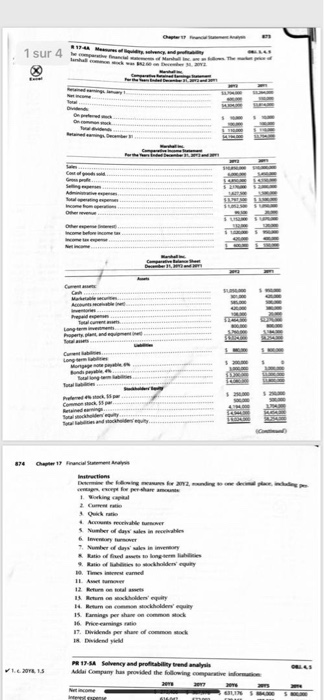

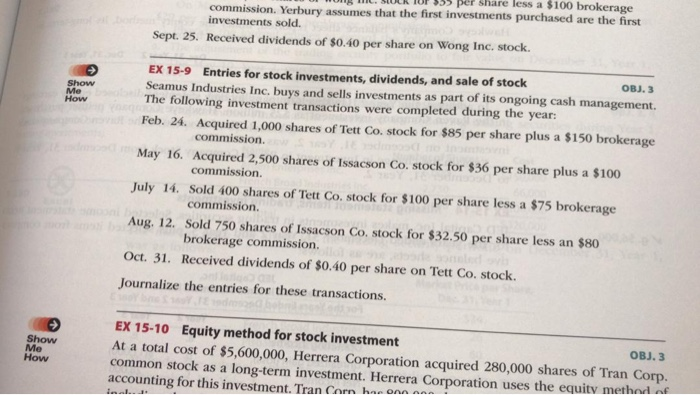

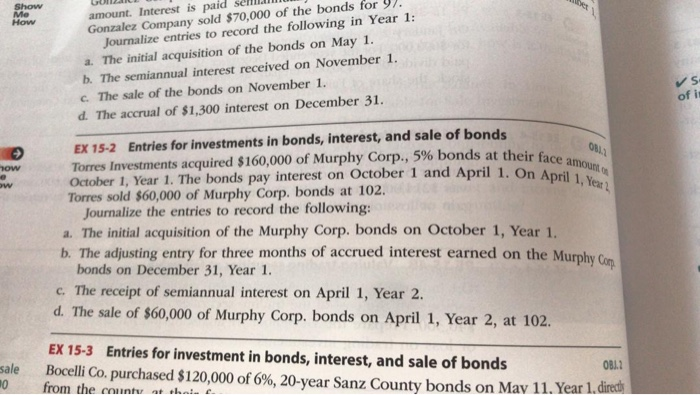

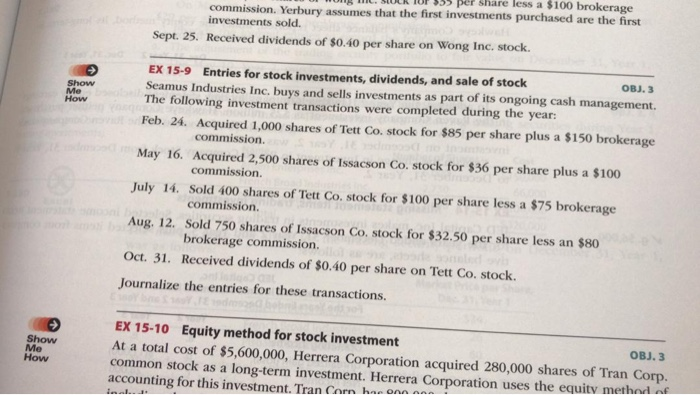

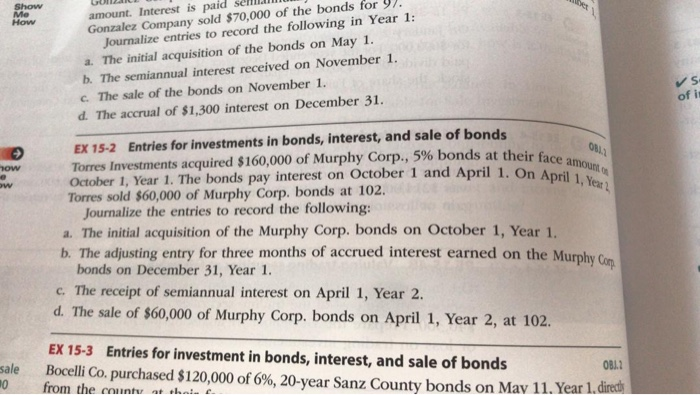

1 sur 4 874 Ch 17 Financial Sta r & Refund to go IL A 13. Return owockholde equity 14. Resumen ockholdene 15. Earning per share on C o ck 16 Preaming 17. Dividende por share of common seck 18. Dividend yield PR 12-A Sorency and profitability trend analysis A Company has provided the following compartiendo commission. Yerbury assumes that the first investments purchased are the first investments sold. Sept. 25. Received dividends of $0.40 per share on Wong Inc, stock. Show How EX 15-9 Entries for stock investments, dividends, and sale of stock OBJ. 3 Seamus Industries Inc. buys and sells investments as part of its ongoing cash management. The following investment transactions were completed during the year: Feb. 24. Acquired 1,000 shares of Tett Co, stock for $85 per share plus a $150 brokerage commission May 16. Acquired 2,500 shares of Issacson Co. stock for $36 per share plus a $100 commission July 14. Sold 400 shares of Tett Co, stock for $100 per share less a $75 brokerage commission. Aug, 12. Sold 750 shares of Issacson Co, stock for $32.50 per share less an $80 brokerage commission. Oct. 31. Received dividends of $0.40 per share on Tett Co, stock. Journalize the entries for these transactions. Show Me How EX 15-10 Equity method for stock investment OBJ. 3 At a total cost of $5,600,000, Herrera Corporation acquired 280,000 shares of Tran Corp. common stock as a long-term investment. Herrera Corporation uses the equity method accounting for this investment. Tran Sarn hoe on AR- GUMAC Show Me How amount. Interest is paid sch Gonzalez Company sold $70,000 of the bonds for Y). Journalize entries to record the following in Year 1: a. The initial acquisition of the bonds on May 1. b. The semiannual interest received on November 1. c. The sale of the bonds on November 1. d. The accrual of $1,300 interest on December 31. S of it their face amount 1. On April 1, Year 2 how EX 15-2 Entries for investments in bonds, interest, and sale of bonds Torres Investments acquired $160,000 of Murphy Corp., 5% bonds at their fac October 1, Year 1. The bonds pay interest on October 1 and April 1. On April Torres sold $60,000 of Murphy Corp. bonds at 102. Journalize the entries to record the following: a. The initial acquisition of the Murphy Corp. bonds on October 1, Year 1. b. The adjusting entry for three months of accrued interest earned on the Murphy bonds on December 31, Year 1. c. The receipt of semiannual interest on April 1, Year 2. d. The sale of $60,000 of Murphy Corp. bonds on April 1, Year 2, at 102. sale 10 EX 15-3 Entries for investment in bonds, interest, and sale of bonds OBJ. 2 Bocelli Co. purchased $120,000 of 6%, 20-year Sanz County bonds on May 11. Year 1.direa from the count at the