Answered step by step

Verified Expert Solution

Question

1 Approved Answer

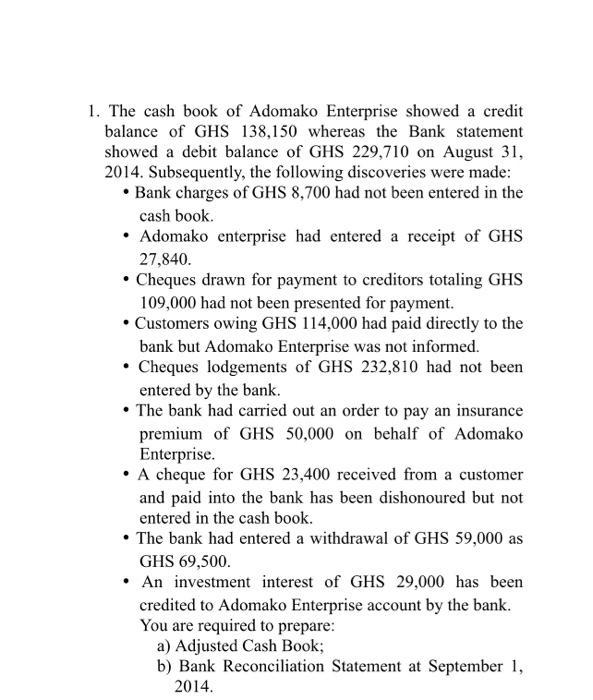

1. The cash book of Adomako Enterprise showed a credit balance of GHS 138,150 whereas the Bank statement showed a debit balance of GHS

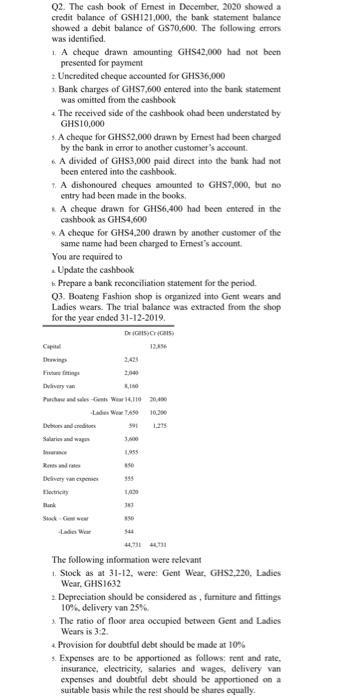

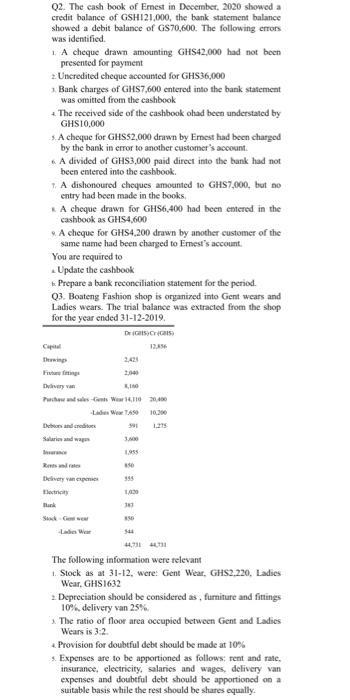

1. The cash book of Adomako Enterprise showed a credit balance of GHS 138,150 whereas the Bank statement showed a debit balance of GHS 229,710 on August 31, 2014. Subsequently, the following discoveries were made: Bank charges of GHS 8,700 had not been entered in the cash book. Adomako enterprise had entered a receipt of GHS 27,840. Cheques drawn for payment to creditors totaling GHS 109,000 had not been presented for payment. Customers owing GHS 114,000 had paid directly to the bank but Adomako Enterprise was not informed. Cheques lodgements of GHS 232,810 had not been entered by the bank. The bank had carried out an order to pay an insurance premium of GHS 50,000 on behalf of Adomako Enterprise. A cheque for GHS 23,400 received from a customer and paid into the bank has been dishonoured but not entered in the cash book. The bank had entered a withdrawal of GHS 59,000 as GHS 69,500. An investment interest of GHS 29,000 has been credited to Adomako Enterprise account by the bank. You are required to prepare: a) Adjusted Cash Book; b) Bank Reconciliation Statement at September 1, 2014. Q2. The cash book of Ernest in December, 2020 showed a credit balance of GSH121,000, the bank statement balance showed a debit balance of GS70,600. The following errors was identified. 1. A cheque drawn amounting GHS42,000 had not been presented for payment 2 Uncredited cheque accounted for GHS36,000 3. Bank charges of GHS7,600 entered into the bank statement was omitted from the cashbook + The received side of the cashbook ohad been understated by GHS10,000 5.A cheque for GHSS2,000 drawn by Ernest had been charged by the bank in error to another customer's account. A divided of GHS3,000 paid direct into the bank had not been entered into the cashbook. 7. A dishonoured cheques amounted to GHS7,000, but no entry had been made in the books. * A cheque drawn for GHS6,400 had been entered in the cashbook as GHS4,600 A cheque for GHS4,200 drawn by another customer of the same name had been charged to Ernest's account. You are required to Update the cashbook Prepare a bank reconciliation statement for the period. Q3. Boateng Fashion shop is organized into Gent wears and Ladies wears. The trial balance was extracted from the shop for the year ended 31-12-2019. Dr (Gal) Cr(GIS) 12,356 Capital Theewings 1,100 Pichandalents Wear 14,110 20,400 We650 10.200 591 1.275 -La Debtors and creditors Salaries and wagen Rents and rate Delivery an expenses Electricity Bank 2,425 Stock-Gwear Lade War 3,000 1955 850 355 1,030 343 850 544 44,731 44,331 The following information were relevant 1. Stock as at 31-12, were: Gent Wear, GHS2,220, Ladies Wear, GHS1632 Depreciation should be considered as, furniture and fittings 10%, delivery van 25% The ratio of floor area occupied between Gent and Ladies Wears is 3:2. Provision for doubtful debt should be made at 10% Expenses are to be apportioned as follows: rent and rate. insurance, electricity, salaries and wages, delivery van expenses and doubtful debt should be apportioned on a suitable basis while the rest should be shares equally. Q2. The cash book of Ernest in December, 2020 showed a credit balance of GSH121,000, the bank statement balance showed a debit balance of GS70,600. The following errors was identified. 1. A cheque drawn amounting GHS42,000 had not been presented for payment 2 Uncredited cheque accounted for GHS36,000 3. Bank charges of GHS7,600 entered into the bank statement was omitted from the cashbook + The received side of the cashbook ohad been understated by GHS10,000 5.A cheque for GHSS2,000 drawn by Ernest had been charged by the bank in error to another customer's account. A divided of GHS3,000 paid direct into the bank had not been entered into the cashbook. 7. A dishonoured cheques amounted to GHS7,000, but no entry had been made in the books. * A cheque drawn for GHS6,400 had been entered in the cashbook as GHS4,600 A cheque for GHS4,200 drawn by another customer of the same name had been charged to Ernest's account. You are required to Update the cashbook Prepare a bank reconciliation statement for the period. Q3. Boateng Fashion shop is organized into Gent wears and Ladies wears. The trial balance was extracted from the shop for the year ended 31-12-2019. Dr (Gal) Cr(GIS) 12,356 Capital Theewings 1,100 Pichandalents Wear 14,110 20,400 We650 10.200 591 1.275 -La Debtors and creditors Salaries and wagen Rents and rate Delivery an expenses Electricity Bank 2,425 Stock-Gwear Lade War 3,000 1955 850 355 1,030 343 850 544 44,731 44,331 The following information were relevant 1. Stock as at 31-12, were: Gent Wear, GHS2,220, Ladies Wear, GHS1632 Depreciation should be considered as, furniture and fittings 10%, delivery van 25% The ratio of floor area occupied between Gent and Ladies Wears is 3:2. Provision for doubtful debt should be made at 10% Expenses are to be apportioned as follows: rent and rate. insurance, electricity, salaries and wages, delivery van expenses and doubtful debt should be apportioned on a suitable basis while the rest should be shares equally.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 ANSWER 2ANSWER Stepbystep Step 1 of 2 Balance as per books of account 121000 Add Overstated of cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started