Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 31 March 2019 Theresa's trial balance did not balance and the difference was posted to a suspense account. She identified the following errors

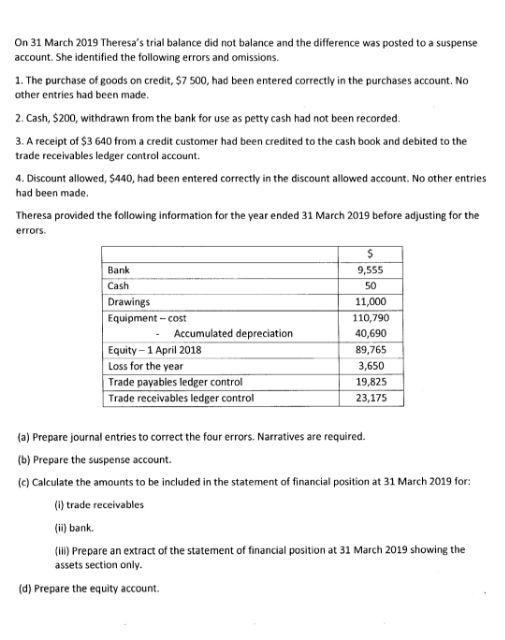

On 31 March 2019 Theresa's trial balance did not balance and the difference was posted to a suspense account. She identified the following errors and omissions. 1. The purchase of goods on credit, $7 500, had been entered correctly in the purchases account. No other entries had been made. 2. Cash, $200, withdrawn from the bank for use as petty cash had not been recorded. 3. A receipt of $3 640 from a credit customer had been credited to the cash book and debited to the trade receivables ledger control account. 4. Discount allowed, $440, had been entered correctly in the discount allowed account. No other entries had been made. Theresa provided the following information for the year ended 31 March 2019 before adjusting for the errors. Bank Cash Drawings Equipment -cost Accumulated depreciation Equity-1 April 2018 Loss for the year Trade payables ledger control Trade receivables ledger control $ 9,555 50 11,000 110,790 40,690 89,765 3,650 19,825 23,175 (a) Prepare journal entries to correct the four errors. Narratives are required. (b) Prepare the suspense account. (c) Calculate the amounts to be included in the statement of financial position at 31 March 2019 for: (i) trade receivables (ii) bank. (II) Prepare an extract of the statement of financial position at 31 March 2019 showing the assets section only. (d) Prepare the equity account.

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Calculation of Average Profit Average Profit 54000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started