject to the budget constraint p'0 = Who. Next show that the markets clear, using the budget constaints to eliminate the Lagrangian multipliers.

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Selection of risky Asset should be made on the bases of Coefficient of Variation CM ie H...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started