Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Terps Cookies has been experiencing dramatic growth. It had sales of $15,000 in 2014 and $18,000 in 2015. Sales are projected to grow

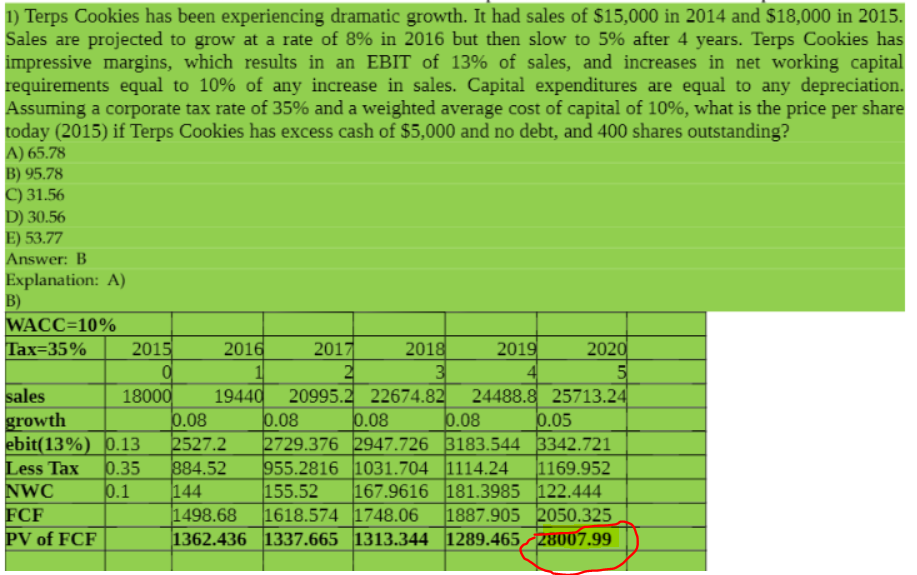

1) Terps Cookies has been experiencing dramatic growth. It had sales of $15,000 in 2014 and $18,000 in 2015. Sales are projected to grow at a rate of 8% in 2016 but then slow to 5% after 4 years. Terps Cookies has impressive margins, which results in an EBIT of 13% of sales, and increases in net working capital requirements equal to 10% of any increase in sales. Capital expenditures are equal to any depreciation. Assuming a corporate tax rate of 35% and a weighted average cost of capital of 10%, what is the price per share today (2015) if Terps Cookies has excess cash of $5,000 and no debt, and 400 shares outstanding? A) 65.78 B) 95.78 C) 31.56 D) 30.56 E) 53.77 Answer: B Explanation: A) B) WACC=10% Tax=35% 2015 0 18000 sales growth ebit(13%) 0.13 Less Tax 0.35 NWC 0.1 FCF PV of FCF 0.08 2527.2 884.52 144 2016 1 19440 20995.2 2017 2 2018 2019 2020 5 3 4 22674.82 24488.8 25713.24 0.05 3342.721 1031.704 1114.24 1169.952 167.9616 181.3985 122.444 1618.574 1748.06 1887.905 2050.325 1337.665 1313.344 1289.465 28007.99 1498.68 1362.436 0.08 0.08 0.08 2729.376 2947.726 3183.544 955.2816 155.52

Step by Step Solution

★★★★★

3.29 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the price per share today 2015 we need to find the present value of all future cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started