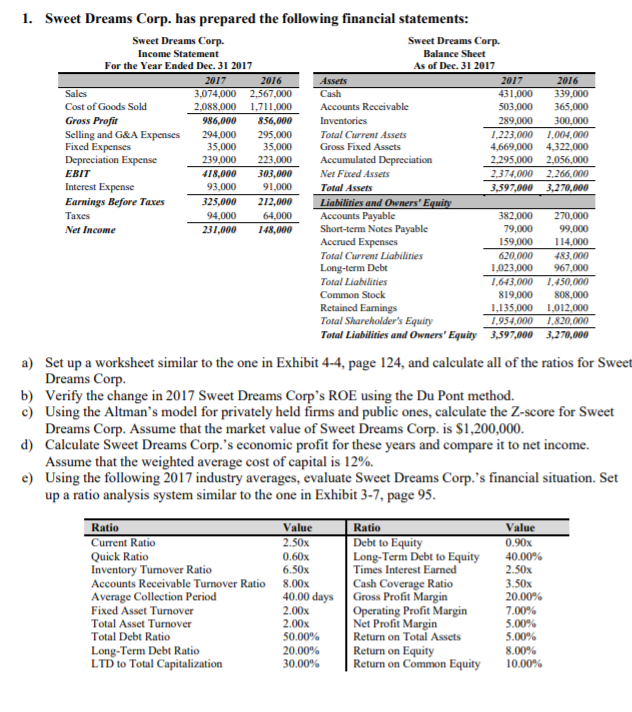

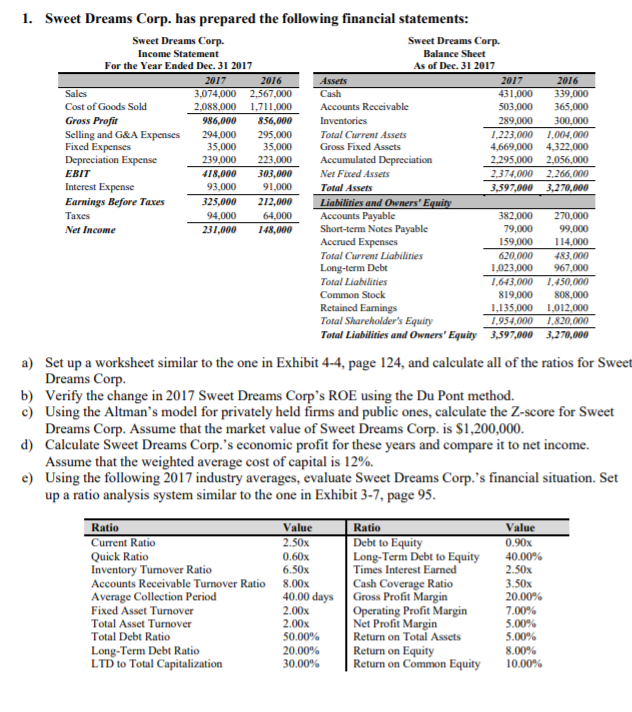

1. Sweet Dreams Corp. has prepared the following financial statements: Sweet Dreams Corp. Income Statement For the Year Ended Dec. 31 2017 Sweet Dreams Corp. Balance Sheet As of Dec. 31 2017 2017 2016 2017 2016 3,074,000 2,567,000 2,088,000 1,711,000 986,000 56,000 295,000 35,000 35,000 Cash Accounts Receivable Cost of Goods Sold Gross Profit Selling and G&A Expenses Fixed Expenses Depreciation Expense EBIT Interest Expense Earnings Before Taxes Taxes Net Income 31,000 339,000 03,000 365,000 289,000 300,000 1,223,000 1,004,000 4,669,000 4.322,000 2,295,000 2056,000 2.374,000 2,266,000 3,597,000 3,270,000 294,000 Total Current Assets Gross Fixed Assets 239,000 223.000 Accumulated Depreciation Net Fixed Assets Total Assets 418,000 303,000 93,000 91.000 325,000 212,000 64,000 and Ow 94,000 231,000 148,000 Short-term Notes Payable 382,000 270,000 99,000 159,000 14,000 620,000 483,000 1,023,000 967,000 1,643,000 1450,000 819,000 808,000 1,135,000 1,012,000 1954,000 1,820,000 Total Liabilities and Owners' Equiry 3,597,000 3,270,000 79,000 Accrued Expenses Total Current Liabilities Total Liabilities Retained Earnings Total Shareholder's Equity a) Set up a worksheet similar to the one in Exhibit 4-4, page 124, and calculate all of the ratios for Sweet Dreams Corp Verify the change in 2017 Sweet Dreams Corp's ROE using the Du Pont method. b) c) Using the Altman's model for privately held firms and public ones, calculate the Z-score for Sweet d) Calculate Sweet Dreams Corp.'s economic profit for these years and compare it to net income. e Using the following 2017 industry averages, evaluate Sweet Dreams Corp.'s financial situation. Set Dreams Corp. Assume that the market value of Sweet Dreams Corp. is $1,200,000 Assume that the weighted average cost of capital is 12%. up a ratio analysis system similar to the one in Exhibit 3-7, page 95 Ratio Current Ratio Quick Ratio Inventory Tumover Ratio Accounts Receivable Turnover Ratio Average Collection Period Fixed Asset Turnover Total Asset Turnover Total Debt Ratio Long-Term Debt Ratio LTD to Total Capitalization 2.50x 0.60x 6.50x 8.00x 0.00 daysGross Profit Margin 2.00x Ratio Debt to Equity Long-Term Debt to Equity Times Interest Earned Cash Coverage Ratio 0.90x 40.00% 2.50x 20.00% 7.00% 5.00% 5.00% 8.00% 10.00% Operating Profit Margin Net Profit Margin Return on Total Assets 50.00% 20.00% 30.00% Return on Common Equity