Question

1. The client would like to better understand his current financial condition. Tips: You need to look at the clients income vs expense, asset vs

1. The client would like to better understand his current financial condition.

Tips: You need to look at the clients income vs expense, asset vs debt, saving vs investment, make use of ratio analysis to comment on the clients financial position.

2. The client would like to evaluate his asset allocation and explore different options to help build wealth quickly by taking moderate risk.

Tips: You need to assess current asset allocation and recommend an alternative one with projected profit. You need to look at investment strategy and debt management, also present and compare the current allocation with the proposed allocation.

3. The client would like to plan his retirement, assure that in the event of unfortunate death, the surviving spouse can maintain the desired lifestyle and fund childrens education.

Tips: You need to discuss saving, pension, insurance and estate planning.

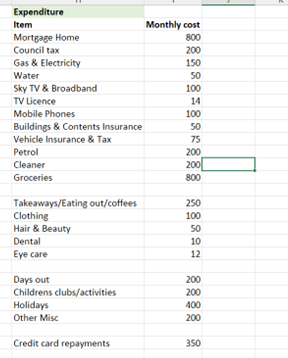

\begin{tabular}{lr} Expenditure & \\ Item & Monthly cost \\ Mortgage Home & 800 \\ Council tax & 200 \\ Gas \& Electricity & 150 \\ Water & 50 \\ Sky TV \& Broadband & 100 \\ TV Licence & 14 \\ Mobile Phones & 100 \\ Buildings \& Contents Insurance & 50 \\ Vehicle Insurance \& Tax & 75 \\ Petrol & 200 \\ \hline Cleaner & 200 \\ Groceries & 800 \\ \hline Takeaways/Eating out/coffees & \\ Clothing & 250 \\ Hair \& Beauty & 100 \\ Dental & 50 \\ Eye care & 10 \\ & 12 \\ \hline Days out & \\ \hline Childrens clubs/activities & 200 \\ \hline Holidays & 200 \\ Other Misc & 400 \\ Credit card repayments & 200 \\ \hline \end{tabular} \begin{tabular}{lr} Expenditure & \\ Item & Monthly cost \\ Mortgage Home & 800 \\ Council tax & 200 \\ Gas \& Electricity & 150 \\ Water & 50 \\ Sky TV \& Broadband & 100 \\ TV Licence & 14 \\ Mobile Phones & 100 \\ Buildings \& Contents Insurance & 50 \\ Vehicle Insurance \& Tax & 75 \\ Petrol & 200 \\ \hline Cleaner & 200 \\ Groceries & 800 \\ \hline Takeaways/Eating out/coffees & \\ Clothing & 250 \\ Hair \& Beauty & 100 \\ Dental & 50 \\ Eye care & 10 \\ & 12 \\ \hline Days out & \\ \hline Childrens clubs/activities & 200 \\ \hline Holidays & 200 \\ Other Misc & 400 \\ Credit card repayments & 200 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started