Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Suppose there are two markets for housing A and B which have the same linear demand curve, but potentially different supply curves. In

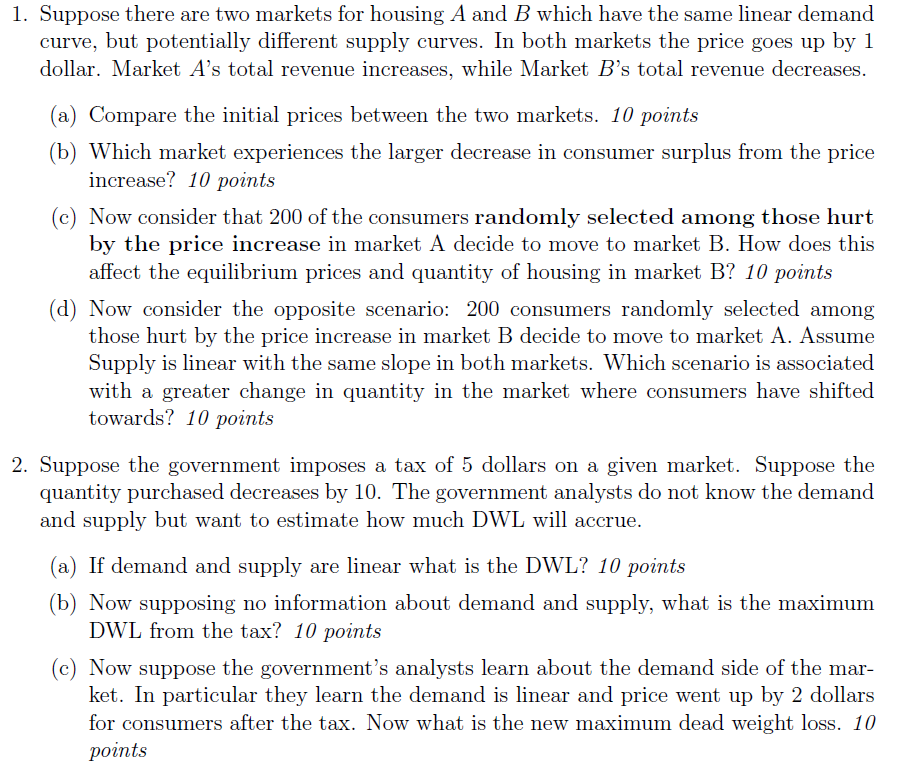

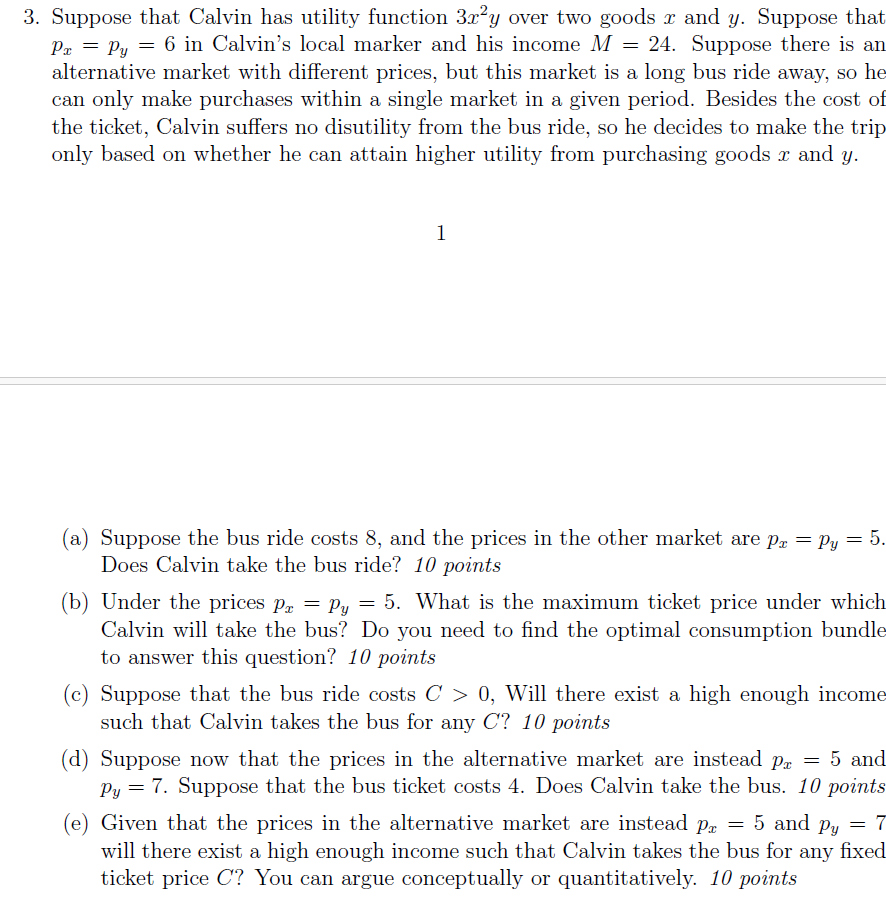

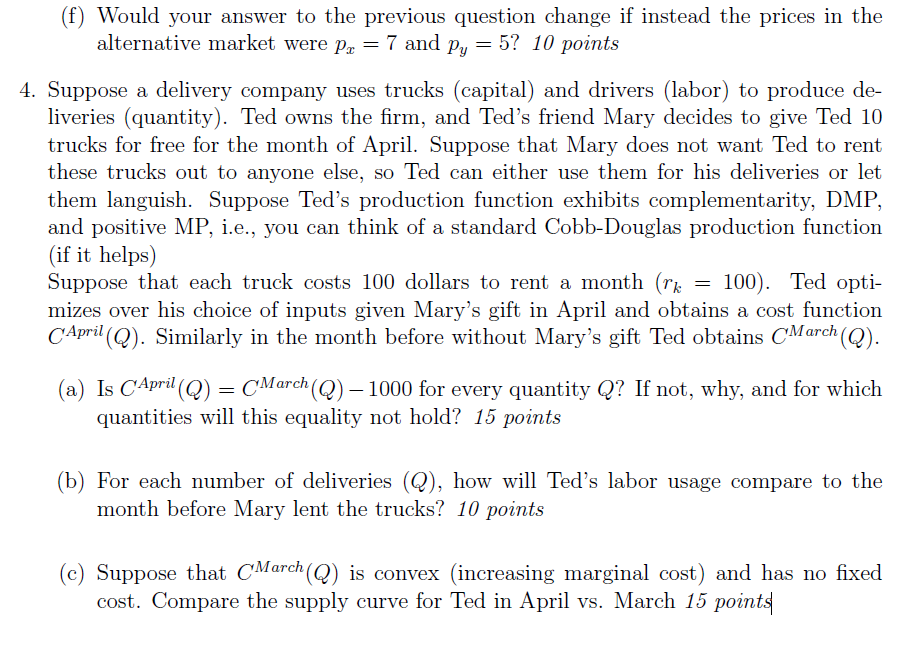

1. Suppose there are two markets for housing A and B which have the same linear demand curve, but potentially different supply curves. In both markets the price goes up by 1 dollar. Market A's total revenue increases, while Market B's total revenue decreases. (a) Compare the initial prices between the two markets. 10 points (b) Which market experiences the larger decrease in consumer surplus from the price increase? 10 points (c) Now consider that 200 of the consumers randomly selected among those hurt by the price increase in market A decide to move to market B. How does this affect the equilibrium prices and quantity of housing in market B? 10 points (d) Now consider the opposite scenario: 200 consumers randomly selected among those hurt by the price increase in market B decide to move to market A. Assume Supply is linear with the same slope in both markets. Which scenario is associated with a greater change in quantity in the market where consumers have shifted towards? 10 points 2. Suppose the government imposes a tax of 5 dollars on a given market. Suppose the quantity purchased decreases by 10. The government analysts do not know the demand and supply but want to estimate how much DWL will accrue. (a) If demand and supply are linear what is the DWL? 10 points (b) Now supposing no information about demand and supply, what is the maximum DWL from the tax? 10 points (c) Now suppose the government's analysts learn about the demand side of the mar- ket. In particular they learn the demand is linear and price went up by 2 dollars for consumers after the tax. Now what is the new maximum dead weight loss. 10 points 3. Suppose that Calvin has utility function 3xy over two goods x and y. Suppose that Px = Py = 6 in Calvin's local marker and his income M = 24. Suppose there is an alternative market with different prices, but this market is a long bus ride away, so he can only make purchases within a single market in a given period. Besides the cost of the ticket, Calvin suffers no disutility from the bus ride, so he decides to make the trip only based on whether he can attain higher utility from purchasing goods x and y. 1 (a) Suppose the bus ride costs 8, and the prices in the other market are px = Py = 5. Does Calvin take the bus ride? 10 points (b) Under the prices px = py = 5. What is the maximum ticket price under which Calvin will take the bus? Do you need to find the optimal consumption bundle to answer this question? 10 points (c) Suppose that the bus ride costs C > 0, Will there exist a high enough income such that Calvin takes the bus for any C? 10 points (d) Suppose now that the prices in the alternative market are instead px = 5 and Py 7. Suppose that the bus ticket costs 4. Does Calvin take the bus. 10 points (e) Given that the prices in the alternative market are instead px = 5 and py = 7 will there exist a high enough income such that Calvin takes the bus for any fixed ticket price C? You can argue conceptually or quantitatively. 10 points (f) Would your answer to the previous question change if instead the prices in the alternative market were pr = 7 and py = 5? 10 points 4. Suppose a delivery company uses trucks (capital) and drivers (labor) to produce de- liveries (quantity). Ted owns the firm, and Ted's friend Mary decides to give Ted 10 trucks for free for the month of April. Suppose that Mary does not want Ted to rent these trucks out to anyone else, so Ted can either use them for his deliveries or let them languish. Suppose Ted's production function exhibits complementarity, DMP, and positive MP, i.e., you can think of a standard Cobb-Douglas production function (if it helps) = Suppose that each truck costs 100 dollars to rent a month (rk 100). Ted opti- mizes over his choice of inputs given Mary's gift in April and obtains a cost function CApril (Q). Similarly in the month before without Mary's gift Ted obtains March(Q). = (a) Is CApril (Q) March(Q) - 1000 for every quantity Q? If not, why, and for which quantities will this equality not hold? 15 points (b) For each number of deliveries (Q), how will Ted's labor usage compare to the month before Mary lent the trucks? 10 points (c) Suppose that CMarch (Q) is convex (increasing marginal cost) and has no fixed cost. Compare the supply curve for Ted in April vs. March 15 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started