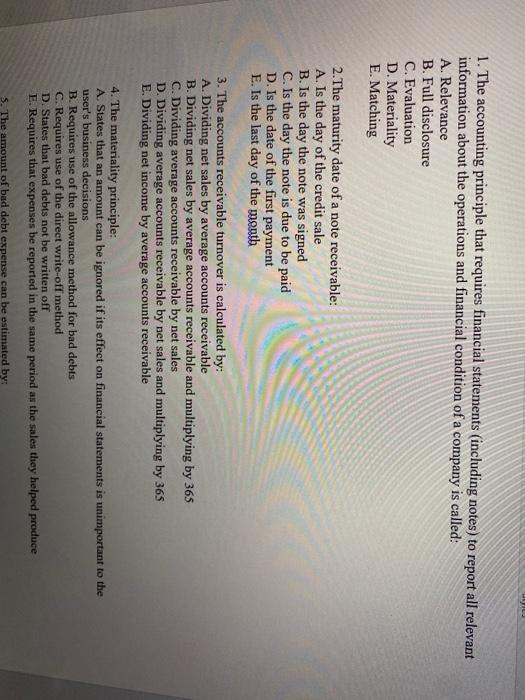

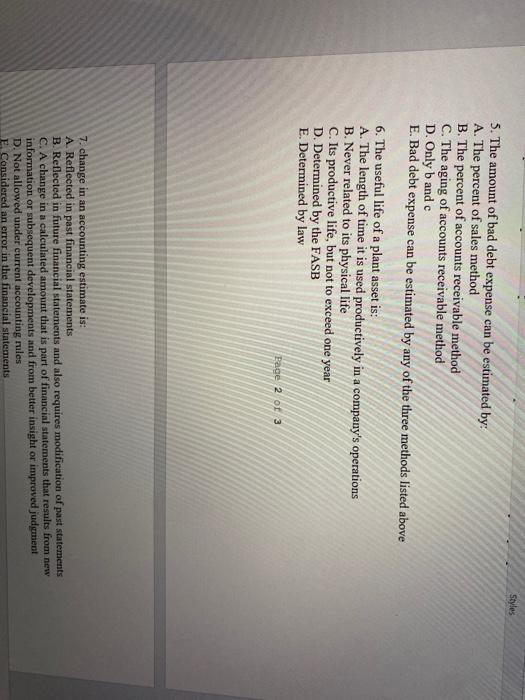

1. The accounting principle that requires financial statements (including notes) to report all relevant information about the operations and financial condition of a company is called: A. Relevance B. Full disclosure C. Evaluation D. Materiality E. Matching 2.The maturity date of a note receivable: A. Is the day of the credit sale B. Is the day the note was signed C. Is the day the note is due to be paid D. Is the date of the first payment E. Is the last day of the month 3. The accounts receivable turnover is calculated by: A. Dividing net sales by average accounts receivable B. Dividing net sales by average accounts receivable and multiplying by 365 C. Dividing average accounts receivable by net sales D. Dividing average accounts receivable by net sales and multiplying by 365 E. Dividing net income by average accounts receivable 4. The materiality principle: A. States that an amount can be ignored if its effect on financial statements is unimportant to the user's business decisions B. Requires use of the allowance method for bad debts C. Requires use of the direct write-off method D. States that bad debts not be written off E. Requires that expenses be reported in the same period as the sales they helped produce 5. The amount of bad debt expense can be estimated by: Styles 5. The amount of bad debt expense can be estimated by: A. The percent of sales method B. The percent of accounts receivable method C. The aging of accounts receivable method D. Only b and c E. Bad debt expense can be estimated by any of the three methods listed above 6. The useful life of a plant asset is: A. The length of time it is used productively in a company's operations B. Never related to its physical life C. Its productive life, but not to exceed one year D. Determined by the FASB E. Determined by law Page 2 of 3 7. change in an accounting estimate is: A. Reflected in past financial statements B. Reflected in future financial statements and also requires modification of past statements C. A change in a calculated amount that is part of financial statements that results from new information or subsequent developments and from better insight or improved judgment D. Not allowed under current accounting rules E Considered an error in the financial statements