Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Suppose you are a financial advisor; your main job is evaluating various investment opportunities in the US Stock Exchange, and you have identified

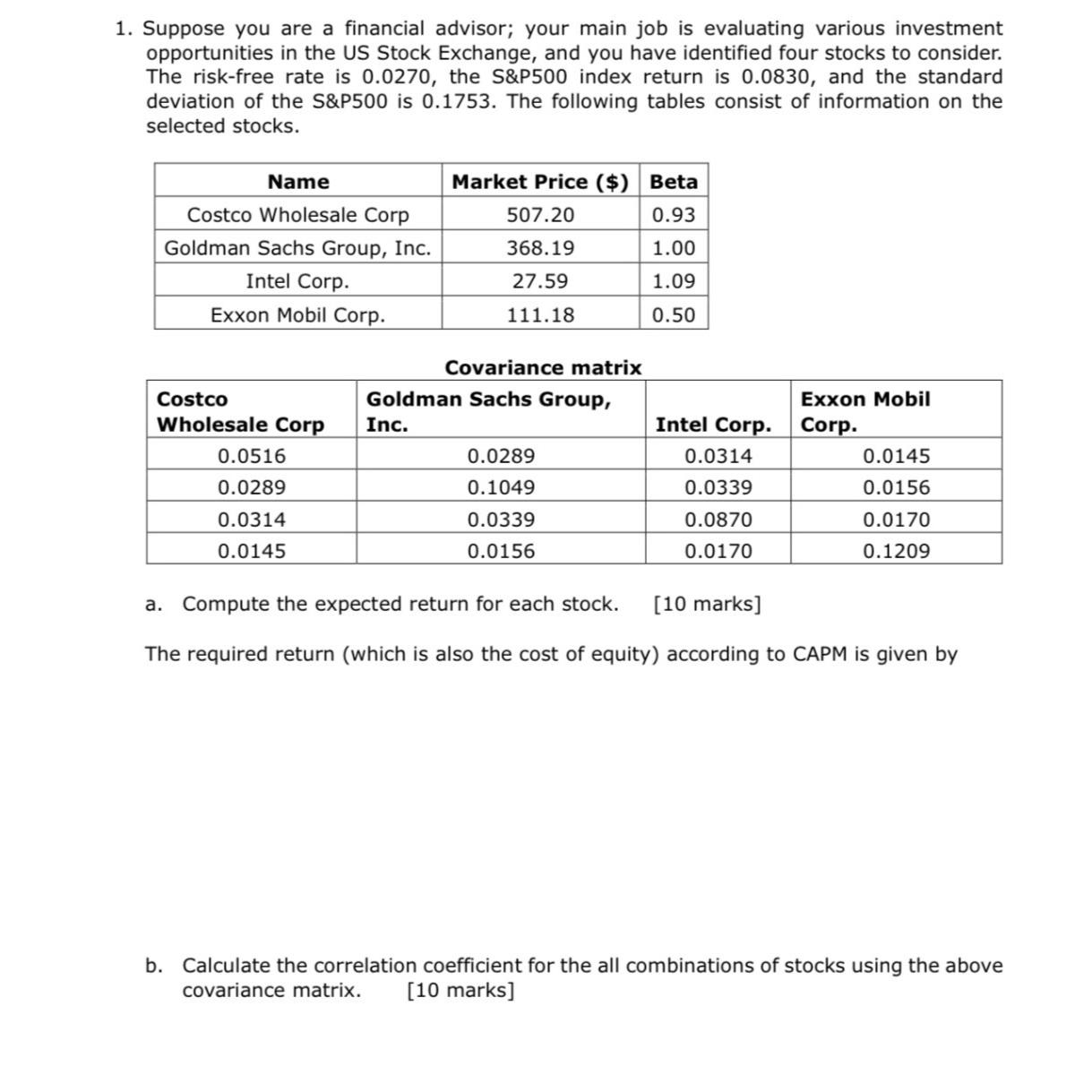

1. Suppose you are a financial advisor; your main job is evaluating various investment opportunities in the US Stock Exchange, and you have identified four stocks to consider. The risk-free rate is 0.0270, the S&P500 index return is 0.0830, and the standard deviation of the S&P500 is 0.1753. The following tables consist of information on the selected stocks. Name Costco Wholesale Corp Goldman Sachs Group, Inc. Intel Corp. Exxon Mobil Corp. Costco Wholesale Corp Inc. 0.0516 0.0289 0.0314 0.0145 Market Price ($) Beta 507.20 0.93 368.19 1.00 27.59 1.09 111.18 0.50 Covariance matrix Goldman Sachs Group, 0.0289 0.1049 0.0339 0.0156 Intel Corp. 0.0314 0.0339 0.0870 0.0170 Exxon Mobil Corp. 0.0145 0.0156 0.0170 0.1209 a. Compute the expected return for each stock. [10 marks] The required return (which is also the cost of equity) according to CAPM is given by b. Calculate the correlation coefficient for the all combinations of stocks using the above covariance matrix. [10 marks]

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Part a 1 Costco Wholesale Corp Expected return Riskfree rate Beta x Market return Riskfree rate 00270 093 x 00830 00270 00270 093 x 00560 002...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started