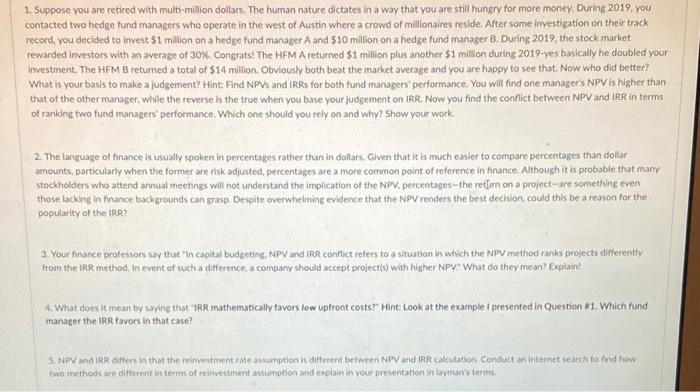

1. Suppose you are retired with multi-million dollars. The human nature dictates in a way that you are still hungry for more money. During 2019, you contacted two hedge fund managers who operate in the west of Austin where a crowd of millionaires reside. After some investigation on their track record, you decided to invest $1 million on a hedge fund manager A and $10 million on a hedge fund manager 8. During 2019, the stock market rewarded investors with an average of 30%. Congrats! The HEM A returned $1 million plus another $1 million during 2019-yes basically he doubled your investment. The HFM Bretumed a total of $14 million. Obviously both beat the market average and you are happy to see that. Now who did better? What is your basis to make a judgement? Hint Find NPVs and IRRs for both fund managers' performance. You will find one manager's NPV is higher than that of the other manager , while the reverse is the true when you base your judgement on IRR. Now you find the conflict between NPV and IRR in terms of ranking two fund managers performance. Which one should you rely on and why? Show your work 2. The language of finance is usually spoken in percentages rather than in dollars. Given that it is much easier to compare percentages than dollar amounts, particularly when the former are risk adjusted, percentages are a more common point of reference in finance. Although it is probable that many stockholders who attend annual meetings will not understand the implication of the NPV, percentages-the return on a project-are something even those lacking in finance backgrounds can grasp. Despite overwhelming evidence that the NPV renders the best deckion could this be a reason for the popularity of the IRR? 3. Your finance professors say that in capital budgeting, NPV and IRR conflict refers to a situation in which the NPV method ranks projects differently from the IRR method. In event of such a difference, a company should accept project(s) with higher NPV" What do they mean? Explaint 4. What does it mean by saying that "IRR mathematically favors low upfront costs" Hint Look at the example i presented in Question 11. Which fund manager the IRR tavors in that case? 5. NPV and IRR ditters in that the reinvestment rate assumption in different between NPV and IRR calculation Conduct an internet search to find how two methods are different in terms of reinvestment assumption and explain in your presentation in layman's terms