Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Tata company has a European call and European put option on the stock XYZ. Today, the stock is trading at $41. The put

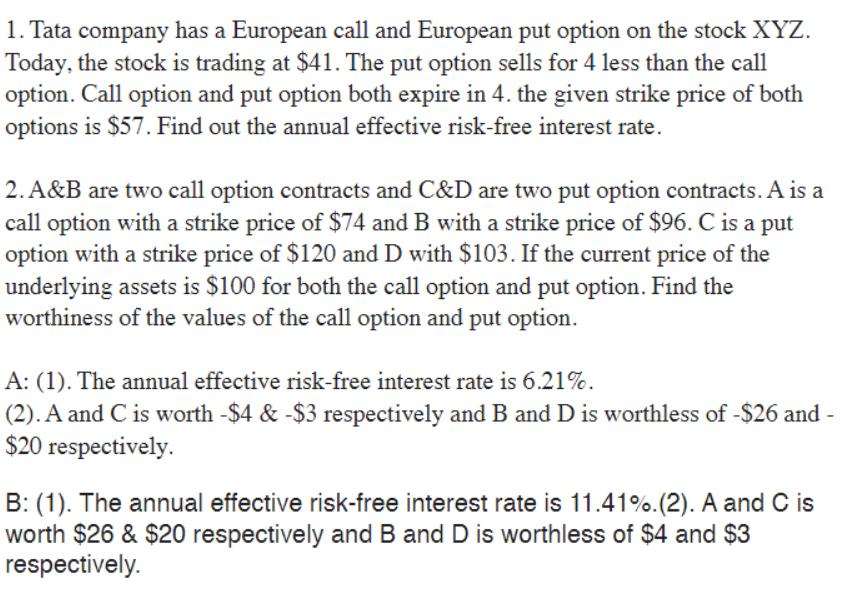

1. Tata company has a European call and European put option on the stock XYZ. Today, the stock is trading at $41. The put option sells for 4 less than the call option. Call option and put option both expire in 4. the given strike price of both options is $57. Find out the annual effective risk-free interest rate. 2. A&B are two call option contracts and C&D are two put option contracts. A is a call option with a strike price of $74 and B with a strike price of $96. C is a put option with a strike price of $120 and D with $103. If the current price of the underlying assets is $100 for both the call option and put option. Find the worthiness of the values of the call option and put option. A: (1). The annual effective risk-free interest rate is 6.21%. (2). A and C is worth -$4 & -$3 respectively and B and D is worthless of -$26 and - $20 respectively. B: (1). The annual effective risk-free interest rate is 11.41%. (2). A and C is worth $26 & $20 respectively and B and D is worthless of $4 and $3 respectively.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Both scenarios A and B provide potential answers but only one can be correct Lets analyze each part to determine the most likely answer Part 1 Tata Companys Options CallPut Parity The informati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started