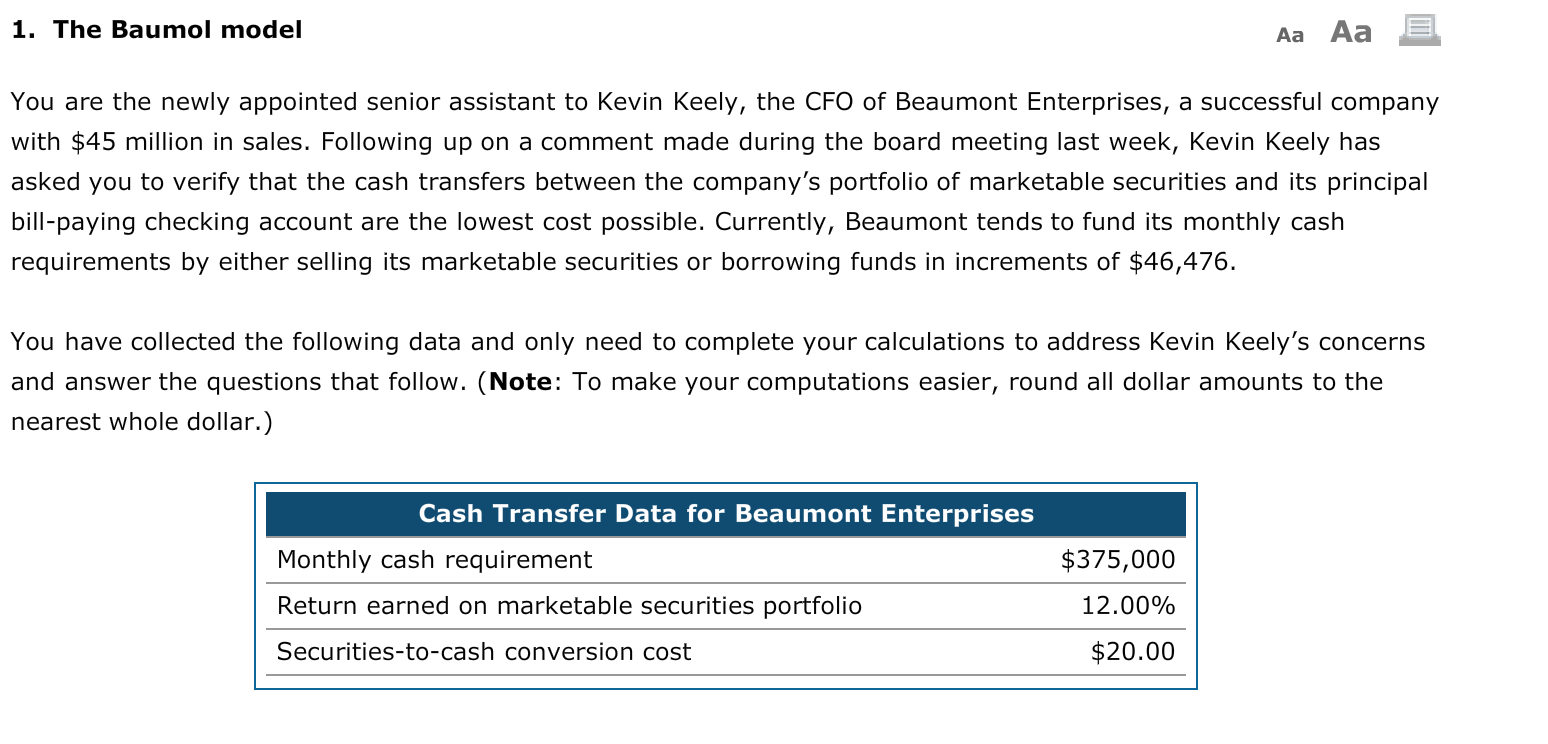

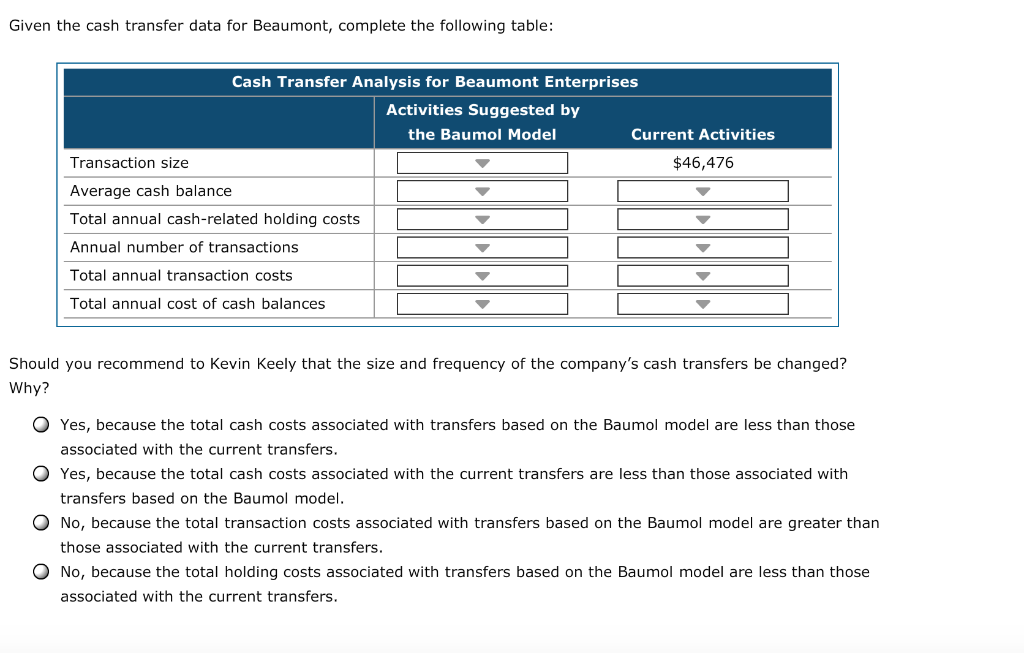

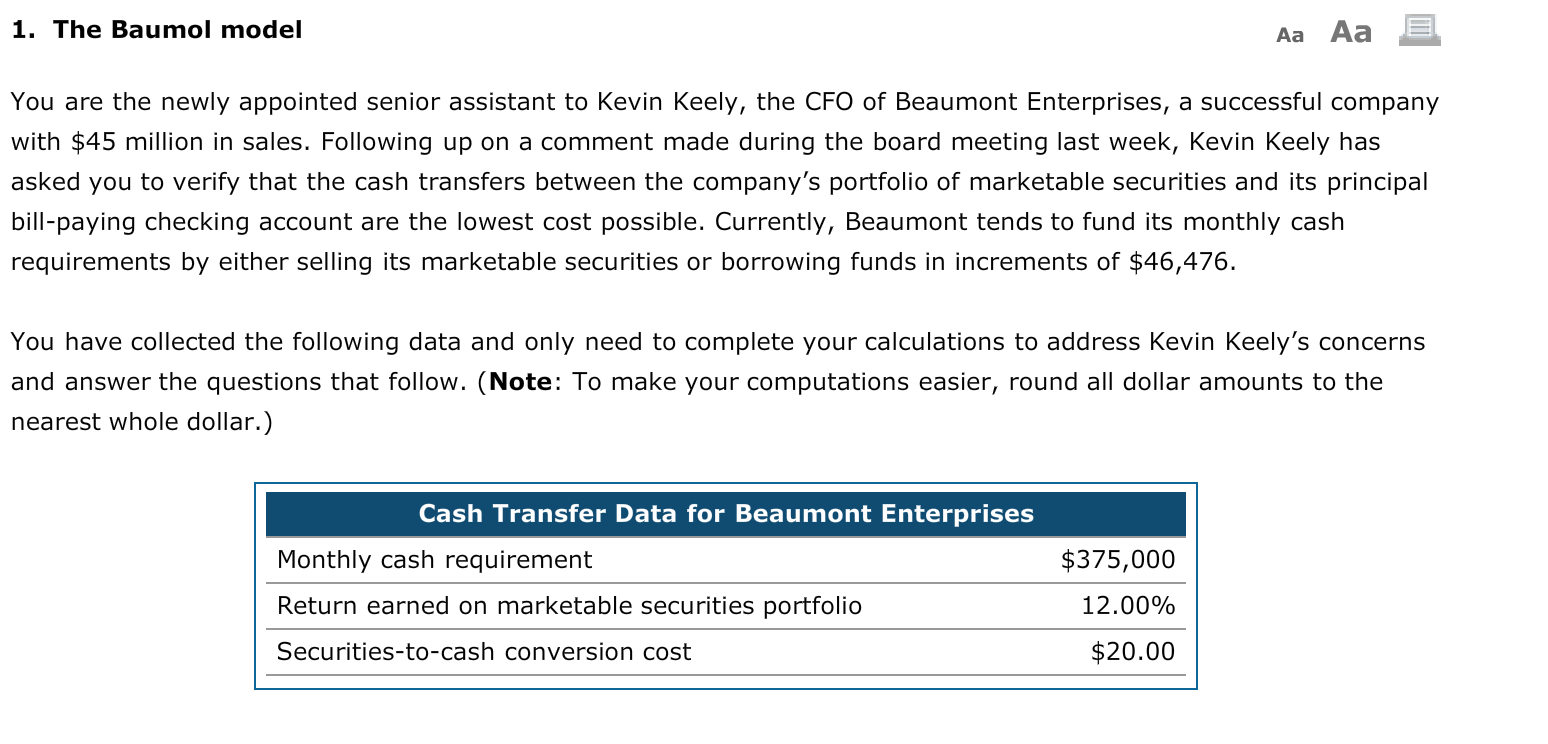

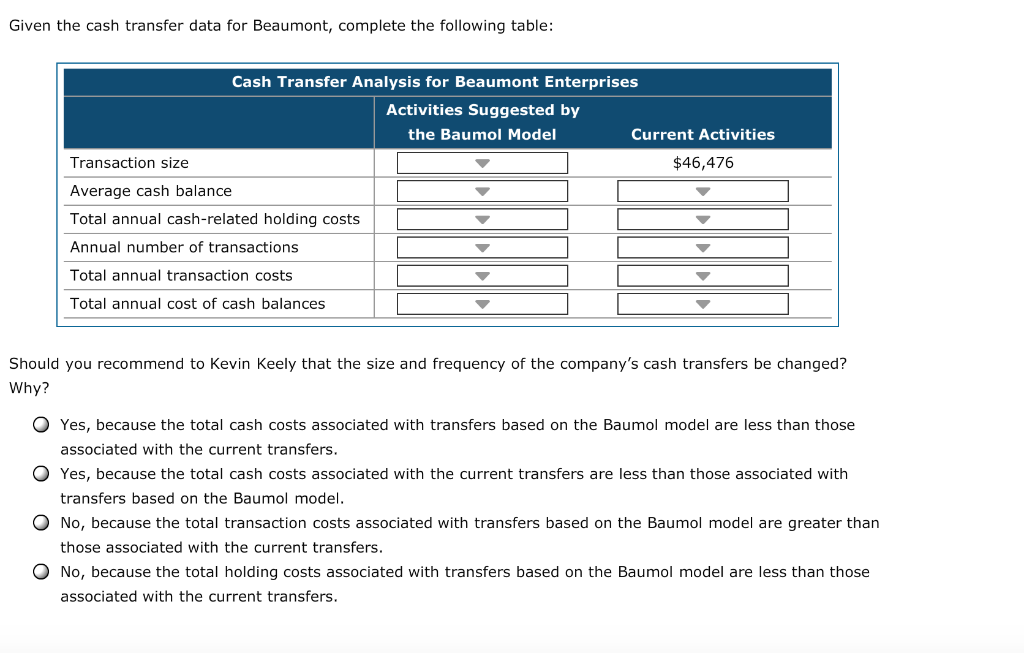

1. The Baumol model Aa Aa E You are the newly appointed senior assistant to Kevin Keely, the CFO of Beaumont Enterprises, a successful company with $45 million in sales. Following up on a comment made during the board meeting last week, Kevin Keely has asked you to verify that the cash transfers between the company's portfolio of marketable securities and its principal bill-paying checking account are the lowest cost possible. Currently, Beaumont tends to fund its monthly cash requirements by either selling its marketable securities or borrowing funds in increments of $46,476. You have collected the following data and only need to complete your calculations to address Kevin Keely's concerns and answer the questions that follow. (Note: To make your computations easier, round all dollar amounts to the nearest whole dollar.) Cash Transfer Data for Beaumont Enterprises Monthly cash requirement Return earned on marketable securities portfolio $375,000 12.00% $20.00 Securities-to-cash conversion cost Given the cash transfer data for Beaumont, complete the following table: Cash Transfer Analysis for Beaumont Enterprises Activities Suggested by the Baumol Model Current Activities Transaction size $46,476 Average cash balance Total annual cash-related holding costs Annual number of transactions Total annual transaction costs Total annual cost of cash balances Should you recommend to Kevin Keely that the size and frequency of the company's cash transfers be changed? Why? Yes, because the total cash costs associated with transfers based on the Baumol model are less than those associated with the current transfers. Yes, because the total cash costs associated with the current transfers are less than those associated with transfers based on the Baumol model. O No, because the total transaction costs associated with transfers based on the Baumol model are greater than those associated with the current transfers. No, because the total holding costs associated with transfers based on the Baumol model are less than those associated with the current transfers. 1. The Baumol model Aa Aa E You are the newly appointed senior assistant to Kevin Keely, the CFO of Beaumont Enterprises, a successful company with $45 million in sales. Following up on a comment made during the board meeting last week, Kevin Keely has asked you to verify that the cash transfers between the company's portfolio of marketable securities and its principal bill-paying checking account are the lowest cost possible. Currently, Beaumont tends to fund its monthly cash requirements by either selling its marketable securities or borrowing funds in increments of $46,476. You have collected the following data and only need to complete your calculations to address Kevin Keely's concerns and answer the questions that follow. (Note: To make your computations easier, round all dollar amounts to the nearest whole dollar.) Cash Transfer Data for Beaumont Enterprises Monthly cash requirement Return earned on marketable securities portfolio $375,000 12.00% $20.00 Securities-to-cash conversion cost Given the cash transfer data for Beaumont, complete the following table: Cash Transfer Analysis for Beaumont Enterprises Activities Suggested by the Baumol Model Current Activities Transaction size $46,476 Average cash balance Total annual cash-related holding costs Annual number of transactions Total annual transaction costs Total annual cost of cash balances Should you recommend to Kevin Keely that the size and frequency of the company's cash transfers be changed? Why? Yes, because the total cash costs associated with transfers based on the Baumol model are less than those associated with the current transfers. Yes, because the total cash costs associated with the current transfers are less than those associated with transfers based on the Baumol model. O No, because the total transaction costs associated with transfers based on the Baumol model are greater than those associated with the current transfers. No, because the total holding costs associated with transfers based on the Baumol model are less than those associated with the current transfers