Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Suppose you took out a loan for $8,000 with a 7% interest rate for seven years. A. Show the year by year payments for

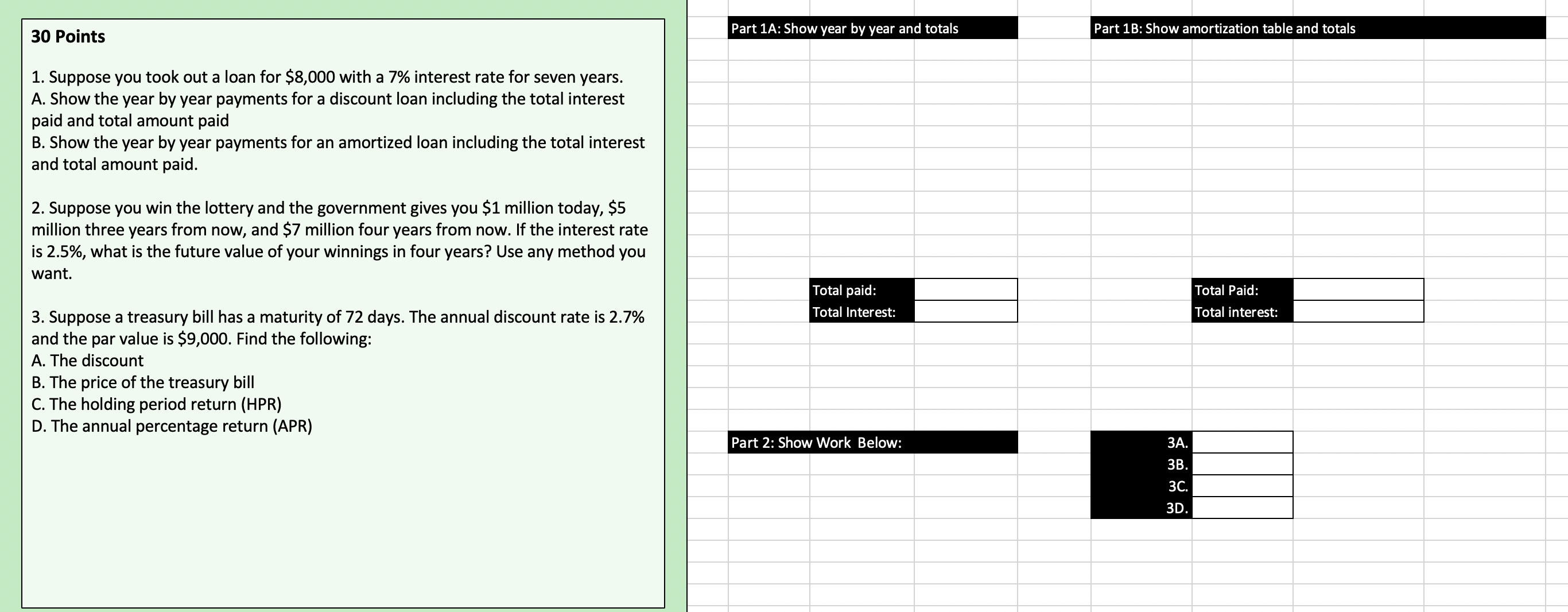

1. Suppose you took out a loan for $8,000 with a 7% interest rate for seven years. A. Show the year by year payments for a discount loan including the total interest paid and total amount paid B. Show the year by year payments for an amortized loan including the total interest and total amount paid. 2. Suppose you win the lottery and the government gives you $1 million today, $5 million three years from now, and $7 million four years from now. If the interest rate is 2.5%, what is the future value of your winnings in four years? Use any method you want. 3. Suppose a treasury bill has a maturity of 72 days. The annual discount rate is 2.7% and the par value is $9,000. Find the following: A. The discount B. The price of the treasury bill C. The holding period return (HPR) D. The annual percentage return (APR)

1. Suppose you took out a loan for $8,000 with a 7% interest rate for seven years. A. Show the year by year payments for a discount loan including the total interest paid and total amount paid B. Show the year by year payments for an amortized loan including the total interest and total amount paid. 2. Suppose you win the lottery and the government gives you $1 million today, $5 million three years from now, and $7 million four years from now. If the interest rate is 2.5%, what is the future value of your winnings in four years? Use any method you want. 3. Suppose a treasury bill has a maturity of 72 days. The annual discount rate is 2.7% and the par value is $9,000. Find the following: A. The discount B. The price of the treasury bill C. The holding period return (HPR) D. The annual percentage return (APR) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started