Question

1. Suppose you read a story in the financial section of the local newspaper that announces the proposed merger of Dell Computer and Gateway. The

1. Suppose you read a story in the financial section of the local newspaper that announces the proposed merger of Dell Computer and Gateway. The merger is expected to greatly increase the profitability of Gateway. If you should now decide to invest in Gateway stock, you can expect to earn

a. above average returns since you will get to share in the higher profits.

b. above average returns since your stock will definitely appreciate as the profits are earned.

c. a normal return since stock prices adjust to reflect change profit expectations almost immediately.

d. none of the above.

2. After the announcement of higher quarterly profits, the price of a stock falls. Such an occurrence is

a. clearly inconsistent with efficient markets theory.

b. possible if market participants expected lower profits.

c. consistent with efficient markets theory.

d. not possible.

3. Since a change in regulations permitting their existence in the mid-1970s and the explosive growth in the number of people who surf the internet, discount brokers have grown rapidly. Efficient markets theory would seem to suggest that people who use discount brokers

a. will likely earn lower returns than those who use full-service brokers.

b. will likely earn about the same as those who use full-service brokers, but will net more after brokerage commissions.

c. are going against evidence that suggests that the financial analysis provided by full-service brokers can help one outperform the overall market.

d. are likely to be poor.

4. Efficient markets theory suggests that stock prices tend to follow a "random walk." Thus the best strategy for investing in stock is

a. a "churning strategy" of buying and selling often to catch the market swings.

b. turning over your stock portfolio each month, selecting stocks by throwing darts at the stock page.

c. a "buy and hold strategy" of holding onto stocks to avoid brokerage commissions.

d. to do none of the above.

5. If expectations are formed rationally, forecast errors of expectations will on average beand thereforebe predicted ahead of time.

a. positive; can

b. positive; cannot

c. zero; cannot

d. zero; can

6. Mutual funds that outperform the market in one period are

a. highly likely to consistently outperform the market in subsequent periods due to their superior investment strategies.

b. likely to under-perform the market in subsequent periods to average the funds' returns.

c. not likely to consistently outperform the market in subsequent periods.

d. not likely to outperform the market in any subsequent periods.

7. According to the theory of efficient capital markets

a. incorrectly valued assets are quickly discovered and bought or sold until their prices are brought into line with their correct underlying value.

b. most investors will not earn excess returns from spending resources on technical market analysis.

c. the best strategy for most investors is to buy and hold a well-diversified portfolio of securities.

d. all of the above are true

8. New information may lead to an immediate change in the price of a stock because

a. the required return on this equity investment may change.

b. the expected constant growth rate in dividends may change.

c. the forecast of the future sales price of the stock may change.

d. all of the above.

e. only (a) and (c) of the above.

9. The value of a company's stock may fall when the economy enters a recession because

a. the value of expected future dividends falls.

b. the required return on equity investments falls.

c. the expected growth rate of dividends fall.

d. only (a) and (b) of the above.

e. only (a) and (c) of the above

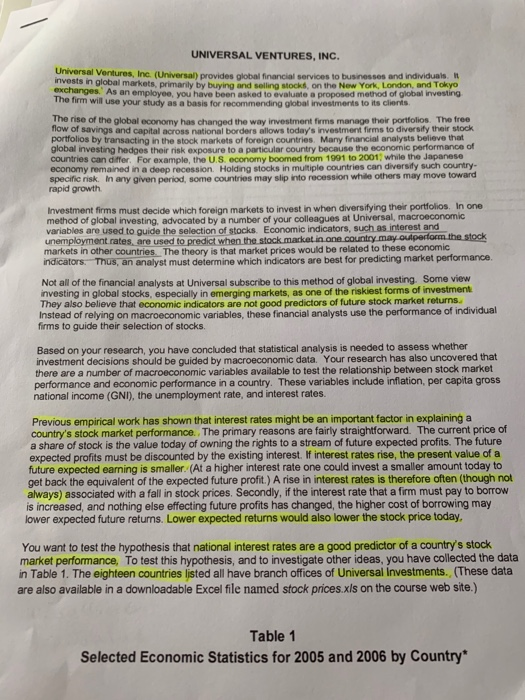

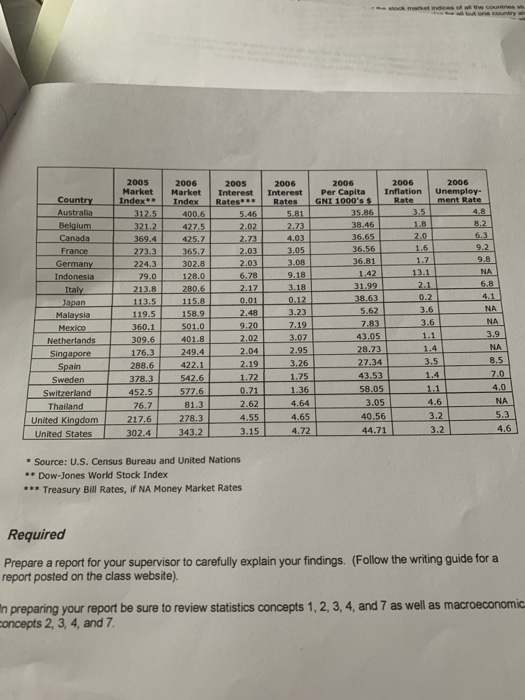

UNIVERSAL VENTURES, INC. Universal Ventures, Inc. (Universal) provides global financial services to businesses and individuals. It invests in global markets, primarily by buying and selling stocks, on the New York, London, and Tokyo exchanges. As an employee, you have been asked to evaluate a proposed method of global investing. The firm will use your study as a basis for recommending global investments to its clients. The rise of the global economy has changed the way investment firms manage their portfolios. The free flow of savings and capital across national borders allows today's investment firms to diversify their stock portfolios by transacting in the stock markets of foreign countries. Many financial analysts believe that global investing hedges their risk exposure to a particular country because the economic performance of countries can differ. For example, the U.S. economy boomed from 1991 to 2001; while the Japanese economy remained in a deep recession. Holding stocks in multiple countries can diversify such country- specific risk. In any given period, some countries may slip into recession while others may move toward rapid growth. Investment firms must decide which foreign markets to invest in when diversifying their portfolios. In one method of global investing, advocated by a number of your colleagues at Universal, macroeconomic variables are used to guide the selection of stocks. Economic indicators, such as interest and unemployment rates, are used to predict when the stock market in one country may outperform the stock markets in other countries. The theory is that market prices would be related to these economic indicators. Thus, an analyst must determine which indicators are best for predicting market performance. Not all of the financial analysts at Universal subscribe to this method of global investing. Some view investing in global stocks, especially in emerging markets, as one of the riskiest forms of investment They also believe that economic indicators are not good predictors of future stock market returns. Instead of relying on macroeconomic variables, these financial analysts use the performance of individual firms to guide their selection of stocks. Based on your research, you have concluded that statistical analysis is needed to assess whether investment decisions should be guided by macroeconomic data. Your research has also uncovered that there are a number of macroeconomic variables available to test the relationship between stock market performance and economic performance in a country. These variables include inflation, per capita gross national income (GNI), the unemployment rate, and interest rates. Previous empirical work has shown that interest rates might be an important factor in explaining a country's stock market performance.. The primary reasons are fairly straightforward. The current price of a share of stock is the value today of owning the rights to a stream of future expected profits. The future expected profits must be discounted by the existing interest. If interest rates rise, the present value of a future expected earning is smaller. (At a higher interest rate one could invest a smaller amount today to get back the equivalent of the expected future profit.) A rise in interest rates is therefore often (though not always) associated with a fall in stock prices. Secondly, if the interest rate that a firm must pay to borrow is increased, and nothing else effecting future profits has changed, the higher cost of borrowing may lower expected future returns. Lower expected returns would also lower the stock price today, You want to test the hypothesis that national interest rates are a good predictor of a country's stock market performance, To test this hypothesis, and to investigate other ideas, you have collected the data in Table 1. The eighteen countries listed all have branch offices of Universal Investments., (These data are also available in a downloadable Excel file named stock prices.xls on the course web site.) Table 1 Selected Economic Statistics for 2005 and 2006 by Country*

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions based on efficient markets theory a above average returns since you will get to share in the higher profits The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started