Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Tex Turner Telecommunications Company needs to raise $1.8 billion (face value) of debt funds over the next two years. If it were to use

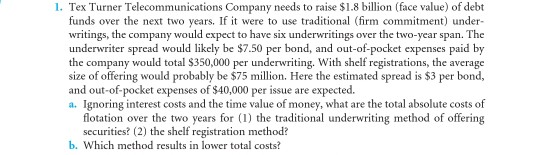

1. Tex Turner Telecommunications Company needs to raise $1.8 billion (face value) of debt funds over the next two years. If it were to use traditional (firm commitment) under writings, the company would expect to have six underwritings over the two-year span. The underwriter spread would likely be $7.50 per bond, and out-of-pocket expenses paid by the company would total $350,000 per underwriting. With shelf registrations, the average size of offering would probably be $75 million. Here the estimated spread is $3 per bond, and out-of-pocket expenses of $40,000 per issue are expected. a. Ignoring interest costs and the time value of money, what are the total absolute costs of flotation over the two years for (1) the traditional underwriting method of offering securities? (2) the shelf registration method? b. Which method results in lower total costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started