Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. The Beyes plan to purchase a house for $285,000. They will pay 20% down, and finance the remainder for 30 years at 6.9% interest

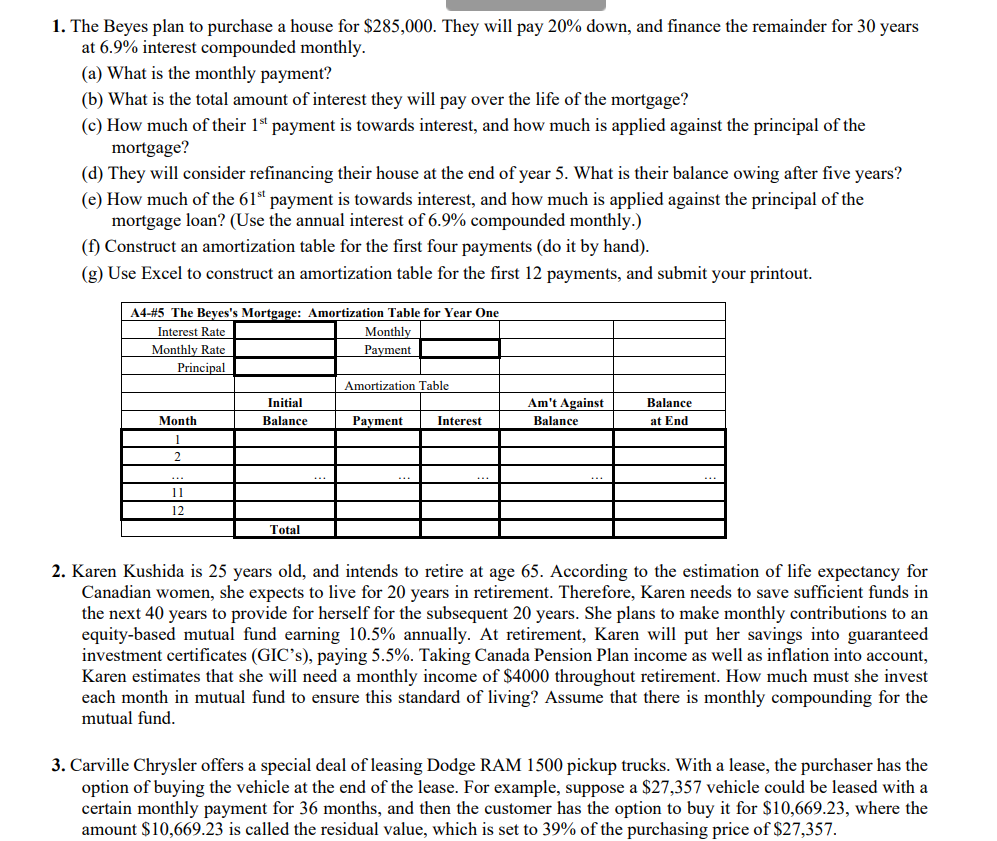

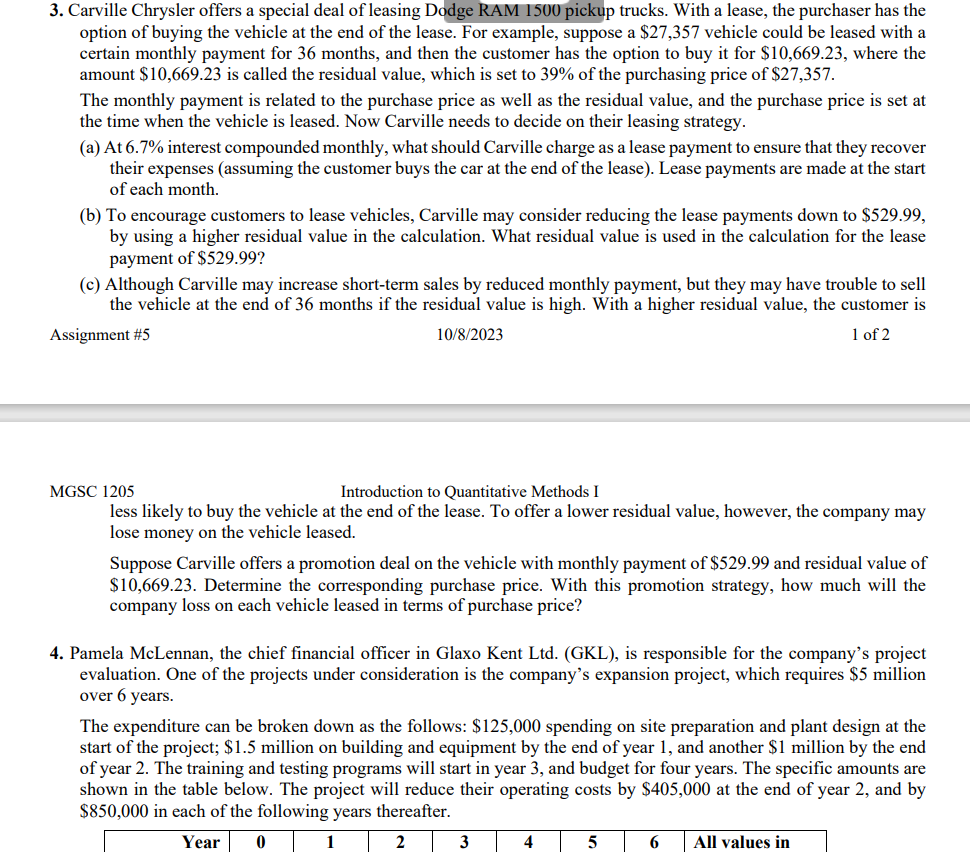

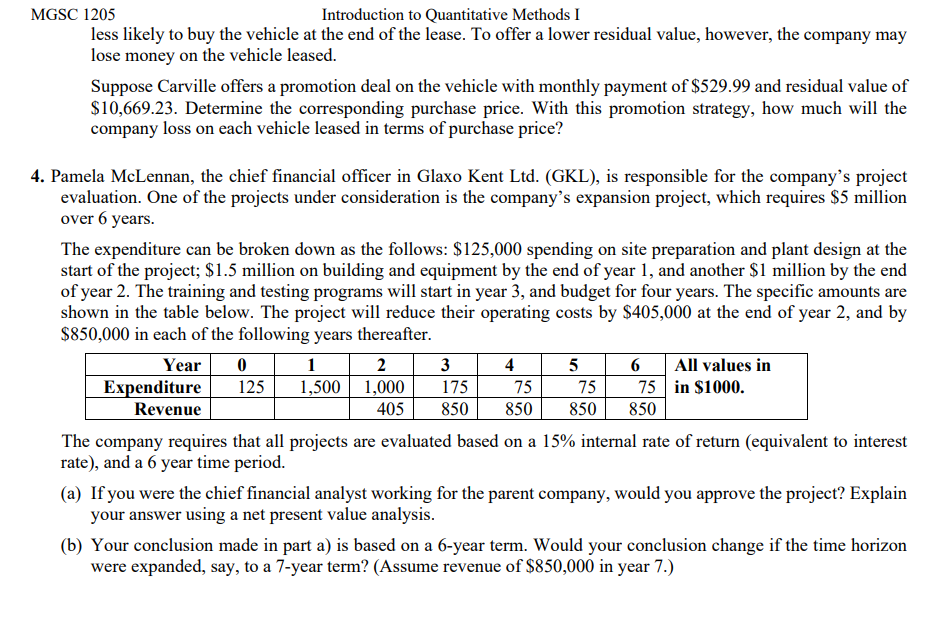

1. The Beyes plan to purchase a house for $285,000. They will pay 20% down, and finance the remainder for 30 years at 6.9% interest compounded monthly. (a) What is the monthly payment? (b) What is the total amount of interest they will pay over the life of the mortgage? (c) How much of their 1st payment is towards interest, and how much is applied against the principal of the mortgage? (d) They will consider refinancing their house at the end of year 5. What is their balance owing after five years? (e) How much of the 61st payment is towards interest, and how much is applied against the principal of the mortgage loan? (Use the annual interest of 6.9% compounded monthly.) (f) Construct an amortization table for the first four payments (do it by hand). (g) Use Excel to construct an amortization table for the first 12 payments, and submit your printout. 2. Karen Kushida is 25 years old, and intends to retire at age 65 . According to the estimation of life expectancy for Canadian women, she expects to live for 20 years in retirement. Therefore, Karen needs to save sufficient funds in the next 40 years to provide for herself for the subsequent 20 years. She plans to make monthly contributions to an equity-based mutual fund earning 10.5\% annually. At retirement, Karen will put her savings into guaranteed investment certificates (GIC's), paying 5.5\%. Taking Canada Pension Plan income as well as inflation into account, Karen estimates that she will need a monthly income of $4000 throughout retirement. How much must she invest each month in mutual fund to ensure this standard of living? Assume that there is monthly compounding for the mutual fund. 3. Carville Chrysler offers a special deal of leasing Dodge RAM 1500 pickup trucks. With a lease, the purchaser has the option of buying the vehicle at the end of the lease. For example, suppose a $27,357 vehicle could be leased with a certain monthly payment for 36 months, and then the customer has the option to buy it for $10,669.23, where the amount $10,669.23 is called the residual value, which is set to 39% of the purchasing price of $27,357. 3. Carville Chrysler offers a special deal of leasing Dodge RAM 1500 pickup trucks. With a lease, the purchaser has the option of buying the vehicle at the end of the lease. For example, suppose a $27,357 vehicle could be leased with a certain monthly payment for 36 months, and then the customer has the option to buy it for $10,669.23, where the amount $10,669.23 is called the residual value, which is set to 39% of the purchasing price of $27,357. The monthly payment is related to the purchase price as well as the residual value, and the purchase price is set at the time when the vehicle is leased. Now Carville needs to decide on their leasing strategy. (a) At 6.7% interest compounded monthly, what should Carville charge as a lease payment to ensure that they recover their expenses (assuming the customer buys the car at the end of the lease). Lease payments are made at the start of each month. (b) To encourage customers to lease vehicles, Carville may consider reducing the lease payments down to $529.99, by using a higher residual value in the calculation. What residual value is used in the calculation for the lease payment of $529.99 ? (c) Although Carville may increase short-term sales by reduced monthly payment, but they may have trouble to sell the vehicle at the end of 36 months if the residual value is high. With a higher residual value, the customer is Assignment \#5 10/8/2023 1 of 2 MGSC 1205 Introduction to Quantitative Methods I less likely to buy the vehicle at the end of the lease. To offer a lower residual value, however, the company may lose money on the vehicle leased. Suppose Carville offers a promotion deal on the vehicle with monthly payment of $529.99 and residual value of $10,669.23. Determine the corresponding purchase price. With this promotion strategy, how much will the company loss on each vehicle leased in terms of purchase price? 4. Pamela McLennan, the chief financial officer in Glaxo Kent Ltd. (GKL), is responsible for the company's project evaluation. One of the projects under consideration is the company's expansion project, which requires $5 million over 6 years. The expenditure can be broken down as the follows: $125,000 spending on site preparation and plant design at the start of the project; $1.5 million on building and equipment by the end of year 1 , and another $1 million by the end of year 2. The training and testing programs will start in year 3, and budget for four years. The specific amounts are shown in the table below. The project will reduce their operating costs by $405,000 at the end of year 2 , and by $850,000 in each of the following years thereafter. MGSC 1205 Introduction to Quantitative Methods I less likely to buy the vehicle at the end of the lease. To offer a lower residual value, however, the company may lose money on the vehicle leased. Suppose Carville offers a promotion deal on the vehicle with monthly payment of $529.99 and residual value of $10,669.23. Determine the corresponding purchase price. With this promotion strategy, how much will the company loss on each vehicle leased in terms of purchase price? 4. Pamela McLennan, the chief financial officer in Glaxo Kent Ltd. (GKL), is responsible for the company's project evaluation. One of the projects under consideration is the company's expansion project, which requires $5 million over 6 years. The expenditure can be broken down as the follows: $125,000 spending on site preparation and plant design at the start of the project; $1.5 million on building and equipment by the end of year 1 , and another $1 million by the end of year 2. The training and testing programs will start in year 3, and budget for four years. The specific amounts are shown in the table below. The project will reduce their operating costs by $405,000 at the end of year 2 , and by $850,000 in each of the following years thereafter. The company requires that all projects are evaluated based on a 15% internal rate of return (equivalent to interest rate), and a 6 year time period. (a) If you were the chief financial analyst working for the parent company, would you approve the project? Explain your answer using a net present value analysis. (b) Your conclusion made in part a) is based on a 6-year term. Would your conclusion change if the time horizon were expanded, say, to a 7-year term? (Assume revenue of $850,000 in year 7.)

1. The Beyes plan to purchase a house for $285,000. They will pay 20% down, and finance the remainder for 30 years at 6.9% interest compounded monthly. (a) What is the monthly payment? (b) What is the total amount of interest they will pay over the life of the mortgage? (c) How much of their 1st payment is towards interest, and how much is applied against the principal of the mortgage? (d) They will consider refinancing their house at the end of year 5. What is their balance owing after five years? (e) How much of the 61st payment is towards interest, and how much is applied against the principal of the mortgage loan? (Use the annual interest of 6.9% compounded monthly.) (f) Construct an amortization table for the first four payments (do it by hand). (g) Use Excel to construct an amortization table for the first 12 payments, and submit your printout. 2. Karen Kushida is 25 years old, and intends to retire at age 65 . According to the estimation of life expectancy for Canadian women, she expects to live for 20 years in retirement. Therefore, Karen needs to save sufficient funds in the next 40 years to provide for herself for the subsequent 20 years. She plans to make monthly contributions to an equity-based mutual fund earning 10.5\% annually. At retirement, Karen will put her savings into guaranteed investment certificates (GIC's), paying 5.5\%. Taking Canada Pension Plan income as well as inflation into account, Karen estimates that she will need a monthly income of $4000 throughout retirement. How much must she invest each month in mutual fund to ensure this standard of living? Assume that there is monthly compounding for the mutual fund. 3. Carville Chrysler offers a special deal of leasing Dodge RAM 1500 pickup trucks. With a lease, the purchaser has the option of buying the vehicle at the end of the lease. For example, suppose a $27,357 vehicle could be leased with a certain monthly payment for 36 months, and then the customer has the option to buy it for $10,669.23, where the amount $10,669.23 is called the residual value, which is set to 39% of the purchasing price of $27,357. 3. Carville Chrysler offers a special deal of leasing Dodge RAM 1500 pickup trucks. With a lease, the purchaser has the option of buying the vehicle at the end of the lease. For example, suppose a $27,357 vehicle could be leased with a certain monthly payment for 36 months, and then the customer has the option to buy it for $10,669.23, where the amount $10,669.23 is called the residual value, which is set to 39% of the purchasing price of $27,357. The monthly payment is related to the purchase price as well as the residual value, and the purchase price is set at the time when the vehicle is leased. Now Carville needs to decide on their leasing strategy. (a) At 6.7% interest compounded monthly, what should Carville charge as a lease payment to ensure that they recover their expenses (assuming the customer buys the car at the end of the lease). Lease payments are made at the start of each month. (b) To encourage customers to lease vehicles, Carville may consider reducing the lease payments down to $529.99, by using a higher residual value in the calculation. What residual value is used in the calculation for the lease payment of $529.99 ? (c) Although Carville may increase short-term sales by reduced monthly payment, but they may have trouble to sell the vehicle at the end of 36 months if the residual value is high. With a higher residual value, the customer is Assignment \#5 10/8/2023 1 of 2 MGSC 1205 Introduction to Quantitative Methods I less likely to buy the vehicle at the end of the lease. To offer a lower residual value, however, the company may lose money on the vehicle leased. Suppose Carville offers a promotion deal on the vehicle with monthly payment of $529.99 and residual value of $10,669.23. Determine the corresponding purchase price. With this promotion strategy, how much will the company loss on each vehicle leased in terms of purchase price? 4. Pamela McLennan, the chief financial officer in Glaxo Kent Ltd. (GKL), is responsible for the company's project evaluation. One of the projects under consideration is the company's expansion project, which requires $5 million over 6 years. The expenditure can be broken down as the follows: $125,000 spending on site preparation and plant design at the start of the project; $1.5 million on building and equipment by the end of year 1 , and another $1 million by the end of year 2. The training and testing programs will start in year 3, and budget for four years. The specific amounts are shown in the table below. The project will reduce their operating costs by $405,000 at the end of year 2 , and by $850,000 in each of the following years thereafter. MGSC 1205 Introduction to Quantitative Methods I less likely to buy the vehicle at the end of the lease. To offer a lower residual value, however, the company may lose money on the vehicle leased. Suppose Carville offers a promotion deal on the vehicle with monthly payment of $529.99 and residual value of $10,669.23. Determine the corresponding purchase price. With this promotion strategy, how much will the company loss on each vehicle leased in terms of purchase price? 4. Pamela McLennan, the chief financial officer in Glaxo Kent Ltd. (GKL), is responsible for the company's project evaluation. One of the projects under consideration is the company's expansion project, which requires $5 million over 6 years. The expenditure can be broken down as the follows: $125,000 spending on site preparation and plant design at the start of the project; $1.5 million on building and equipment by the end of year 1 , and another $1 million by the end of year 2. The training and testing programs will start in year 3, and budget for four years. The specific amounts are shown in the table below. The project will reduce their operating costs by $405,000 at the end of year 2 , and by $850,000 in each of the following years thereafter. The company requires that all projects are evaluated based on a 15% internal rate of return (equivalent to interest rate), and a 6 year time period. (a) If you were the chief financial analyst working for the parent company, would you approve the project? Explain your answer using a net present value analysis. (b) Your conclusion made in part a) is based on a 6-year term. Would your conclusion change if the time horizon were expanded, say, to a 7-year term? (Assume revenue of $850,000 in year 7.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started